Non-Banking Financial Company (NBFC) is financial institution that does not have a banking license but can offer financial products and services to customers. NBFC Registration is primarily concerned with loans and advances, acquisition of shares, hire-purchase, finance leasing, chit fund, etc. An NBFC must be different from a bank in ways like an NBFC cannot accept savings and current account deposits, cannot issue cheques drawn on itself, and its depositors do not get a deposit insurance and credit guarantee coverage.

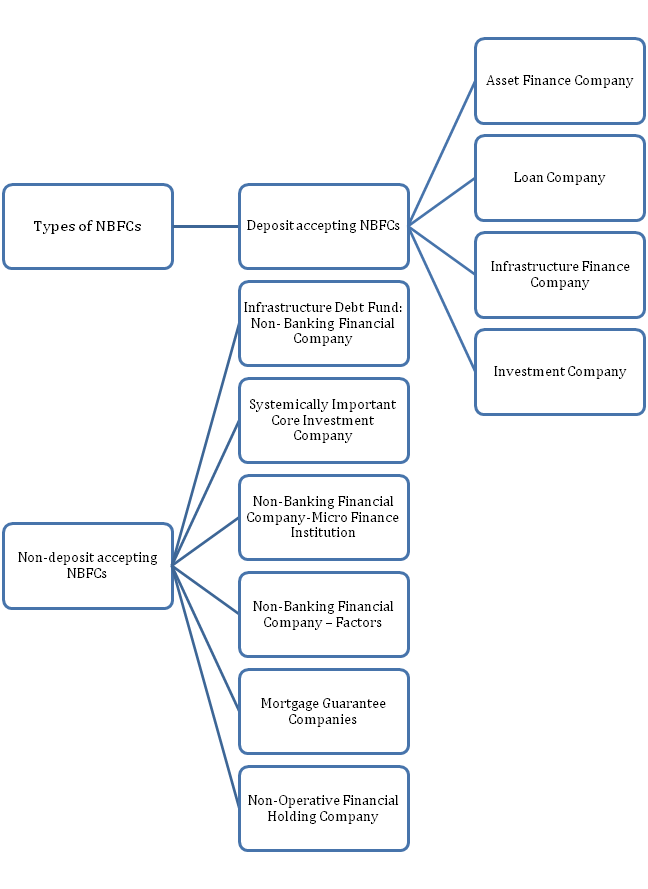

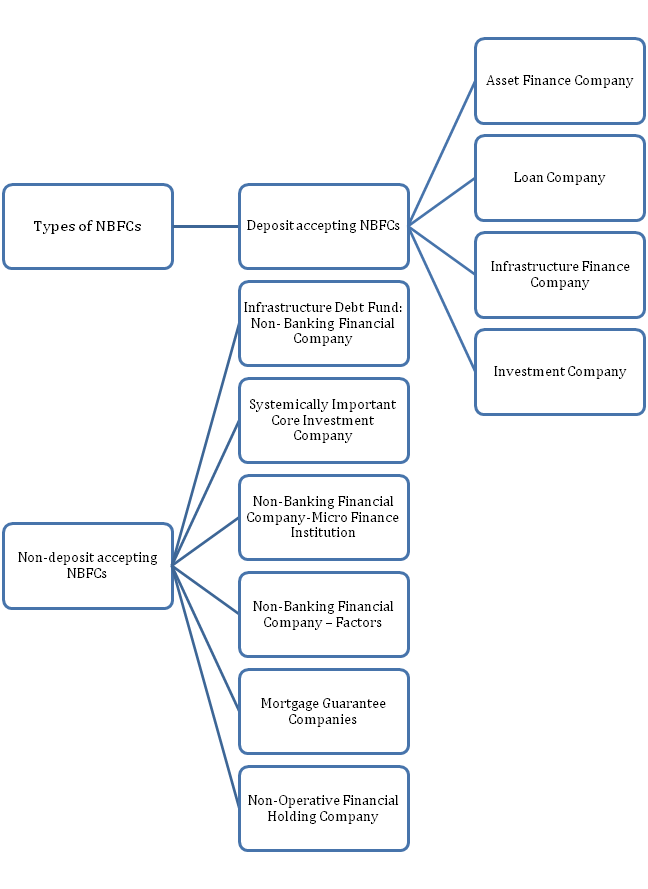

Types of NBFC

The advantages of a Non- Banking Finance Company

- Low cost & Time: It is an easy task to register a NBFC is in comparison to register a small Bank. The time and cost are both excess in terms of opening a Bank.

- Easy Registration: The registration process of NBFC is easy.

- Industry Growth Ratio: presently, the fintech industry is expanding as everyone wants an easy funding source. Thus, it will be advantageous for aspiring entrepreneurs to get them registered under NBFC and earn a good return.

