The term ‘alternative investment fund’ (aka AIF) regarded as a vehicle established for raising fund from multiple investors with an end goal to invest these funds into assets for the sake of high return. In a laymen term, an AIF is regarded as an investment that differs from traditional investment avenues. In this blog we would brief everything about AIF registration.

What is the Meaning of AIF Registration?

Alternative Investment Fund Registration can be referred to as legal permission, which enables every investor to avail of no. of benefits, whether for getting or investing funds. AIF is a private fund that doesn’t come under the jurisdiction of any regulatory agency.

It is a fund that invites investors from domestic and overseas locations to invest funds for collective benefits. Alternative Investment fund (AIF) does not encompass the category of funds under Securities and Exchange Board of India (Mutual Funds[1]) Regulations, 1996. AIF includes private equity funds, venture capital funds, debt funds, etc.

Categories under which you can seek AIF Registration

An applicant can seek AIF registration under three categories, which are as follows:-

Category – I AIF

This category deals with that category of funds that are invested in a start-up or social ventures. Following are the funds that come under this category:

- Social Venture funds

- Venture Capital Funds

- Sme Funds

- Infrastructure Funds

Category – II AIF

Under this category, Alternative Investment Funds cannot undertake to borrow except for daily operational requirements.

Category – III AIF

Alternative Investment Funds like hedge funds which trade with an aim to make short term returns or some other class of funds which are thoroughly accessible and for which no specific concessions are rendered by the government or other regulators.

Read our article:What are Alternative Investment Funds and why they are becoming increasingly popular across the Globe?

What are the Eligibility Criteria for AIF Registration?

Following criteria required to be met by the applicant to avail registration for Alternative investment fund:-

- As per the statutory rights included in the company’s MOA and AOA, the applicant cannot invite the public to subscribe to its securities.

- Under no circumstances, the numbers of investors for AIF cannot surpass the maximum limit i.e. 1000.

- If the applicant is a trust, then it has to submit the registered trust deed drafted in the view of Registration Act, 1908.

- In case the applicant is LLP, then the applicant is required to furnish the partnership deed filed under the supervision of the Registrar under the LLP Act, 2008.

- Investor must belong to the Indian Territory. The individual with NRI status can also apply for this registration.

