The Real Estate (Regulation & Development) Act, 2016, came into effect from May 1, 2017. There began a norm for strict compliance under RERA that had to be adhered to by each developer, builder, and construction giant in different parts of the country. Most of the states have established their RERA offices where they work under the established Act. Though the RERA Act is not retrospective, it mandates every project to be registered with the respective State RERA offices by the promoters within 3 months of the Act’s commencement.

Compliance under RERA

RERA registration is just a start of compliances under RERA of various provisions of RERA regulations. It gives complete details of a project to RERA authority and the public at large, which would try to ensure that all compliances are met. Some of the compliance is as under:

Uploading of Agreement/Approval/Plan, etc

RERA regulation has mandated to publish the details along with the copy of agreements, approvals, etc., on the website of RERA Authority for the general public viewing purpose.

Quarterly updating with the RERA

Every registered project must update the project’s prescribed details on the website of the respective State RERA authority. Failure to do so may attract heavy penalties and penal proceedings from the RERA authority.

Separate bank accounts required for 70% of receipts

According to the RERA law, every developer is required to deposit 70% of the receipts from the customers in a separate RERA designated account, which must be used only for cost of a project.

Comply with Prescribed process of booking and the allotment

RERA regulations have prescribed certain obligations and responsibilities on the developers while booking a new flat or allotment, some of them are:

- Ensure that the transaction is done through RERA registered agent

- Making available the approved plan to a buyer

- Non-acceptance of the advance more than 10% of unit cost

Taking necessary approval and the insurance

According to RERA regulation[1], the builder or developer is required to take all the necessary approvals and insurance, as required by the state laws. RERA regulations relating to the insurance are very confusing and must require detailed research.

Formation of the allottee’s association

As per RERA regulations, every builder or developer shall form the society/association or co-operative society as prescribed by the respective State Government. If the State Government specifically provides nothing, then society must be constituted within 3 months from a month in which majority of flats are sold.

Timely completion and delivery, including common areas

Every builder and association is required to complete a project at a given time and give possession within 3 months. All the common areas must be transferred to an association of the allottees.

Review of building quality

The developer requires reviewing the quality of the building. According to RERA law, any defects in the structure shall be rectified by the builder within 30 days of intimation without any additional cost.

Read our article: Unfair practice in RERA: Misleading Real Estate Advertisements

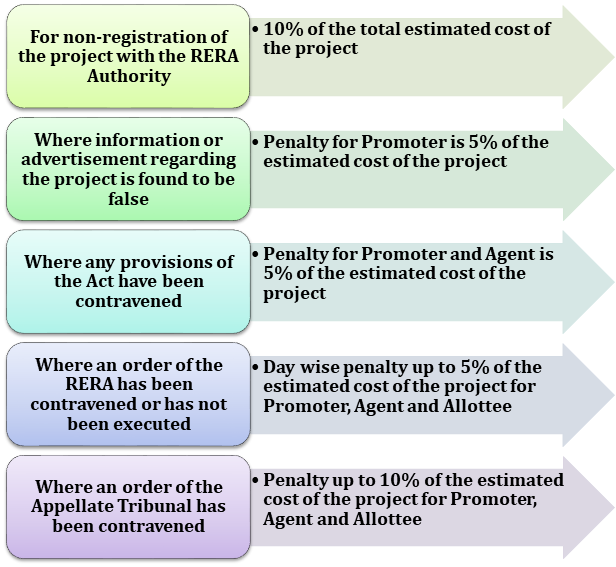

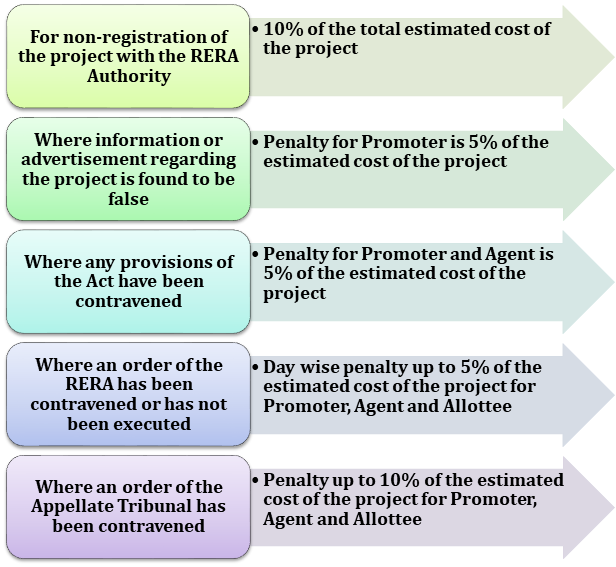

Penalties for Non-compliance under RERA

The RERA Act gives explicit and mentions specific penalties for offenses by promoters, real estate agents, builders, and other parties involved under the ambit of this Act.

Those are as follows:-

Other important Compliance under RERA regarding Project Account

- Developers are required to deposit 70% of the project funds in a designated bank account. Of the total collections, only 30% have to be withdrawn or used without any restriction.

- If the estimated receivables of an ongoing project are less than the estimated cost of completion of a project, then 100% of the amount to be realized from the allottees must be deposited in the said separate account.

- Withdrawal from a RERA Account to be certified by the Architect, Engineer, and Chartered Accountant.

- Withdrawals from a RERA Account to be in proportion to the percentage completion method.

- Withdrawals from a RERA Account can be made for the purpose of payment of construction and land cost of that project only.

- The amount in the RERA designated account cannot be used for Admin and Marketing expenses.

The objective of the RERA Act

The RERA aims to establish a Real Estate Regulatory Authority that would regulate and promote the real estate sector. The main objective of the Act is to protect the interest of homebuyers and promote timely delivery of properties or projects.

The RERA was also enacted to boost investment in the sector. The provisions like timely completion and delivery of the projects to a buyer and making the information of a project plan, layout, government approvals, land title status, and sub-contractors available, consent of 2/3rd of the allottees on any alteration or addition in the project, and other such provisions, would bring in more accountability and transparency in a real estate sector.

RERA has been implemented and enacted in all states as well as Union Territories except in the States of Jammu and Kashmir and West Bengal. The State of West Bengal has followed the different path altogether. Instead of RERA, a State of West Bengal has implemented, the West Bengal Housing Industry Regulation Act. Also, the State Advisory Council of Jammu and Kashmir has approved the Real Estate (Regulation and Development) Bill, 2018.

Conclusion

The legislative regime was not too strong to render a developer and a builder guilty of misconduct and also for breaching the terms and conditions of the builder buyer agreement in the long run. Introduction and enforcement of compliance under RERA come further to protect the interest of the home buyers as well as save them from any kind of financial burdens.

Read our article:What is Phase-wise RERA Registration?