A gift deed is a form of legal documentation that is used to validate the process of the property’s transfer. Unlike a sale agreement, the gift deed in India is executed without sale consideration. In legal terms, the gift deed typically comes into the existence when a donor decided to transfer his/her assets to the donee in the form of a gift. In simple words, a gift deed acts as legal proof for the act of gifting. Since executing a gift is purely a legal process, there are few things you must know while making a gift deed. In this blog, you will get familiar with the concept of Gift deed including the gift deed registration.

Registering a Gift deed in India

A typical gift deed outlines a legal declaration to be filed and signed by the donor in the presence of the sub-registrar. The form is also required to be signed by the donee as well as witnesses to validate the transfer, particularly in case of immovable property. Once the gift deed in India is executed, the donor is not eligible to revoke the deed at the later stage. However, there is an exception to that- if the donor includes the revocation clause in the contract then he/she can revoke the deed at any stage during the lifetime. It’s a good idea to execute a gift deed if you want to avert future complications over the transferred asset. This is something you must consider in the first place while making a gift deed.

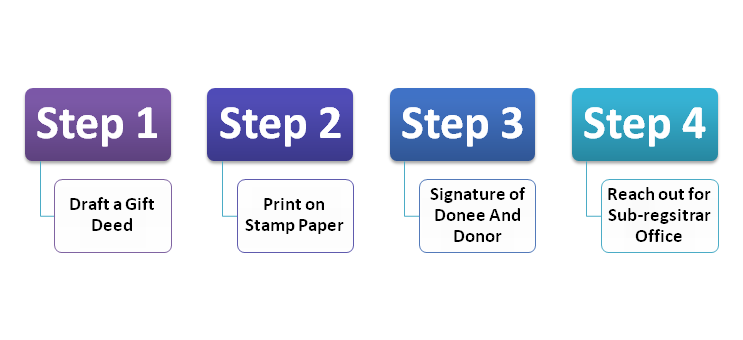

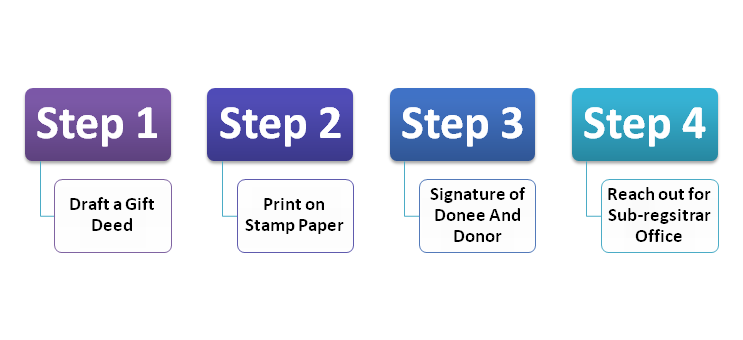

Process of making a Gift Deed in India

Read our article:Procedure for Gift deed registration: A Step By Step Guide

Gift Deed Clauses

The following are the clauses which are enclosed in a typical gift deed in India :-

Consideration Clause

A gift deed is executed purely – voluntarily and without any consideration.

Revocation Clause

It allows the donor to revoke the deed at the later stage if any complications arise.

Free Will

If the transfer of the property is done in the presence of the coercion or fear, then the gift deed shall be deemed legally invalid.

Possession of Property

This clause states that the presence of the real owner of the property is a must for drafting a gift deed.

About Donor and done

Gift deed shall manifest the relationship between the recipient and the donor as the estimation of the stamp duty depends on that.

Rights and Liabilities

The clause indicates the right of the donor and donee.

Information about property

Indicates the estimated value of the property along with its address

Gift deed Delivery

Shows the delivery date of the property

State-wise Gift Deed Registration Charges

| State/UT | Gift Deed Registration Charges |

| Delhi | 6% for women & 4% for men |

| Maharashtra | Stamp duty = Rs. 200 Registration charges= Rs 200, for gifting the residential or agricultural land to one’s relative after their demise. |

| West Bengal |

For

transferring property to a non-family member: 5% of the property’s value in panchayat areas, and 6% of value in municipal areasFor transferring property to a family member: 0.5% of the property’s market value. |

| Uttar Pradesh | 2% of the property’s market value |

| Karnataka |

For

transferring property to non-family member: 5% of the property’s value + surcharge + cess and registration fee (1%)For transferring property to a family member: Rs.1000 + registration fee of Rs.500 +surcharge + cess |

| Andhra Pradesh | Stamp Duty: 2% of the property’s market value Registration Charges: 0.5% property’s market value |

| Tamilnadu | Stamp Duty: 7% of the property’s market valueRegistration Fee: 1% property’s market value |

| Madhya Pradesh |

For

transferring property to a non-family member: 5% of the property’s market value. For transferring property to a family member: 2.5% of the property’s market value. |

| Telangana | Stamp Duty: 5% of the property’s market value. Registration Fee: 0.5% of the property’s market value. |

| Rajasthan | Stamp Duty: 6% of property’s market value. Registration Fee: 1% of the property’s market value. |

Involvement of the Minor in a Gift Deed

Transferring an asset through a gift deed comes with certain exceptions, particularly when it comes to the age of the donor. As per bylaws, the involvement of the minor is strictly prohibited for executing a gift deed.

On the contrary, if the recipient is a minor, a natural guardian can act as a donee on his/her behalf. The guardian would keep aforesaid under their possession until the minor attains the permissible age as per the provision. So be cautious with the age factor while making a gift deed.

Documents required while drafting a Gift Deed

Drafting the right set of documents is crucial while making a gift deed. The following list manifests the required documents that an applicant needs to at the sub-registrar office.

- PAN card[1]

- Driving license, Voter ID card, password as an identification proof.

- Aadhaar card

- Proof regarding the property’s ownership such as sale deed or related documents.

Revocation of the Gift Deed

Section 126 illustrates several provisions for the cancellation of the gift deed which are as follow:

- The donor and the recipient must draw an agreement through mutual consent for revoking the gift deed under certain criteria.

- The cancellation condition must be made clear to the recipient of the property.

- The revocation is only possible if the clause for revocation is mentioned in the deed.

- A bonafide gift cannot be revoked unilaterally. One has to engage with legal proceedings for the cancellation of the bonafide deed.

Conclusion

A gift deed is an effective legal instrument for the seamless transfer of property in India if made voluntarily. It is free from tax liabilities up to a certain limit. Also, it free from sale as well as central taxes. Connect with the proficient team of CorpBiz to get seamless and quality assistance different registration processes including the gift deed in India.

Read our article:Document Needed for Making a Gift Deed: A Complete Overview