- Easy Recovery of Loans: Since NBFCs are very systematic and they offer considerably less loan amount, therefore, borrowers return the amount easy which makes it convenient for lenders

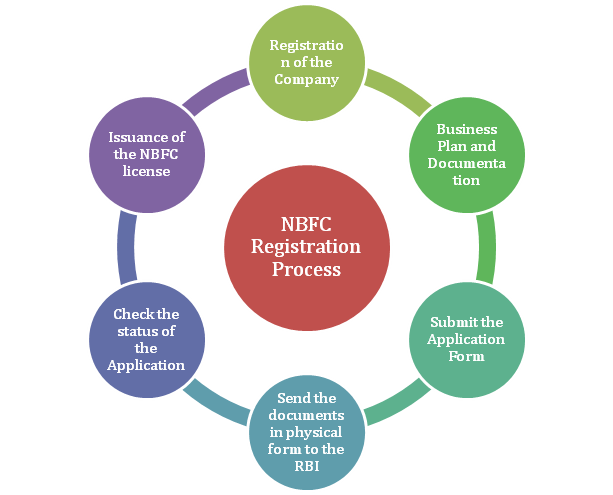

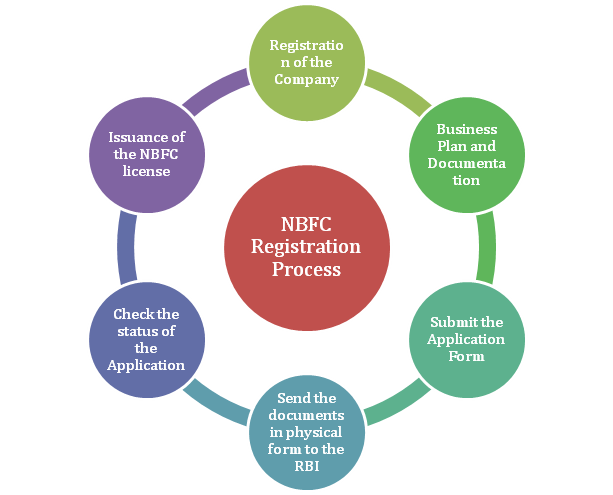

Registration Process for NBFC

- Step 1: Register a company under the Companies Act 2013.

- Step 2: Minimum Net Owned Funds of a Company should be Rs. 10 crores or more.

- Step 3: There must be at least 1 director in a company from the same background.

- Step 4: Good CIBIL score must required to present to register as NBFC.

- Step 5: Next, to visit RBI’s official website and fill in an application form.

- Step 6: Submit the required documents, along with an application form.

- Step 7: Once we have submitted an application form, a CARN number will be generated.

- Step 8: Send a hard copy of the application to the regional branch of RBI.

- Step 9: After an application is checked and verified, the License shall be given to the company.

Read our article:Prerequisites of NBFC Registration: A Comprehensive Overview

Registration Requirements for NBFC

NBFC’s in India are regulated by Reserve Bank of India (RBI). As per RBI guidelines, for an NBFC says that it cannot carry on non-banking financial business if in case it does not have a certificate of registration from the bank (except for the NBFC’s who are not regulated by the RBI), and if it does not have Net Owned Funds of Rs. 2 crores.

An NBFC incorporated under Companies Act, 2013[1] willing to commence a business of non-banking finance should comply with the following RBI guidelines:

- It has to be registered under Section 3 of the Companies Act, 2013

- It must meet the requirements of minimum Rs. 10 crores of Net Owned Funds (except for NBFC-MFIs, NBFC-Factors, and CIC)

Net Owned Funds can be calculated from a last audited balance sheet of the firm. Paid-up Equity Capital, Share Premium Account Balance, Free Reserves, and Capital Reserve will constitute Total Owned Funds. In order to calculate Net Owned Funds, Balance of Accumulated Loss, deduct Revaluation Reserves,and the book value of Intangible Assets from Total Owned Funds. If the investment in shares of other NBFC’s or in debentures and shares of subsidiaries and group companies is in excess of 10% of the owned funds shall be subtracted from the Net Owned Funds.

Documents required NBFC Registration

- Certificate of Company Incorporation

- Detailed information about management along with a brochure of the company

- A copy of PAN or Corporate Identity Number (CIN) of the company

- Documents related to the office location/address

- Certified copy of the Articles of Association (AOA) and Memorandum of Association (MOA)

- List of Directors’ profile must be duly signed by each director must be attached

- CIBIL or credit reports of the Directors of the Company are required

- A copy of a board resolution which certifies that a company has not carried out or stopped NBFC activity and will not carry until the registration from RBI is granted

- A board resolution on ‘Fair Practices Code’ is to be passed, and the certified copy of a same is to be submitted.

- Certificate issued by the statutory auditor stating that the company is not holding the public deposit and does not accept it as well.

- Certificate specifying owned funds as on the date of an application from the Statutory Auditor is required.

- Information regarding the bank account, loans, balances, credits, etc. is to be furnished.

- If applicable, an audited balance sheet and profit and loss statement along with the directors and auditor’s reports of the preceding three years have to be submitted.

- A self-certified copy of a bank statement and Income Tax Returns are required.

- Information detailing a company’s future plan, generally for the next three years, and the projection of balance sheets, cash flow statements, and income statements.

NBFC Registration Fees

- Fees must be deposited for NBFC registration is classified under various types which are mentioned below:

- While registering the company, a fee based on the company’s authorized capital is to be paid to the Ministry of Corporate Affairs (MCA)

- A company also need to pay fees based on the authorized capital and other few factors for the MOA (Memorandum of Association) and AOA (Articles of Association) of the company

- Simplified Performa for Incorporating Company electronically (SPICe+) filling might also require the company to pay certain fees

- For (DIN) Director Identification Numbers, a predetermined fee is paid to the MCA

- A (DSC) Digital Signature Certificate is required for each director, and thus its generation would require a payment of periodic fees

- Additional fees must required to be paid while applying to the registrar.

Conclusion

Corpbiz is dedicated to helping in startups and MNC in solving legal and compliance related to starting and running their business. Our goal is to offer one-click access to all individuals & industries for all their legal & professional desires. We have worked with large number of Fintech companies in India and helped them in building a lending business, Assisted them in obtaining permission from SEBI, IRDA & RBI.

Read our article:Documents Required for NBFC Registration