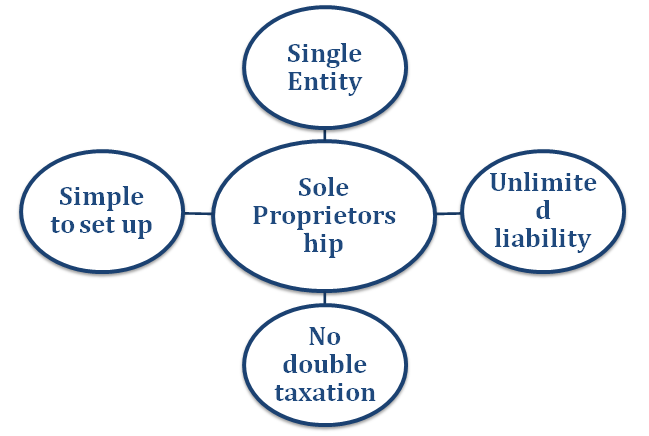

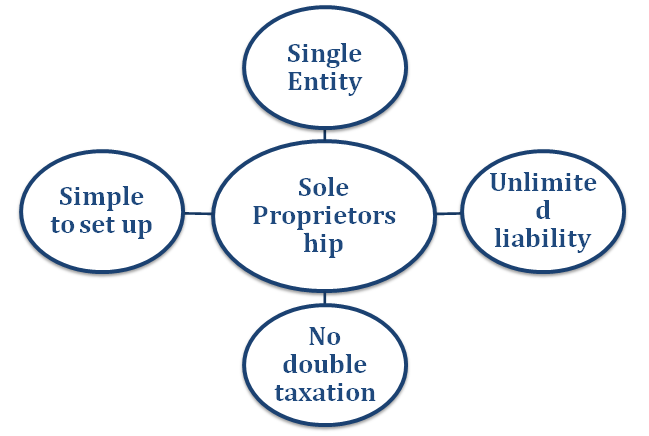

Sole Proprietorship is regarded as one of the most popular business models in India. It is easy to form and requires less registration formalities from any authority. It is suitable for entrepreneurs whose intension is to work independently without any legal obligations. Sole Proprietorship business model gives the complete authority to an individual to run their business at their own discretion. In this blog, we will be looking into the complete procedure for Sole Proprietorship registration.

Procedure for Sole Proprietorship registration

Since the Sole Proprietorship firm is not treated as a legal entity, it not necessary to avail of governmental registration for the same. However, there are some documents that a person needs to procure at this disposal before establishing a Sole Proprietorship firm.

Read our article:Here’s how you can Register Sole Proprietorship Business in India

Documents required to establish Sole Proprietorship Business in India

- Aadhar Card and PAN (Personal Identification Number) Card

- Bank account details

- Documents that authenticate the existence of business premises.

PAN Card

PAN card is mandatory for filing the ITR. If you haven’t secured your PAN number yet, make sure to head over to the NSDL online portal and applied for the same. As a part of the standard registration protocol, you need to fill up an applicant upon reaching the portal. The authority will then scrutinize your application on the predetermined grounds and generate the PAN number within a week.

The whole process will cost you around 110 bucks that you need to submit as a registration fee at the time of submission of the application. Also, keep in mind that you have to furnish your identity during online registration and address proof along with the photographs. After completing all the required investigation, the authority will send the PAN card to the applicant’s registered address.

Aadhar Card

Although Sole Proprietorship doesn’t seek any governmental registration, the applicant needs to procure some mandatory registrations to execute their business activities such as Aadhar Card, SME registration, Shop & Establishment Act License, and GST Registration.

Aadhar number is a must-have requirement for all business registration. The applicant seeking the establishment of Sole Proprietorship Business also needs to link their PAN number with Aaddhar for filing the annual taxes. Keep in mind that without Aaadhar, you won’t be able to set up any business form in India.

Feel free to navigate to AadharSeva Kendra or E-Mitra to get the possession of your personal identification number. The E-Mitra, in particular, is a government-driven online portal that will allow you to avail PAN number more conveniently. As soon as you complete the application formalities, your Aadhaar card will be generated within two to three weeks.

Bank Account

Once you successfully obtain Aadhar number and PAN, you will become eligible to open an account in any bank. Apart from these mandatory documents, you also need to submit the GST registration document for the same.

Registered office proof

If you are planning to execute your business activities on a rented property, then you must secure NOC from the landlord. On the contrary, you need to provide utility bills in case if the place of business is belong to you. Apart from that, there are some supplementary documents as well that applicants need to render for the establishment of their business.

Registering as SME

Though it’s not mandatory for the sole proprietorship business to avail Small and Medium Enterprise (SME) registration, it could significantly impact the business’s existence and growth. With such registration at disposal, the business entities can avail of numerous benefits such as securing government tender, getting ISO certificate, and exemptions under Direct taxes.

Shop and Establishment Act License

Shop and Establishment Act License is compulsory for small-scale enterprise and proprietorship business. The Municipal Corporation[1] is the authority that allocates this license to the business owners. The issuance of the Shop and Establishment Act License is done on the basis of number of employees and the nature of business.

GST Registration

GST registration isn’t compulsory for the business owners that earn below the minimum threshold limit i.eRs. 20 lakhs. It’s essential to note down that GST is an indirect form of taxation applicable to all business entities, including e-Commerce operators. You will be required to arrange the following documentation to avail of GSTIN from the concerned authority.

- Proprietor’s Aadhaar Card and PAN.

- Utility bills such as water bills and electricity bills.

- Documents acting as address proof for a business place.

- Copy of bank passbook displaying IFSC code, address of the premises, and account number.

Obtaining GSTIN isn’t a complicated task at all, as it can be availed by merely submitting a simple application on the GST portal. Upon receiving the application, the authority would conduct a comprehensive investigation of the given credentials and then finally furnish the GST number to the applicant. The whole process would take around 3-4days before its reach to the completion. After availing of the GST number, the applicant can start their business activities.

Conclusion

Nearly all business entities in India are under the enormous pressure of maintaining harmony with the given compliance. These firms are highly vulnerable to hefty penalties as the margin of error for them is very low. In case if you are not willing to face legal constraints after establishing the business, make sure to adopt the Sole Proprietorship business model. Since this business model doesn’t revolve around the complexities, it would give you better control of other variables that hamper the business’s efficacy in one way or another. We hope that everything has been clear to this point regarding procedure for Sole Proprietorship registration. If you need some additional guidance on this matter, connect with our CorpBiz’s expert today.

Read our article:Proprietorship Firm vs. Private Limited Company: Key Differences