Every business needs funds to ensure seamless growth and consistent prosperity. The procurement of funds is a daunting task, and its quantum depends on the structure of the business. While starting a business, an individual comes across tons of parameters, including business structures that may negatively impact their ROI. Thus selecting the right structure can significantly degrade the tax liabilities, paperwork, and stringent norms. One must commence with a selection of business structures suitable for raising funds. So without any ado, let’s get started with the concept of Business Structure w.r.t raising fund.

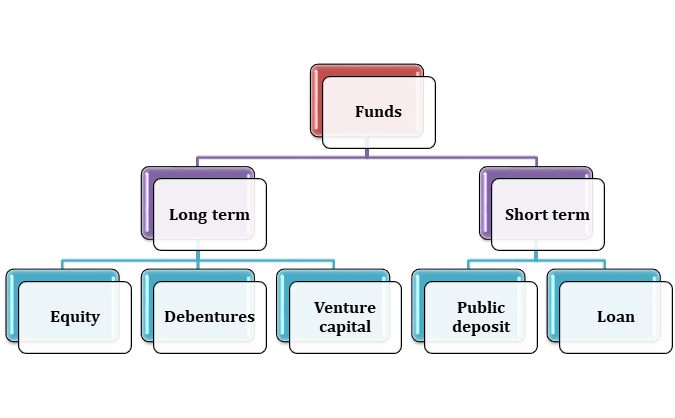

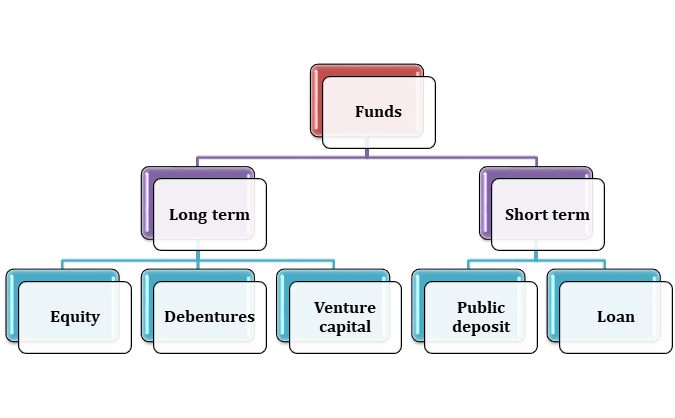

The funds can be raised through equity funding and debt funding.

What is Equity Funding?

Equity funding is one of the most effective strategies to raise capital for the company seeking immediate financial backup for bill payment, or a growth-oriented investment. This type of financing usually supports the startup and demands no immediate security against the allotted fund except a few company’s shares. These shares are generally referred to as equity, thus naming the process equity funding[1].

What is Debt Funding?

Debt funding refers to the allotment of funds to the company against the predetermined rate of interest and period. Here, for borrowing a fund, the company needs to provide a loan certificate to the investor by selling bonds.

Below, we have briefed the concept of different business structures concerning raising funds.

Private Limited Company – Great platform for fundraising

A private limited company does its fundraising by issuing equities. Thus, shareholders are the ones who control the company. A private limited company can also raise its capital by issuing securities. However, while doing so, the firm might confront some provisions restricting them to issue the securities to the public. Since this law discourages the public’s prior notification in such a case, the procurement of additional capital may become a daunting task for the company. It is probably one of the best Business Structure w.r.t raising funds.

Right issue

The right issue is a financial asset that is primarily issued to the existing shareholders. Thus, it is the most convenient option of fundraising, which discourages additional sharing of ownership.

Private placement

Whenever the company decided to allot or issue some shares to a specific group of person is known as a private placement. However, this type of share allotment cannot skip provisions under the Company Act. The allocation of share, in this case, is limited to 200 members.

Employee stock ownership plan (ESOP)

The equities shared with an employee or the Director of the company is known as ESOP. Generally speaking, ESOP is an employee benefit plan similar to a profit-sharing plan. The allotment of ESOP discourages immediate issuing if it spends less than one year in the market since its inception. Here the allotted shares are non-shareable to any other person. A company has plenty of options for raising capital via debts.

It can take advantage of loans, bonds, or debentures to secure additional capital. But it has to conduct its action as per Company Act provision and norms. It must be aware of the limitation imposed on the threshold of raise debts. Further, prior approval of shareholders is required to authenticate this process of fundraising.

Read our article:Procedure to increase the authorized share capital of a company

Partnership Firm – A moderate fundraising platform

Among all the business types, a partnership firm is arguably one of the most hassle-free forms of business. Its formation discourages stringent complaints, and it is quite easy to maintain as compared to counterparts. Unlike private limited firms, a partnership firm cannot issue share for fundraising, there a plethora of options out there for them. To crank up the existing capital volume, the firm can opt for more partners or request advances from the financial house.

Since the ownership of the partnership firm is shareable, they have multiple benefits over a sole proprietorship in terms of fundraising. Adding up more partners can result in increased capital and shareable liabilities. Thus, a partnership firm adheres to more authenticity and can avail quick loans from a bank due to high credibility. Although it has a moderate presence in the business realm in terms of fundraising, it is a reasonable Business Structure w.r.t raising fund.

Limited Liability Partnership – Support fundraising

LLP is a perfect mix of companies and a partnership firm. It doesn’t serve a long list of liabilities, and it acts like a legal entity, identical to a company. Furthermore, LLPs discourage stringent norms, and it can grow gradually without any harsh compliances. Henceforth, LLP registration can avail countless benefits as compared to its counterparts.

Its funding option is also identical to a partnership firm. Since it is not deemed as a private company, it does not follow the concept of equities. Consequently, it has all the authority to accumulate additional capital, similar to a partnership firm. It can boost up the number of partners and can avail credit from a bank to serve the fundraising purpose.

Since the capital or tax liabilities are not equally shareable among the LLPs partners, it has more credibility when contrasted with partnership firms. Furthermore, LLP comes under the strict provision of MCA; therefore, it manifests more trust and authenticity. It is pretty much an acceptable platform as far as Business Structures w.r.t raising fund is concerned.

Proprietorship Firm – Discourage fundraising

The business that runs single-handily by an individual is known as Proprietorship Firm. It discourages interference and sharing of ownership. This business structure could be helpful for those who seek easy procurement of funds via self-investment or through loans. Since it is not treated as a separate legal entity, the proprietor may not get loan approval from the major banks. And due to this, the proprietorship firms often fail to avail good amount of loan. Therefore, if your business seeks a regular supply of capital, then the proprietorship firm can be an excellent option for you. It is not an optimal choice as far as Business Structures w.r.t raising fund is concerned.

Conclusion

Every business structures have its benefits and cons. If your priority is a regular supply of funds, then a partnership firm could be a great choice. On the other hand, if you are looking for a legit option that discourages sharing ownership and still generates hassle-free funds for the company, you can go ahead with the rest of the options based on your tax liabilities and operating compliance.

Read our article:Private Limited Company: Funding & Sources