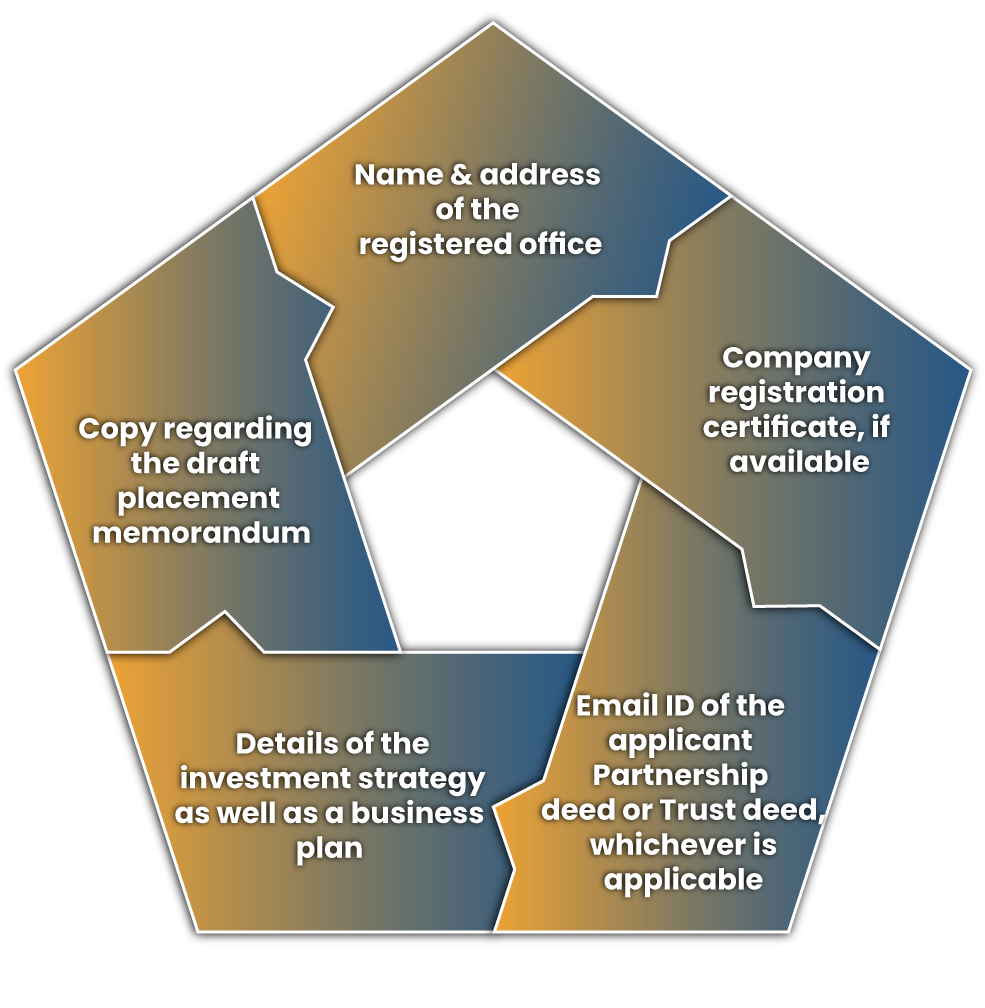

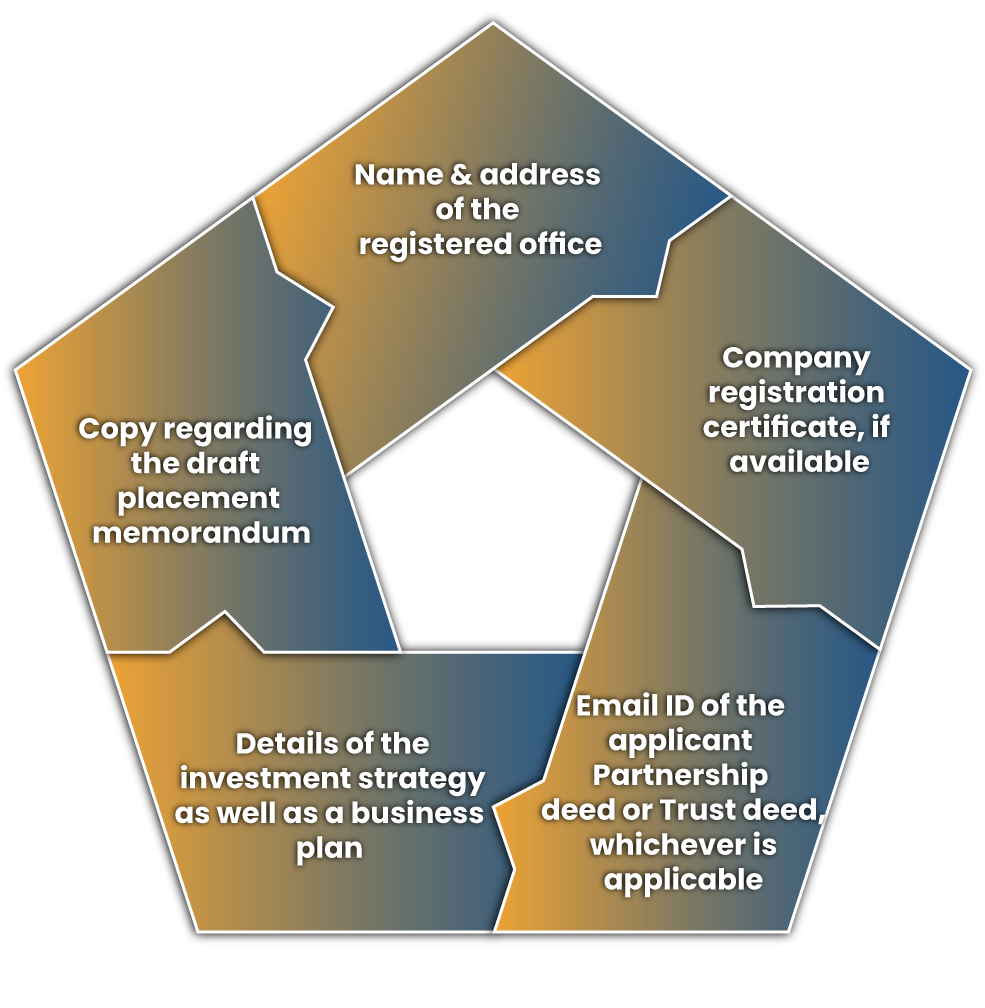

Paperwork required to be fulfilled for AIF Registration

An applicant who wishes to avail of AIF registration should arrange the following documentation with exception: –

Process for Registering the Alternative Investment Fund in India

Following are the steps related to the AIF registration. Applicants are requested to follow them in a given order.

Step 1 – First, the applicant needs to draft an application in Form A as per the provision mentioned under Securities and Exchange Board of India (AIF) Regulations, 2012. Keep in mind that a duly filed application will go along with the requested documentation and fees.

Step 2 – Upon receiving the application, within 3 weeks, the applicant will receive a reply from the concerned authority i.e., SEBI.

Step 3 – The applicant has to go through the SEBI regulations to check the eligibility criteria.

Step 4 – It is compulsory for the applicant to cite in the covering letter that is approved by SEBI as a venture capital fund or not. If the applicant is already registered, then he/she needs to furnish all the details accordingly.

The applicant is required to disclose their past engagement AIF activities, if any. In the cover letter, the applicant has to clearly mention that the application is for the registration of a new fund.

Step 5 – As an essential part of the registration process, the applicant must furnish Form A duly signed & stamped. A bank draft enclosing the amount of registration fees should also go with the application.

Issuance of AIF Registration Certificate

- Security and Exchange Board of India shall consider the provisions as mentioned in the SEBI’s regulation, 2012 for the purpose of issuance of the registration.

- After finding out that required prerequisites are met by the application, the authority i.e., SEBI, will approve the application and intimates the same with the applicant as soon as possible.

