The banking & financial sectors are the growth-oriented sectors of this nation. The advent of Non-Banking Financial Companies, broadly known as NBFCs, has triggered the growth of credit disbursement & financial inclusion of individuals and entities, particularly those that belong to the unbanked section. NBFCs have earned a reputation of being the most trusted financial avenue for those who lack access to conventional credit facilities. Facilitating easy credit with a minimal rate of interest is the USP of these institutions. NBFC sector is thriving at a monumental pace that lures the attention of domestic and overseas investors. Setting up an NBFC in India is a tedious undertaking due to countless compliances and paperwork. Its establishment seeks countless requisites, involving as a minimum capital requirement for NBFC. This blog takes a snapshot of the detail relating to the minimum capital requirements to start an NBFC in the country.

What is the role of NBFCs in India?

The NBFCs functions under the ambit of the Companies Act, 2013 and guidelines framed by RBI. The operating protocols of these institutions somehow match with the traditional banks, except on few fronts. Unlike conventional banks, NBFCs have relaxed norms related to loan disbursement, rate of interest and loan recovery.

These institutions aim to render a wide array of services, including business loans, personal loans, home loans, stocks, housing finance, general insurance, prepaid payment instruments, etc., to individuals and businesses across the country.

NBFCs have played a vital role in bridging the gap in the banking sector by facilitating seamless and easy credit facilities to the unbanked section of this country.

