The Reserve Bank of India has the expert committee report released on Resolution Framework for COVID-19 relates to stress. The Reserve Bank on August 7, 2020, has announced the constitution of an Expert Committee under the chairmanship of Shri K.V. Kamath in order to make recommendations on financial parameters. It has made resolution plans under the ‘Resolution Framework for Covid19-related Stress’ along with sector-specific benchmark ranges for such parameters.

Recommendations by the Committee to RBI

The Committee has submitted the report to a Reserve Bank on September 4, 2020, which is being placed on the RBI website. The Committee has recommended financial parameters including aspects related to leverage, liquidity and debt serviceability. The Committee has also recommended financial ratios for 26 sectors that could be factored by lending institutions when a resolution plan gets finalize for a borrower.

A Reserve Bank of India[1] has broadly accepted the recommendations of a Committee. Accordingly, to a circular the Resolution Framework guidelines were announced on August 6, 2020, has now been issued by Reserve Bank of India specifying five specific financial ratios. The specific sector thresholds for each ratio in respect of 26 sectors to be taken into account when the resolution plans were finalized. In respect to other sectors where certain ratios have not been specified, the lenders will make the assessment on their own keeping in view the contours of the circular dated August 6, 2020, and the follow-up circular issued.

Read our article:Supreme Court Recommends Comprehensive System of Advance Tax Ruling to Reduce Litigation

RBI has Revised Priority Sector Lending Guidelines

The Reserve Bank has also revised the priority section lending Guidelines. The RBI has comprehensively reviewed the (PSL) Priority Sector Lending Guidelines to align it with emerging national priorities and have a sharper focus on inclusive development, after having the discussions with all stakeholders.

Revised PSL guidelines will now enable better credit penetration to credit deficient area. It increases the lending to small and marginal farmers and weaker sections and also boosts credit to renewable energy, health and infrastructure.

The Bank finance start-ups (up to ₹50 crores) and provide loans to farmers for installing solar power plants for solarisation of a grid-connected agriculture pump. Also, provide loans for setting up (CBG) Compressed Bio-Gas plants and has included fresh categories eligible for finance under priority sector.

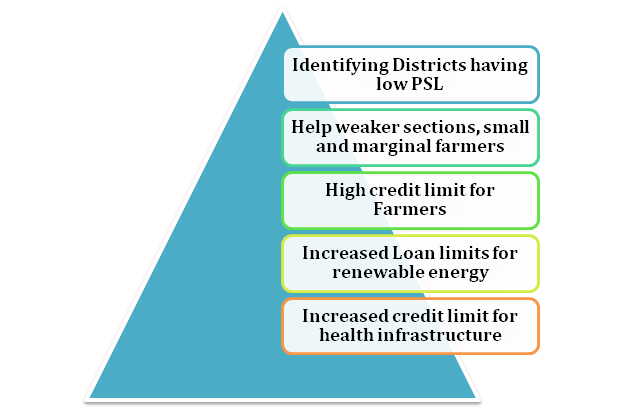

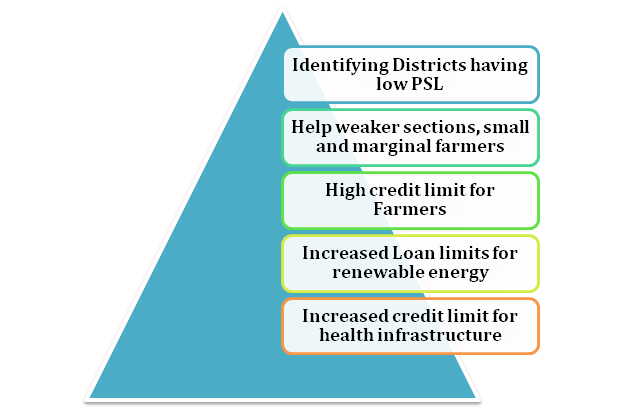

Features of Revised Priority Sector Lending (PSL) guidelines

Some of the features of revised PSL guidelines are:

- To address regional disparities in a flow of priority sector credit, higher weightage assigned to an incremental priority sector credit in ‘identified districts’ where a priority sector credit flow is comparatively low.

- The targets are for “small and marginal farmers” and “weaker sections” has been increased in a phased manner.

- The higher credit limit has specified for (FPOs) Farmers Producers Organisations / (FPCs) Farmers Producers Companies undertaking farming with assured marketing of the produce at the pre-determined price.

- The Loan limits for a renewable energy have been increased and is doubled.

- For an improvement of health infrastructure, the credit limit for health infrastructure (including under ‘Ayushman Bharat’) has been doubled.

Conclusion

The Reserve Bank of India released an expert committee report on the ‘Resolution Framework for Covid19-related Stress’.The Committee has recommended financial parameters for leverage, liquidity and debt serviceability. It has also recommended financial ratios for 26 sectors that could be factored by lending institutions.

Also, The Reserve Bank has revised the priority section lending Guidelines. Now, bank can finance start-ups (up to ₹50 crores) and provide loans to farmers for installing solar power plants and also for setting up (CBG) Compressed Bio-Gas plants. You may please contact our professional for further information or assistance.

Read our article:Lok Sabha passes Companies (Amendment) Bill, 2020

Resolution-Framework-for-COVID-19-Related-Stress