Non-Banking Financial Institutes, aka NBFCs, are the anchor of the financial sector, accountable for the 12.5% rise in GDP. Unlike earlier days, NBFC registration is now quite easy to perform due to less paper. Before we address this registration process briefly, let us shed some light on the basics of NBFCs, whose role is to facilitate the easy loans/credit to the public. Even though NBFCs operation is enclosed in RBI regulation, they won’t work, unlike conventional banks. However, an infamous Sahara group’s incident has forced the RBI to strengthen the compliance to ensure lag-free day-to-day operations of companies after a successful registration process. There is a long list of prerequisites of NBFC registration.

The NBFC registration process isn’t that complicated as it seems. The company that seeks NBFC registration can approach to Ministry of Corporate Affairs before getting RBI’s approval. It helps companies to avoid all the hassle concerning the incorporation.

Prerequisites of NBFC Registration

The fulfilment of some prerequisites of NBFCs is mandatory to avail registration from RBI. The list mentioned below will explain everything regarding Prerequisites of NBFC Registration.

- The organization ought to be a registered entity under the Companies Act, 2013, and have 100% compliance with ROC.

- The company’s net owned funds should not be less than Rs. 2 Crore.

- At least one of the directors should have a working experience with NBFC/Banking.

- CIBIL records must be clear without exception.

- The company must have brief understanding of NBFC business, RBI regulations, NBFC Compliances, Disclosures, Taxation for e.g., Obligations under PML rule.

These prerequisites, collectively, will be enough for the NBFCs registration process. To avail the NBFC license, an applicant must apply online and offline. Furthermore, a comprehensive list of documents is required for the successful registration process. The given list will brief you on what type of documents is required to avail NBFC license.

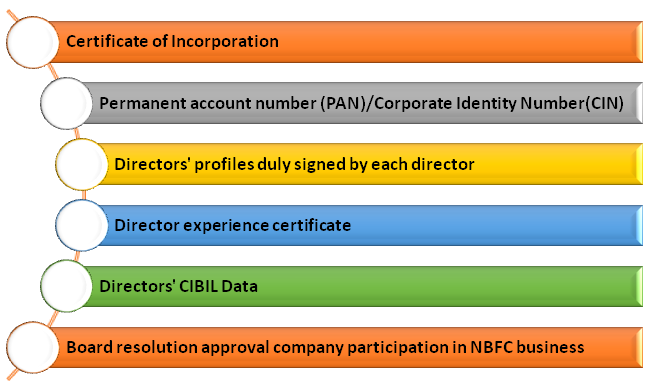

Documents for NBFC license

Details of the Documents

- Certificate of Incorporation

- Memorandum of Association accompanied by Articles of Association

- The memorandum should exhibit details regarding financial business.

- Copy of Permanent account number (PAN)

- Corporate Identity Number (CIN) allotted to the company.

- Directors’ profiles duly signed by each director

- Director experience certificate that represents its working background in NBFC

- Directors’ CIBIL Data

- Two years of Financial Statements concerning unincorporated Bodies, if any, in the company where the directors still possess directorship with/without substantial interest.

- Board Resolution approving submission of the application

- Board Resolution exhibiting the company’s acceptance/pledge concerning the integrity of public deposit

- The resolution should convey the organization’s conduct towards the unethical procurement of public deposit.

- Board resolution showing the company’s participation towards the NBFC activity regardless of the timeframe and its acceptance not to start the same unless they get permission from RBI

- Board Resolution showing the formulation of “Fair Practices Code”

- Statutory Auditors Certificate that shows the company’s compliance towards provision for procurement of public deposit.

- Statutory Auditors Certificate certifying that the company isn’t pursuing any kind of NBFC activity.

- Statutory Auditors Certificate showing the net owned fund of the company as on date of the application.

- Authorized Share Capital details along with the current shareholding pattern of the company with percentages

- Copy of &banker’s certificate and Fixed Deposit receipt

- Banking related details such as current balance, account info, branch address, and loan facilities, etc. availed.

- Copy of Audited balance sheet (last three years) and Profit & Loss account accompanied by directors & auditors report

- Documents illustrating the company’s plans for upcoming years (three years to be specific) encompassing the following elements:

- Thrust of business

- Asset/income pattern statement

- Projected balance sheets

- Market segment

- Cash flow statement

- Copy of the documentary evidence that authenticates the company’s source of the start-up capital

- Self-attested income Tax returns and bank statements etc

Steps to Register as NBFC

Step 1: Register the company under the Companies Act 2013 or under Companies Act 1956[1].

Step 2: Make sure that the Company’s Net Owned Funds aren’t less than Rs. 2 crores.

Step 3: At least one director of the company should have a working experience for a few years in the NBFC field.

Step 4: Remember, NBFC registration seeks an excellent CIBIL score without exception.

Step 5: Next, navigate to the official website of RBI and fill up all the details in the application form.

Step 6: Make sure you have possession of the required documents that you need to submit along with the application form.

Step 7: Once the application form is submitted, you will receive a CARN number.

Step 8: Get hold of the application’s hard copy and submit to the regional branch of RBI.

Step 9: Once the verification of the application is done, the license will be awarded to the company.

NBFC Registration Fees

An NBFC registration fee encompasses many expenses. Here is the classification of the fees structure for NBFC registration which is as follows:-

- An applicant must pay a fee (based on the company’s authorized capital) to the Ministry of Corporate Affairs (MCA).

- The fee structure for NBFC registration also encompasses the expenses for MOA (Memorandum of Association) and AOA(Articles of Association) of the company.

- A certain amount of fees is also payable concerning Simplified Proforma for Incorporating Company electronically (SPICe).

