The RBI has given another window to the MSMEs on dated 06-August 2020, in which the RBI granted loan restructuring policy for the preferable growth of the MSMEs who all have been duly certified after the MSME Registration. RBI loan restructuring policy will provide aid to specifically those affected by the Covid 19 pandemic.

The RBI loan restricting policy will be considered the new framework that was non-remittance but “accepted” as dated January 1, 2020. RBI loan restructuring policy will aid in the bulk of MSMEs impacted by the pandemic situation due to Covid 19. The Government of India has imposed the National Lockdown. Spontaneous functioning and economic activities have stopped. It results in stress in the MSME sector, which has got emphasized and needs further necessary support. Thus it has been decided that forming the stressed MSME borrowers to be qualified and trained for the restructuring their debt under the existing framework and providing their accounts with the concerned lender, classified as the standard on dated 1st of March, 2020. The said restructuring policy will have to be implemented by 31st of March 2021.

The MSMEs sector is facing a crisis for this RBI has decided to take a step toward improving the MSME.

Who shall be benefited under the RBI Loan Restructuring Policy?

The Micro Small and Medium Enterprises, which does not fall under non-performing asset (NPA) until the date March 1, 2020, and previously treated as “accepted” accounts, will benefit from the RBI loan restructuring policy be enforced on dated 01, March 2021. It can be considered a continuing scheme extension until the date 31st December 2020, an “accepted” account until January 1, 2020.

The MSMEs which have registered under the Goods and Service Tax with approx borrowings up to the amount of INR 25 crore as of 1st March 2020 will be covered under the RBI loan restructuring policy.

Read our article:What is MSME Registration and how to get it?

Why Is RBI Loan Restructuring Policy Required?

The action is compelling as the opportunity for MSMEs loan account falling under NPA is above than that of others. When the RBI has released its last financial stability report, in which RBI had stated that MSMEs sector had affected very much due to lack of cash flows during the Covid 19 pandemic.

The RBI loan restructuring policy will contribute the essential relief for the MSMEs both sector which has been affected more due to the National lock down imposed by the Indian Government resulting conditions, containment, reverse migration, supply chain and trade choking etc.

RBI Regulations on Loan Restructuring Policy

The Commercial Banks (includes the Small Finance Banks[1], the Local Area Banks and the Regional Rural Banks) and All Primary (Urban) Co-operative Banks/the State Co-operative Banks/ District Central Co-operative Banks, All-India Financial Institutions, All Non-Banking Financial Companies released the notification with the Circular D.O.R. No.BP.BC.34/21.04.048/2019-20 dated 11- February-2020. It was done in the observation of the continued requirement to uphold the feasible MSME entities fallout of Covid 19 pandemic and to fall these instructions with the resolution framework from Covid 19 pandemic. It has been pronounced to increase the terms allowed in the aforesaid circular. As per the present loans to MSMEs categorized as “standard” can be reconstructed without any downfall in the asset categorizations, Subject matter under listed conditions:-

- The aggregate exposure, which includes the non-fund based facilities and the NBFCs to the borrower, shall not more than Rs. 25 crores as of March 1st of 2020.

- The borrower’s account shall be a ‘standard asset’ as of March 1, 2020.

- The restructuring of the borrower account will be implemented by March 31, 2021.

- The borrowing entity should be GST-registered till the date of implementation of the restructuring. Notwithstanding, this situation will not be enforced on the MSMEs; those are exempted from GST registration. The same shall be determined only based on the exemption limit obtained till March 1, 2020.

- The Assets classification of borrowers is classified as the standard which can be maintained as such. In contrast, the details which could have shifted into the NPA category between March 2, 2020, and the date of implementation would be upgraded accordingly to the ‘standard asset’, on the date of enactment of the RBI loan restructuring policy. The asset categorization assistance will be available only if the RBI loan restructuring policy is enforced as per the circular provisions

- As hitherto, banks shall maintain an additional provision of 5% over and above the provision already held by them for accounts restructured under these guidelines.

How will the RBI Loan Restructuring Policy Be Enforced?

To implement the RBI loan restructuring policy, the RBI has set up a five-member expert committee directed by KV Kamath, the former chairperson of ICICI Bank. He will prepare the propositions based on the requirement of financial parameters. When the RBI has provided the broad contours,

While the RBI is privileged with the broad curve and the committee will suggest the MSMEs sector-specific standard that touches for such parameters to be separate into each settlement plan for borrowers with aggregate exposure of amount INR 1,500 crore time enchantment.

The panel will also commence a process corroboration of settlement plans for details above the stated threshold. The RBI shall announce this along with alterations in 30 days. As per the RBI’s systemic risk review, the three sectors most skeptically affected by the pandemic are tourism, real estate, and airlines.

Were Earlier Such Policy Not Exploited by Banks & Corporates?

