The RERA Act, 2016, became into existence from 1 May 2016 with 69 sections notified as out of 92 sections. The Ministry of Housing & Urban Poverty Alleviation as notified the RERA rules for Delhi RERA on 31 October, 2016 to protect the interest of buyers and has ensured transparency in the real estate sector.

Importance of RERA compliance

To infuse transparency into a system and have the Control Mechanism over an ongoing project of the registered developers, the RERA Authority has come up with the Quarterly Compliance system. According to Section 4(2)(I), (D) of the RERA Act, 2016[1], a separate account must be maintained in that 70% of the amount collected from the home buyers must be deposited, which has to be strictly used by the developer in its Project only. After submitting all the documents of quarterly compliance with the banks stating the percentage of completion of work, this separate account amount must be withdrawn. Hence, this acts known to be a tool of governance to verify the actions.

RERA is mandatory for all commercial and also for residential real estate projects where land under development is over 500 sq m or a number of units to be constructed exceeds eight apartments must have to register with the RERA authority before launching of the real estate project. Every Promoter must make an application to an authority for registration of real estate projects. The projects which are ongoing on a date of commencement of this Act and for which completion certificate has not been issued must have to get RERA registration. If the real estate project fails to register a property, it will attract a penalty.

However, the repair, renovation, or redevelopment projects which are not involving marketing, advertising, selling, and new allotment are not required to get registered.

What is Quarterly Compliance in Delhi RERA?

- Every quarter the developers need to submit various documents regarding their proportionate completion of the Project.

- The trio of sequential documents of Architect Certificate (Form 1), Engineer Certificate (Form 2), and Chartered Accountant Certificate (Form 3) is categorized as RERA Return.

- Also, the no. of flats sold, booked, and leased with their respective construction status need to be informed.

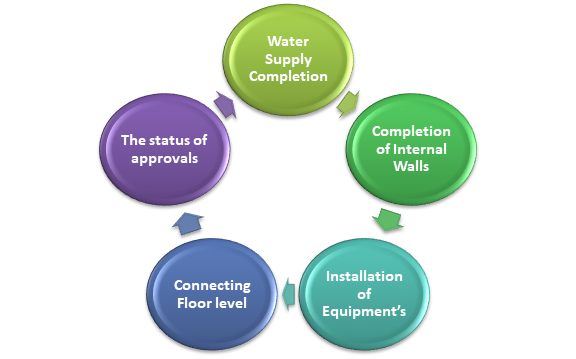

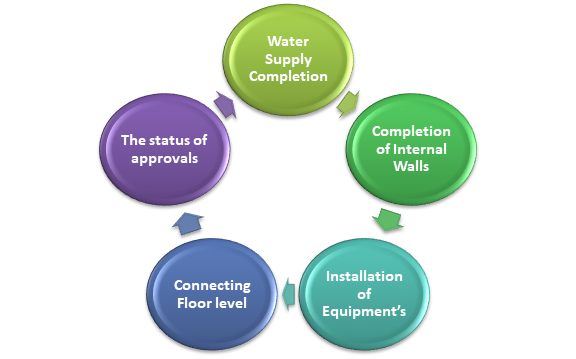

- The RERA Quarterly Compliance Checklist includes the following:

Detailed Information

- Percentage of Water Supply completion.

- Percentage of Completion of Internal Walls, Internal Plaster, floorings within flats/premises, etc. with details

- Installation of lifts, water pumps, Fire Fighting Fittings and Equipment as per CFO NOC, Electrical fittings to Common Areas, electro, mechanical equipment, Compliance to conditions of environment /CRZ NOC, Finishing to entrance lobby/s, plinth protection, Compound Wall and all other requirements.

- Percentage of completion of Staircases, Lifts Wells, and Lobbies at each Floor level are connecting Staircases and Lifts, Overhead and Underground Water Tanks.

- The status of approvals- received, applied & expected the date of receipt, to be applied & date planned for application, Modifications, amendment, revisions issued by competent Authority as to license, permit/approval for the Project.

Read our article:Penalties under RERA on Builders and Agents

Penalties for non-compliance under Delhi RERA

The RERA Act gives explicit and also mentions of specific penalties for offenses by real estate agents, promoters, builders, and other parties who get involved under the ambit of this Act:

- For the non-registration of a project with the RERA Authority: 10% of the total estimated cost of a project is charged. However, the agent is charged a penalty of Rs. 10,000 per day during default tenure up to 5% of property cost

- Where information or advertisement regarding the Project is found to be false: Penalty for Promoter is 5% of the estimated cost of the Project.

- Where any provisions of the Act have been contravened: Penalty for Promoter and agent is 5% of the estimated cost of the project/ property.

- Where an order of the RERA has been contravened or has not been executed: Daily penalty for every day after the passing of the order, is charged up to 5% of the estimated cost of the project or property for Promoter, agent and the allottee.

- Where an order of the Appellate Tribunal has been contravened: Penalty is charged up to 10% of the estimated cost of a project or property for Promoter, agent, and the allottee.

Prosecution and Compounding

- Non-compliance of penalty order by Promoter (for non-registration of Project) issued by the Authority entails imprisonment up to 3 years or further penalty of 10% of estimated cost or both.

- Non-compliance with an order of the Appellate Tribunal by Promoter entails imprisonment up to 3 years or penalty of 10% of estimated cost or both.

- Non-compliance with an order of the Appellate Tribunal by Agent entails imprisonment up to 1 year or day to day fine of 10% of the estimated cost of apartment or plot of land.

- Non-compliance with an order of the Appellate Tribunal by Allottee entails imprisonment up to 1 year or day to day fine of 10% of the estimated cost of apartment or plot of land.

- Imprisonment punishment would be compounded (before or after the institution of prosecution) by the Court.

Conclusion

The legislative action was not strong enough to render a developer and a builder guilty of misconduct and also for breaching any terms and conditions of the buyer agreement in the long run. Introduction and enforcement of Delhi RERA come further in order to protect the interest of the home buyers as well as also to save them from any kind of financial burdens.

Read our article: RERA Delhi: How to Register Real Estate Agents or Promoters or Buyers