There are so many business owners out there who have no idea which business organization should they opt to reap more ROI. While starting up a business, one has to choose between Private limited company and LLP registration. A business motive becomes unachievable if an incorrect business organization was chosen. Hence, an individual or group needs to analyze their option before entering any business organization. If the concept of these business entities is not clear to you, this blog is for you. Here you will learn everything about Private limited company and LLP in detail.

What is Private limited company?

The private companies are the business entities where the shares are held privately. They could act as a sole runner for the company or hire directors to get things in control on their behalf. This kind of business entity is usually owned by some shareholders privately.

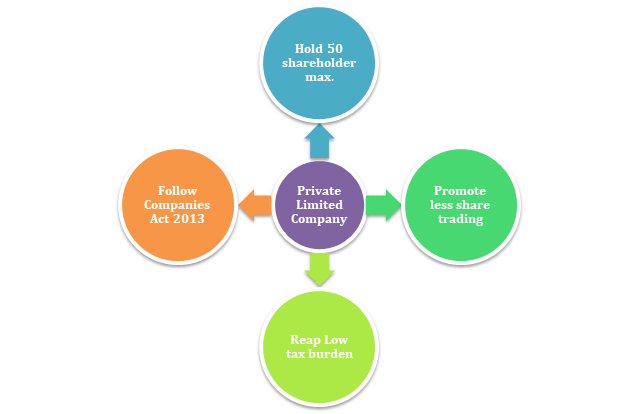

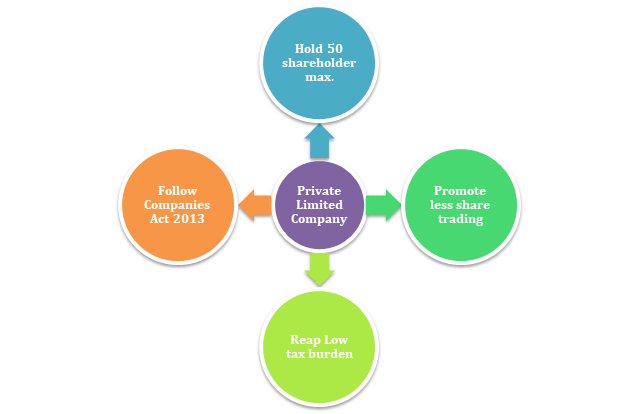

In private companies, the shareholding limit decides the accountability of the owners. The number of shareholders that can be part of a private company is limited to 50 only. This type of business entity restricts the trading of the shares as well. No shareholder of a private company can engage in the trading of shares with the outside world.

Advantages of a private company

- The shareholder’s accountability in a private company depends on the extent of their shareholding. Their assets cannot be used to compensate for the company’s debt.

- Although this has one anomaly where fraud is committed w.r.t the company, it will neutralize the owner’s liability protection.

- There is a limitation on the trading of shares; it acts as an advantage to the shareholders seeking protection of share from the hostile takeover.

- In all likelihood, private companies continue to exist regardless of the presence of its core member, including the owner. Even after the demise of the core members, the company will continue to conduct its operation. It will remain unchanged with the same privileges and possessions. It will continue its service till wound up is there as per Company Act 2013.

- It is an autonomous entity, and it holds its liability and assets. It is authorized to hold properties and funds as well.

- The conduct of a private company is based on the Companies Act 2013; they have to ensure conformity with the disclosure norms under the act.

- Income tax act 1961 supports lower tax burden and interest rate for the companies, unlike the counterparts working under different provisions.

- Being a legal entity, a private company has all the authority to sue others in its name and vice versa.

Complications with a private limited company

- The transfer of share is less feasible in the private limited company. The provisions for procurement of share under Company act for private companies are quite stringent.

- In a private limited company, the provision for a number of members, in any case, is limited to 50.

- The prospectus of the private company is not sharable with the public.

- In the stock exchange, shares cannot be quoted.

Read our article:How to validate the Company Registration Number?

What is for limited liability partnerships (LLP)?

LLP stands for limited liability partnerships. This new form of business support partnership and corporation. Here the partnership exists with limited liability. Generally, LLPs are bound to conduct their operation under the provision of the LLC Act, 2008, and MCA.

Advantages of LLP

- The formation of LLP seeks little capital investment, which means, it can be formed by any capital amount. It offers less financial hassles to the owners. A minimum of 2 partners is required to establish an LLP. Moreover, the extension on the number of partners is also feasible here.

- LLPs’ registration cost is lower than other companies.

- All limited companies need to scrutinize their account via periodic auditing. LLP is not subjected to such provision, though. However, there is an exception to that, whenever the LLP’s contribution surpasses Rs. 25 lakh or Rs. 40 lakh figure w.r.t annual turnover, the company needs to legalize their account through auditing.

- An existing partnership firm can be easily transferred to LLP. To achieve that, the concerned party needs to follow the provision under clause 58 & Schedule II of the LLP Act[1]. Additionally, a legal firm such as form 17 and form 2 needs to filled by the firm to serve this purpose.

- The LLP firm is required to file two return i.e., annual return and statement of accounts and solvency.

- The dividend distribution tax does not apply to LLP.

- Substantial tax deductions apply to the interest given to the partners, remuneration, and salary bonus commission.

Complications with limited Liability Partnerships

- LLP’s financial accounts are subjected to public disclosure. The members who are not willing to share their account detail with others may dislike LLP for this.

- Tax relaxation could be perplexing here.

- Since the company is limited by share, profit cannot be retained in the same way. This means that the effective distribution of earned profit is a crucial necessity here.

- The unfortunate demise of one partner can dissolve LLC in no time.

Conclusion

To sum up, it’s all boils down to the individual’s preference for whether to select LLP or private limited company. Both the option has its benefits and disadvantages. If you are low on budget and have a fantastic business plan, then LLC is for you. On the flip side, if you prefer to go with provisions, 100% legality, and safe business practices, then private limited company registration is better for you. The choice is yours, but you need to do the math properly before rushing to register the relevant authority. Make sure you have all the requirements covered before engaging in any business. This will support your decision-making and let you pick the right option between Private limited company and LLP. At last, we would like you to connect with us, in case if you feel helpless or seek more info on this topic.

Read our article:Comparison between OPC and LLP: Advantage of One Person Company