- After getting the green signal from the authority, the applicant must submit the registration fees via bank.

- As soon as the authority receives the payment regarding the registration fees, the registration certificate will be granted to the applicant.

Fee Structure Regarding the AlF Registration

An applicant requires to submit the payment as a registration fee as mentioned under SEBI regulations. The list below would render more clarification on that:

- The registration fee related to the Category I Alternative Investment Fund is Rs. 5, 00,000.

- The registration fee related to the Category II, Alternative Investment Fund, is Rs. 10, 00,000.

- The registration fee related to the Category III, Alternative Investment Fund, is Rs. 15, 00,000.

What is the Validity Period of AIF registration?

AIF registration certificate will continue to serve its purpose till the point of existence of the business; meaning- it comes with lifetime validity.

After getting the AIF registration from the authority, the applicant has to ensure conformity with the given requirements:-

- AIF needs to ensure conformity with the reporting requirements as provided by SEBI.

- Stay updated with the circulars and guidelines rolled out on the SEBI’s website to stay in the complaint.

- If investor should approach to SEBI for making changes in the detailed furnished to the authority

Conclusion

From the aforesaid information, we can conclude that AIF registration is compulsory for investment selling to establish the business of Venture capital, Angel Funding, etc. Presently, AIF is gaining popularity in the financial market due to innumerable benefits its offers to the investors.

The AIF registration process is relatively simple and straightforward, provided the applicant has the right set of documentation at their disposal. The registration holders are required to stay compliant with SEBI’s regulation to avoid conflict arising in business operation in future.

Read our article:Growth of Alternative Investment Funds (AIF) in an Indian Perspective