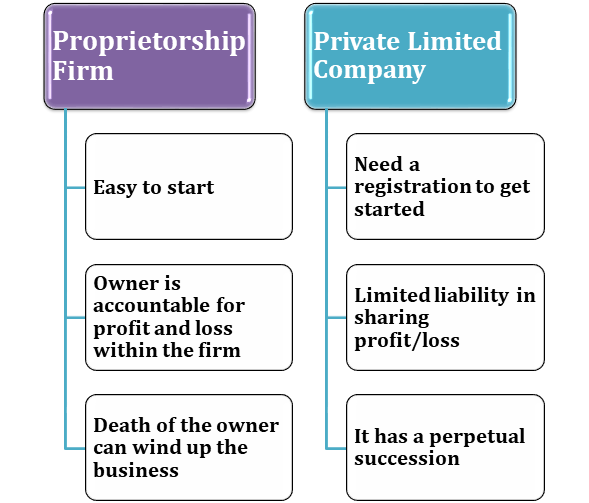

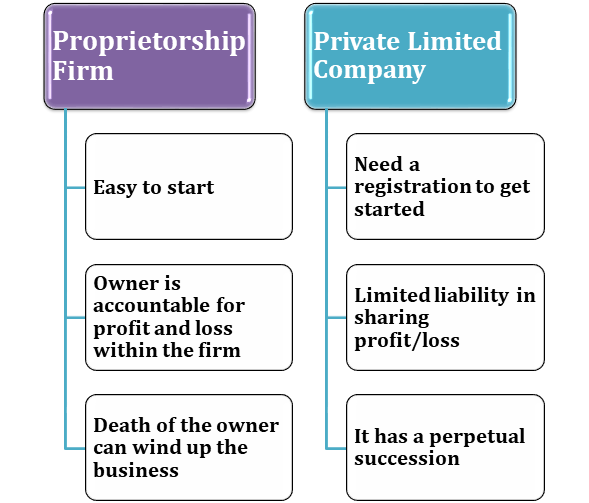

Identifying a perfect business structure is one of the most daunting challenges faced by new startups. Whether you want to avail higher ROI or avert tax liabilities, you must have sufficient knowledge about the different business structures to reap those benefits. This blog will draw your attention to the concept related to Proprietorship Firm vs Private Limited Company.

What is a Private Limited Company?

The private limited company is a type of business structure that defies the right of share trading with the general public. That means in the private limited company, the trading of share is strictly an internal affair. Also, the liability in such a business structure depends on the magnitude of share possessed by the shareholders/members.

Although Shareholders hold the right to pursue the company’s operation, they can hire directors to serve the same purpose. The number of shareholders that can serve one private limited company is limited to 200.

Read our article:A Complete overview on Business Structures & Raising Fund

Benefits offered by a Private Limited Company

- The shareholder’s liability depends on the amount of share they hold in the company.

- Their personal assets cannot be used to cover up the company’s debt. However, in the case of bankruptcy or fraud, this provision will dissolve without any exception.

- The hostile takeover of share in a private limited company is comparatively lower than other business structures.

- Private Limited Company works in an autonomous framework, and the absence of its core members cannot disrupt it. The company will continue to exist and operate in full control even after the demise of the shareholder.

- Private Limited Company possesses its own assets and liability. The company has the discretion to sue any entity w.r.t legal disputes.

- This type of business structure works under the strict of Companies act 2013. This let them ensure transparency in their business practices.

- It confronts limited tax liabilities under the income tax act 1961[1].

What is Proprietorship Firm?

A sole proprietorship firm is a kind of business structure that requires a single owner instead of several core members. The difference between the owner and this business form is next to negligible. Here is the single owner is accountable for the well-being of the company. The following list will give a better idea of proprietorship’s advantages.

Proprietorship advantages concerning a private limited company

- The formation of a proprietorship-based business is easier than other business forms.

- The proprietorship-based setup discourages the inclusion of the shareholders of the Director due to negligible legal differences between the business and the owner.

- The owner is the only accountable person to address the company’s related matters.

- The proprietorship business doesn’t attract strict compliances or regulation as compared to other business forms.

- The proprietorship business is free from dual taxation. That means the owner needs to bear the income-related tax instead of business income tax.

Proprietorship Firm vs. Private Limited Company

| S.no | Factors | Private limited company | Proprietorship |

| 1. | Registration | Private limited companies serve as a Companies Act 2013-registered entity. | Proprietorship serves no formal registration. |

| 2. | Name of the business | The company has to include the term “Pvt. Ltd” in its name | Proprietorship’s firm has the discretion to serve this purpose. |

| 3. | Liability | Here the number of shares held by the shareholders will decide the liability. | Proprietorship’s firm serves countless liabilities. |

| 4. | Separate legal entity | Private Ltd. company can act as a separate legal entity as per Company Act 2013. | This form of business doesn’t have such liberty. The owner is the only person accountable for the company’s well-being. |

| 5. | Number of members | Here the maximum number of members is limited to 200. The minimum limit is one. | One |

| 6. | Transferability | Here the Transferability is possible by the transfer of shares. | The proprietorship business is not transferable. |

| 7. | Foreign ownership | Some of the sectors support the concept of foreign ownership for growth or expansion. | The proprietorship business doesn’t permit the intervention of Foreign ownership. |

| 8. | Existence | Its existence does not depend on the relevant members and shareholders. | Depend on the owner only. |

| 9. | Legal compliance | A private limited company is accountable for conducting board meetings and AGM in the predetermined timeframe. It also has the discretion to file Annual Returns annually with the Registrar of the company every year. On the taxation front, the company is entitled to file its taxes in a timely manner. | Since the proprietorship firm served by the single owner, there is no point in conducting a board meeting here. Also, such a business form defies the concept/provision of filling of the annual report or income tax return. |

| 10. | Taxation | Its profit attracts taxation of 30% plus a surcharge. The cess is also applicable here. | Here the tax is applicable on the owner’s income |

Conclusion:

Selecting the wrong business structure could lead to dire consequences; thus, its essential for an upcoming entrepreneur to analyze their options inside out. Proprietorship firms are good at rendering tax-free income and mental peace, whereas Private Limited Company is all about credibility, transparency, and better business practices. If you wish to handle all the liabilities on your own and seek negligible intervention and low tax burden, then proprietorship is the best option.

On the contrary, if you are a supporter of the transparent environment and want to grow your business rapidly, it’s better to register with the Company Act, 2013. However, it would be best if you kept in mind that Private limited firm attracts tax to a considerable degree and often expose to cess. We strongly believe that you have now got better idea w.r.t Proprietorship Firm vs Private Limited Company. Feel free to provide your valuable feedback through the comment section in case if you need any assistance.

Read our article:Guide on Difference between Private limited Company and LLP