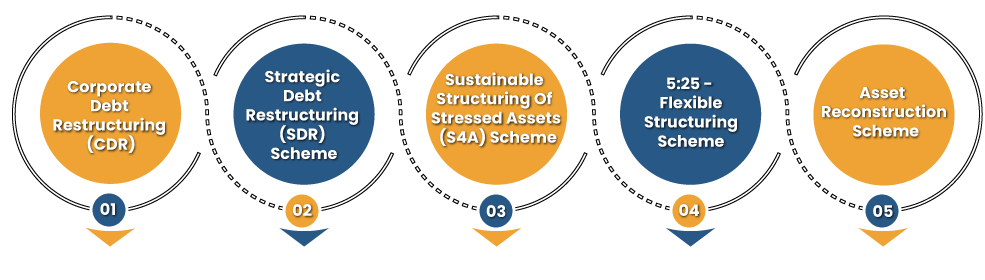

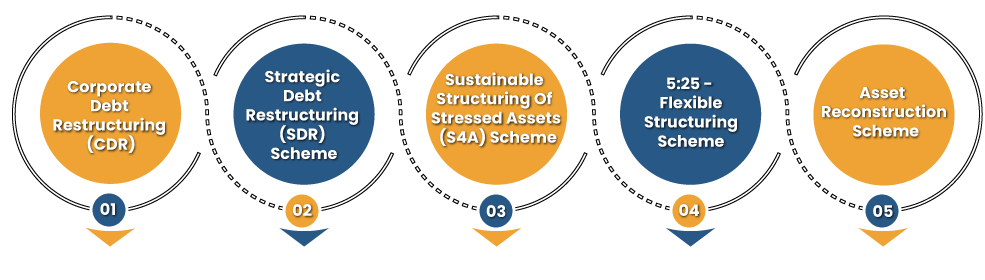

Earlier, there were many monetary schemes to promote enhancement of the MSMEs sector, but due to their not being properly implemented, the Banks & Corporate were exploiting them. Following are the categorization of such policies.

Corporate Debt Restructuring (CDR)

The RBI has terminated the corporate debt restructuring (CDR) policy from April 1, 2015. For many years, corporations were exploiting the debt recast ideas, with the governor turning a blind eye to administrations by the shady advertiser in conspiracy with some banks. Banks has also prepared an isolated corporate debt restructuring unit with erstwhile IDBI overseeing the process.

The advertisers of several large corporate extracted off several bank funds while their cells were undergone. They associated with the corporate debt restructuring unit, and to get their loans to recast, some of them get more than once. These advertisers handled getting fresh loans and used liberal loan recasts to evergreen their accounts and keep them out of the NPA books. Now some of them have declared themselves bank corrupt.

Strategic Debt Restructuring (SDR) Scheme

In the Strategic Debt Restructuring (SDR) scheme, banks provided a chance to disciple the loan cost into 51% of equity, which was to be given to the highest aspirant once the firm became feasible. But unfortunately, this idea could not help banks to sort out their worst loan problem as only sales have participated through this measure because of growth issues.

Sustainable Structuring Of Stressed Assets (S4A) Scheme

Within the Sustainable Structuring of Stressed Assets (S4A) scheme, the banks were unwilling to be allowed to write-downs as there were no incentives to do so, and write-downs of the large debtors that could exhaust banks’ capital cushions.

5:25 Flexible Structuring Scheme

This scheme was crashed due to the re-subsidize that has done at the higher rate of interest as such the financial institution could save their net present value of the loan amount. This was executed with a thought that it can be the best tool to expand the NPAs covered under the financial institution.

Asset Reconstruction Scheme

There was major issues faced by the ARCs to determine the assets they had from the financial institutions, & they only want to take the loan on cheap rate of interest. Consequently, financial institutions were cautious about sanction loan on a large scale.

Insolvency & Bankruptcy Code Kicked Off All Early Schemes

After noticing the downgrade performances of banks & corporate the RBI has announced a binding loan resolution process through its June 7 circular DBR.No.BP.BC.45/21.04.048/2018-19

Does the RBI Loan Restructuring Policy Have Safeguards?

Before implementing, the RBI has prepared the safeguards in the resolution framework to establish it does not manage to overgrow former bad loans. RBI loan restructuring policy on vast publicity will need independent credit assessment by rating companies, and process corroboration did by the Kamth- led expert panel.

Unlike restructuring of bulkier corporate vulnerability, for personal loans, there will be no need for third party authorization from the expert panel, or by acclaiming bureaus, or need for ICA. The RBI has stated that loans under settlement cannot be drawn out by more than two years. In the case of multiple lenders to a single borrower, banks need to sign an ICA. Banks need to make a 10% provision against such accounts under resolution to mitigate the impact of expected loan losses. For banks not willing to be part of the ICA, a penal provision of 20% has been specified.

What are the Leading Differences with Preceding Reciprocated Policies?

Previously, the restructuring policy does not have any entry barriers, respective to the current scheme available for the companies, which still faces Covid-related stress, which was identified till the cut-off date of March 1.

The Strict timelines for invocation of resolution plan and its implementation have been defined under the scheme, unlike was largely open-ended. Under this scheme, signing the ICA largely for all lenders once the resolution plan has a majority voting. Otherwise, they would face twice the amount of the provisions provides. The Independent external evaluations, the process validation, and the precise and specific resolution are featured as safeguards.

Conclusion

Within the specific and urgent time sphere, in the field of relief for the MSME sector in the era of stress during the uncertain COVID-19 and unexpectable pandemic, RBI as usual in its favorable and monetary scheme which announced today has extended the restructuring of debt for MSME borrowers. The RBI also came with extended relief to large corporate, SME segment with the key safeguard and approaches to support them.

Literally, such a loan restructuring policy permits a borrower with some flexibility in terms of grace and extension tenure for loan EMI, interest payments to safeguard and support the borrower to buy. It allows a good time to pay off his loan amount to the respective lenders. The Loan restructuring policy helps the lender save on higher provisioning. Otherwise, the banks have to make higher provisions on default or a non-performing asset (NPA), directly impacting their profitability.

Read our article:Procedure to Avail MSME Registration Certificate in India

PR150332B938A0C7E4C64AE20D15EA85F8DB1