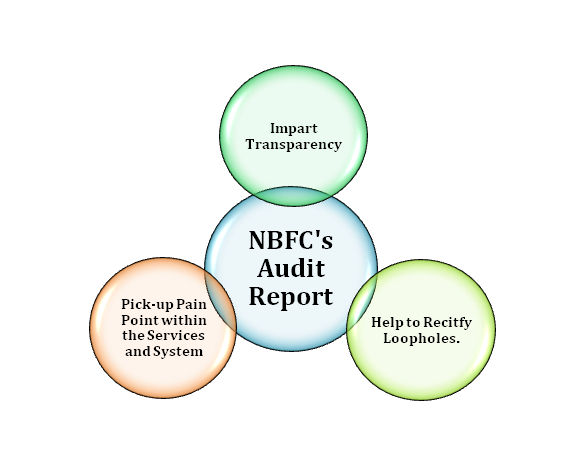

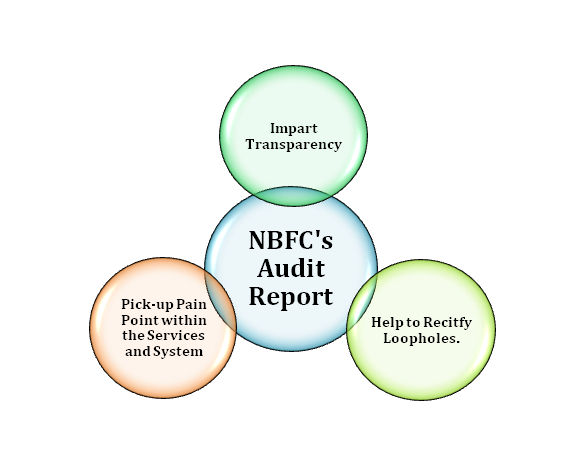

The audit report is prepared by the in-house auditors of the company. The audit report reflects the financial prowess of the company that helps investors to make informed decisions. This forces the auditors to pay extra attention while interpreting the data collected during the auditing process to draw a legitimate conclusion. The audit report is generated after a comprehensive evaluation of the company’s financial attributes against the GAAP’s compliances. Any skepticism in the audit report could build up a sense of uncertainty among the investors. The audit report imparts the sense of transparency in the system helping the organization to escalate the growth. In this blog, we will look into the Audit Report Format for NBFC.

Read our article:Internal and Statutory Audits in Non-Banking Financial Companies: All You Need To Know

What is an NBFC?

A registered company working under the canopy of Companies Act, 2013 involved in:-

- Business advances and loans

- Acquisition of securities, shares, bonds or debenture issues by local authority or government

- shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature,

- Leasing, Insurance Business, Hire Purchase, Chit Business

Significance of NBFC audit report

- The audit report doesn’t render any implication regarding the company’s performance. Instead, it is deemed as a critical indicator of the authenticity of the company’s financial statement[1].

- The auditor report is prepared by the in-house auditor of the company that reflects the company’s financial position based on the auditor’s opinion.

- In layman terms, the audit report is a financial stance of the company against the compliances mentioned under the GAAP*.

- An unbiased and error-less audit report means the company doesn’t involve in the infringement of the accounting standards. Meanwhile, the unclean report gives the implications of non-compliance and unfair business practice.

Audit Report Format for NBFC

The typical audit report format consolidates the followings information:-

Title

The title of the report declares it has been prepared by the autonomous auditors.

Addressee

The name of the entity or executives to whom the audit report is being delivered.

Report

The audit report encloses various financial details, such as Profit & Loss, balance sheets, and the cash flow statement. Additionally, the audit report also consolidates the summary regarding the accounting policies.

Management’s Responsibility for Financial Statements

Management’s Responsibility for Financial Statements aka MRFS is a sort of company’s declaration regarding financial standing.

Auditor’s responsibility

This section encloses the declaration stating the auditor’s opinion on the financial statements.

Opinion

Such a section indicates the auditor’s impression regarding the financial standing of the company after the completion of an audit. In this section, the auditor typically mentioned the audit outcome in terms of Modified Opinion and Un-modified Opinion.

Basis of opinion

Impart the clarification regarding the grounds on which the opinion is being made by the auditor.

Additional Reporting Responsibility

Such a section comes into existence when the auditor needs some additional reporting regarding the regulatory and legal requirements.

Signature of the auditor

The auditor signature is required to authenticate the audit report.

Place of sign

Here the auditor incorporates the city’s name in which the report has been signed.

Date

The date on which the report is signed.

Key inclusions in NBFC Auditor’s report

- Physical verification of the firm’s securities and shares.

- NBFC Prudential Norms incorporated or not.

- The number of loans availed by the firm against the shares.

- Whether KYC protocol is followed not.

- Cover up loans- a financial aid avail by the firm to counteract the existing liabilities.

- Checking if the firm has complied with the AS 13 “Accounting for Investments” or not.

- Checking balance confirmation.

- Checking follow up on loans and advances

- Checking if payment for asset acquisition is made to the supplier or not. In addition to that, the original invoice for the same has been drawn out in the NBFC’s name.

- Confirming that the assets conferred on hire purchase are insured against it

- Ascertaining appraisal system of the NBFC for extending the equipment leasing finance

- Verifying that the lease agreement.

What is GAAP?

Generally Accepted Accounting Principles (GAAP) consolidates fundamental accounting principles that act as a framework for more refined accounting rules & industry-oriented accounting practices. For instance, the Financial Accounting Standards Board (FASB) take advantages of GAAP to lay down their own accounting standards. Thus; we can now conclude the GAAP contains

- Standard accounting guidelines.

- The apex body of the country furnishes Accounting Standards.

- Industry-oriented accounting practices encompass vague and unorthodox scenarios.

In India, GAAP consolidates an array of provisions and guidelines that form an auditing framework. The preparation of the financial statements is done on the basis of the rule laid down by the Institute of Chartered Accountants of India (ICAI). The ICAI rolled out periodic updates rendering clarity on the accounting process. Well, that’s all about the Audit Report Format for NBFC.

Auditors undertake the following tasks during the auditing process.

- Investigate the Memorandum of Association to pinpoint the nature, objective, and principal business activities of the corporation.

- The auditor may scrutinize the minutes of the meeting, conduct meetings with the core executives to ascertain the business plan and principal business activities.

- Verification of the share and security held by the NBFC.

- Declaration from the entity holding security of the NBFC.

- Verification of the credit facilities and the investment made by the firm against the predetermined ceiling.

- Ascertaining Trading of investment by examining the board resolution or meeting documents.

- Cross-examining the value of investments against NBFC prudential norms directions.

- Validating investment injected in the subsidiary companies.

Conclusion

It boils down to the transparency that an entity has to maintain to buildup trustworthiness among the investors. Any NBFCs who seek prompt growth need to build a framework that supports the provisions for periodic auditing to maintain transparency within the system. Having said that, the auditing protocol is good enough to ensure the financial wellbeing of the company. Precisely, Internal Audits are done voluntarily as it is not mandatory by law. The internal auditor can conduct a comprehensive audit periodically and pinpoint the area of improvement. It helps the company to target the pain point and obliterate them with a relevant solution.

Read our article:NBFC Registration: Step by Step Procedure