- Every director needs to provide a Digital Signature Certificate (DSC); thus its generation subjected to payment of periodic fees.

- Additional fees should go along with the application to the registrar.

Different types of NBFCs

The NBFCs can be classified under two widespread fronts:

- Based on the activity

- Based on the deposits

The types of Non-Banking Financial Corporations are as follows:

On the nature of their activity:

- Core Investment Company

- Mortgage Guarantee Company

- Loan Company

- Investment Company

- Micro Finance Company

- Asset Finance Company

- Infrastructure Finance Company

- Housing Finance Company

Based on deposits:

- Deposit accepting Non-Banking Financial Corporations

- Non-deposit accepting Non-Banking Financial Corporations

What services do the NBFCs offer?

NBFCs are the private entities that deal with the business of loans, acquiring securities, and issuing shares issued by the local authority or government. They are also engaged in acquiring other marketable securities such as leasing, chit business, hire-purchase, insurance business, and many more.

Read our article:NBFC Registration: Step by Step Procedure

What sort of services NBFCs are not dealing at this point?

NBFC isn’t involved in rendering services to the agriculture-based institution, trading of goods (other than securities), or industrial activities.

How exactly NBFCs differ from banks?

NBFCs and banks offer more or less identical in terms of the nature of services. But there are some critical differences between them given below

- NBFCs cannot opt for demand deposits.

- Issuing cheques is prohibited for NBFCs, especially when drawn on itself.

- NBFCs don’t support payment and settlement systems.

Advantages of NBFC:

- NBFC provides loans and credit at a faster pace.

- NBFCs can involve in the trading of money market instruments.

- NBFCs can help managing shares and portfolios of stocks.

- NBFC can take care of shares, stock, and other necessities.

- NBFCs are the one-stop destination for hassle-free money borrowing. Its pain-free provisions let users avail quick monetary help with less paperwork.

- Easy availment of the money is one of the key highlights of the NBFCs.

- The modern method has let NBFCs perform better than traditional bankers, where lending is a complicated and vague task.

- NBFCs have taken full advantage of modern communication technology, so providing a quick update and offering to concerned parties isn’t a hassle anymore. A swift approach has made NBFCs a prominent choice in the lending business.

- Technology is limited to the head of financial services and also benefitting NBFCs to perform better and render unparalleled services to the customers.

- Digitalization has placed the NBFCs right in the driving seat amid this fierce competition, where users have plenty of options regarding lending service.

- The combo of database and partnership with Government agencies has help NBFCs to get better penetration in the fiscal regime and lures more customers in a quick time.

Disadvantages of NBFC:

- The decreasing demand deposit is not accepted by NBFCs when contrasted with the activity of commercial banks.

- An NBFC does not support payment and settlement system, and as such, an NBFC doesn’t offer cheques drawn on itself.

- Unlike conventional banks, NBFC doesn’t provide a deposit insurance facility to the depositor.

- Only a few NBFCs provide the benefit of deposit acceptance. This liberty can only provide by those NBFCs who holds a registration certification to accept the public deposit. NBFCs regulatory mechanism is somewhat stringent.

To mend to loophole between banks and NBFCs, RBI has implemented some norm on NPA and capital adequacy. This norm clarifies the provision regarding minimum capital adequacy to the NBFC.

RBI’s guideline in the context of NBFCs code of conduct

- Under no circumstances, NBFCs should seek demand deposits from public depositors as it is a mandatory part of their conduct.

- The possession of the public deposits by the company should not extend 60 months period. Here the provision for the minimum period is 12 months.

- The Reserve Bank of India does not underpin the NBFCs code of conduct concerning repayment of the amount.

- The company shall offer the rate of interest, based on the RBI guidelines.

- NBFCs are fully entitled to issue cheques to the customer for the sake of the settlement or payments.

- The company is entitled to provide statutory return records on the deposit avail by the company via NBS-1 form every year.

- The company must provide a quarterly return on the company’s liquid assets.

- The company must facilitate the submission of the balance sheet every year.

- The evaluation of credit ratings is mandatory for the company every six months. Also, furnish one copy to the RBI.

- The half-yearly ALM return is compulsory to be submitted by the companies who hold

- Public Deposit of Rs.20 Crore or more.

- The NBFCs depositors, under no circumstances, benefit from the protection of deposit insurance and Credit Guarantee Corporation (DICGC).

- Only those NBFCs are permitted to accept conditional deposits from public depositors who have a Minimum Investment Grade Credit.

- NBFCs cannot provide additional benefits, gifts or incentives, to the depositors or customers, like conventional banks.

- The limitation of Public deposit in the form of Liquid Assets should stay at 15%.

Conclusion

There is no denying that NBFCs are playing a vital role in the financial sector. Whether it’s a question of lending money with flexible tenure and interest rate to the customer or furnishing swift credit to the help seekers in a demanding situation, NBFCs are way ahead of the conventional banking methodology and code of conduct.

The synergy between bank and government database has made the NBFCs stringent in many ways. From customer outreach to service rendering, the evolving RBI norms and technology are helping NBFCs to render excellent services. Of course, being a private lending entity, NBFCs have their own disadvantages, which seems to be dissolving every passing day due to evolving RBI standard.

The corporate seeking NBFCs registration must be well aware of the prerequisites of NBFC Registration. The amount of information here will give you a clear idea about what it takes to avail an NBFCs registration certificate from the concerned authority. Hopefully, everything we mentioned here is crystal clear to you. But if you think that some section of this topic is misleading or not providing sufficient information, kindly let us know.

Read our article:Documents Required for NBFC Registration