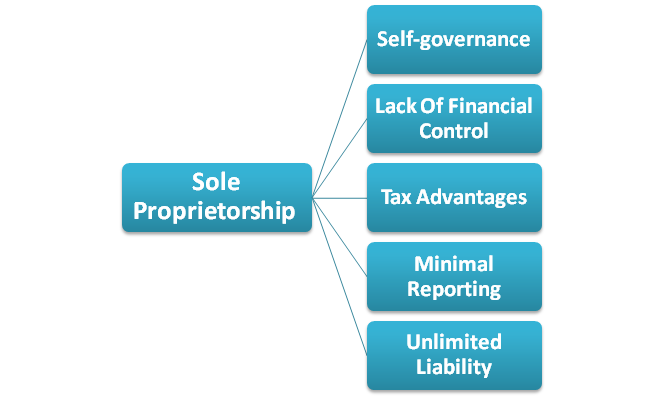

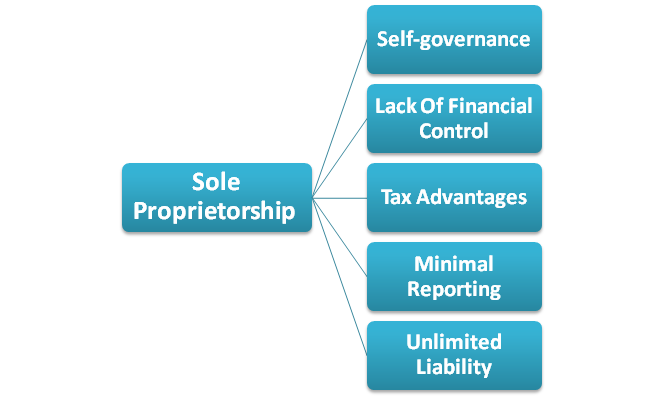

As the name suggests, a sole proprietorship is an independent business model operated by a single individual. Furthermore, these business models seek no governmental registration and could be run with a minimum of hassles. The ease of formation and less compliance make this business model quite popular across the unorganized business sector. In this write up we will break down information on Tax obligations for Sole proprietorship.

Tax obligations for Sole proprietorship

A sole proprietorship taxed differently unlike other business models. Sole proprietors in India don’t need to file a separate tax return on the income generated from their business. Simply put, the income earned by sole proprietors will be treated as their personal income and taxed accordingly. Just like individual assessee, the sole proprietors need to address tax obligations as per current IT rules based on the slab rates applicable to his taxable income. The income tax rate for the sole proprietors is similar to that of the individual income tax rate.

Read our article:Procedure for Sole Proprietorship Registration: A Step by Step Guide

Income tax rate for sole proprietorship for FY 2020-21

The table below explains the different slab rates for sole proprietorship for FY 2020-21

| Income slab range (in INR) | Tax rate (New regime) | Tax rate (Old regime) |

| 0- 2,50,000 | NIL | NIL |

| 2,50,001- 5 lakhs | 5% | 5% |

| 5,00,001- 7.5 lakhs | 10% | 20% |

| 7,50,001- 10 lakhs | 15% | 20% |

| 10,00,001- 12.5 lakhs | 20% | 30% |

| 12,50,001- 15 lakhs | 25% | 30% |

| Above 15,00,000 | 30% | 30% |

Tax slab for Sole Proprietors falls in the age group of 60-80 years

| Slabs rate (in INR) | Rate of tax |

| Up to Rs. 3 lakhs | Nil |

| Rs.3,00,001 to Rs.5 lakhs | 5% |

| Rs.5,00,001 to Rs.10 lakhs | 20% |

| Above Rs.10 lakhs | 30% |

Health and Education Cess

Cess is an additional levy imposed on the tax obligation by the government to procure capital for a particular purpose. Cess is generally computed on the income tax liability before appending interest given under 234A, 234B, and 234C of IT Act 1961[1] and surcharge, if any.

Tax slab for Sole Proprietors who is above 80 years

| Income Tax Slabs | Tax Rate | Health and Education Cess |

| Up to Rs. 5 lakh | Nil | Nil |

| Rs.5,00,001 to Rs.10 lakh | 20% | 4% of Income Tax |

| Above Rs.10 lakh | 30% | 4% of Income Tax |

Example of calculating the Tax obligations for Sole proprietorship

Mr. Raghav, aged 51 years managing a retail store as a proprietor, the particular of this income is illustrated in the given table.

- Net profit of Rs. 4, 20,000 generated in the previous year.

- Income of Rs. 18,000 reaped by the owner from the house property.

During the year, Mr. Raghav contributed to PF of Rs 50,000 in January and paid insurance premiums on the self of Rs. 10,000 and daughter of Rs 28,000. The evaluation of tax liability and total income is given below.

| Particulars | Amount in INR |

| Income generated from the House Property | 18,000 |

| Profits generated from the business | 4.2 lakh |

| Gross Total Income | 4,38,000 |

| Deductions available under VI-A | . |

| Premium paid towards Life Insurance | 38,000 |

| Contribution to PPF | 50,000 |

| Total Income | 3.5 lakh |

| Tax On Total Income [(350000-250000)*5%] | 5,000 |

| Rebate under section 87A | 2,500 |

| Total Tax Payable | 2,500 |

| Surcharge* | NIL |

| Tax Including Surcharge | 2,500 |

| Health and Education Cess (4% of the income tax) | 100 |

| Net Tax Payable | 2,600 |

Surcharge– Surcharge is a tax levied on tax. It is not imposed on the income generated but rather on tax payable. For instance, if Mr. X is earning an income of Rs 100 on which the Rs 30 as a tax is imposed, the surcharge @10% would be applied to the income tax value which makes the total taxable amount equivalent to Rs 33. Currently, a surcharge of 10% applies to an individual’s income exceeding Rs 50 Lakhs. Similarly, if the individual’s income surpasses the one crore mark then a surcharge @15% would be applied to that.

Different ways of filing the Income Tax Return

The sole proprietor needs to obtain a Permanent Account Number before filing an income tax return. However, the issuance authority won’t be able to furnish an independent PAN to the applicant since the sole proprietorship business doesn’t hold any separate identity. Thus; the PAN card allotted to the sole proprietor will be utilized to meet the income tax-related requirements.

Individuals engaged with a sole proprietorship business required to file the ITR-3 form. The sole proprietor can also serve this purpose through an online platform by using the digital signature. Individuals operating as a sole proprietor must file income tax return on or before 31st July. If the income tax return of the sole proprietorship seeks statutory audit as per the Income Tax Act, then the last of filling further extended to 30th September. Please note that an audit must be carried out by the registered CA to maintain the legality of the process.

Conclusions

As a sole proprietor, addressing your tax liability is much easier than other business models. It’s worth noting that the income of the sole proprietors is taxes as personal income, making it easier to manage tax obligations. Liabilities and business assets are distinctive because sole proprietorship are not treated as an independent business entity. All you need to consolidate your sole proprietorship’s income, profit, and losses on individual ITR form. Whether is matter of addressing tax liability or filling ITR on urgency, CorpBiz can help you out in finding best possible ways of encountering such obligations.

Read our article:Know the Documents Required for Sole Proprietorship Registration