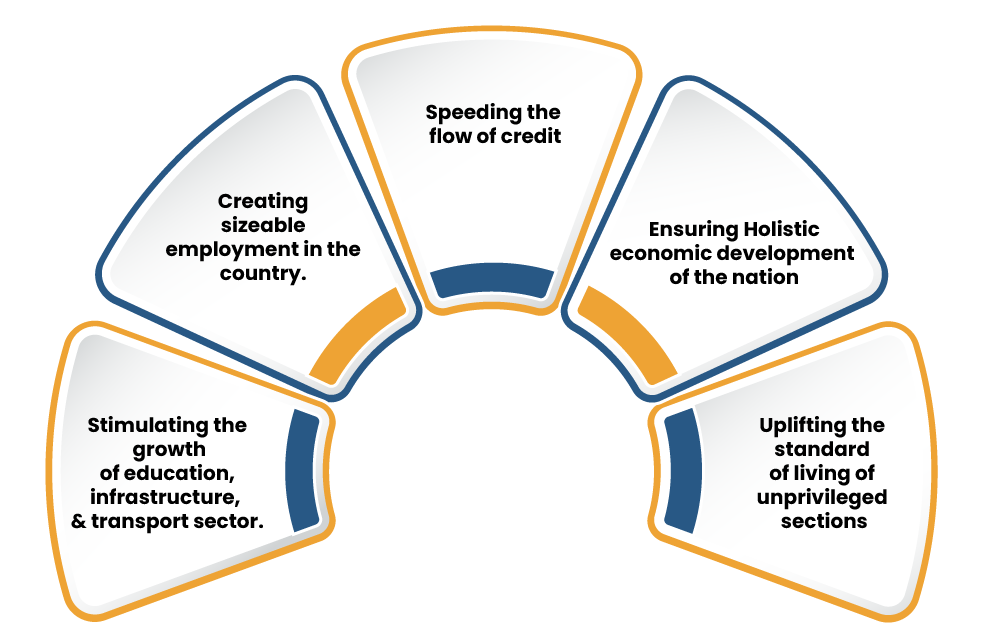

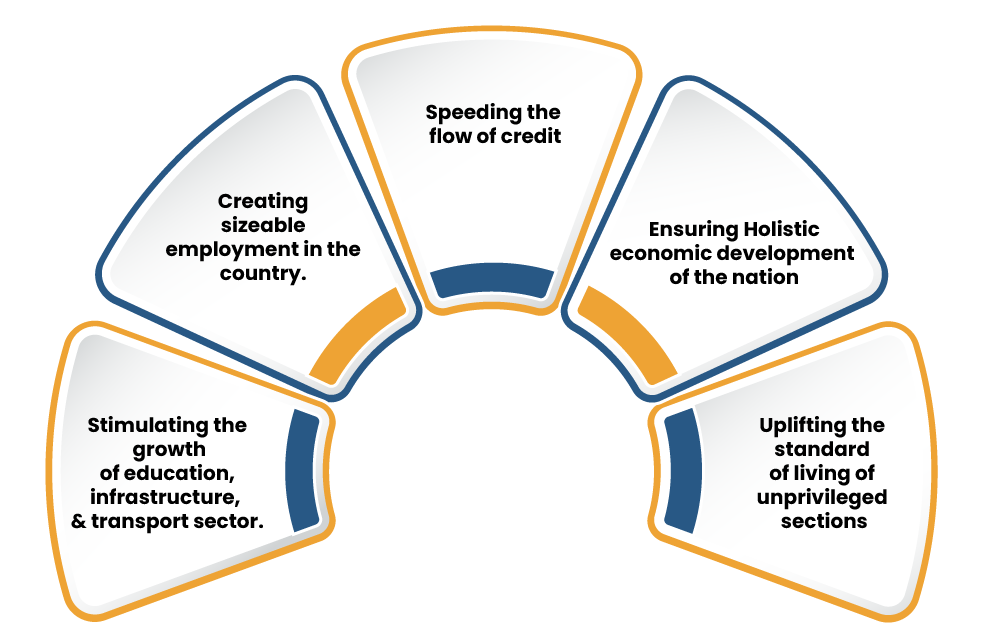

How are Non-Banking Financial Companies helping India to thrive?

Apart from resolving financial issues of the unbanked section of the society, the NBFCs are also helping in;

Conditions Relating to NBFC Registration in India

The RBI is a prime regulator of NBFCs in India, with certain exceptions. Any entity aiming to operate as an NBFC in India is mandated to follow RBI’s norms.

Section 45-IA of the RBI Act, 1934 has underpinned the following conditions for an entity intending to function as an NBFC in India.

- The company must be operating u/s 3 of the Companies Act, 2013[1]. Entities possessing business structures like Partnership or Sole Proprietorship are prohibited from functioning like an NBFC in India.

- Directors of the company must possess mini. Experience of 10 years in the financial regime. Such directors must be acting as full-time Directors of the company.

- The company should possess a brief NBFC business plan manifesting the operational strategy for the next five years. Further, it must entail clear goals and objectives, the market, products and services offered, risk management policies, technology, & operational system.

- The company and its Directors must have a healthy credit history with an uncompromised CIBIL score. These individuals must be free from any past default on the part of loans repayment to a bank.

- Company must ensure conformity with norms of FEMA Act, 1999 in case it is planning to open its door to Foreign Direct Investment.

- The company must stay in line with RBI’s norms meant for the minimum capital requirement for NBFC. This implies that the company must possess a mini. sum set aside as its NOFs (Net Owned Funds).

Read our article:Analysis of RBI’s Norms for Appointment of Statutory Central Auditors

An Outlook on Minimum Capital Requirement for NBFC Registration

Section 45-IA of the RBI Act, 1934, has set out the minimum capital requirement for NBFC in India. The Reserve Bank has framed stringent norms around minimum capital to alleviate any risk triggered by the financial crisis. The said norms are meant to support the customer’s interest and trigger market growth.

Coming to the minimum capital requirement for NBFCs, the Reserve Bank has provided that such entities are mandated to maintain minimum Net Owned Funds of INR 2 crores.

The RBI Act was amended in the year 1997, facilitating the mini. capital threshold as Rs 25 lakhs. But, in the subsequent amendment, this limit was increased, the new registrations now have to maintain a minimum NOFs of Rs 2 crores. The NBFCs functioning before this amendment were permitted to operate, with an extension to escalate their NOFs legitimately.

But, this norm also revolves around certain exceptions. The entity that aims to operate as an NBFC or MFI (Micro Finance Institution) is mandated to manage a minimum capital of INR 5 crores.

The same limit has been slashed down to Rs 2 crores in case entities operating in the North-Eastern states of the country. MFIs should open an account in a designated bank & deposit the capital as a fixed deposit.

To addition to that, the Companies Act’s registered entities seeking to function as NBFC must have NOFs of Rs 5 crores. The NBFC-factors functioning before this amendment had to visit the RBI to avail an extension to meet the minimum capital requirement for NBFC.

What are Net Owned Funds?

Net Owned Funds refers to the aggregate sum of the fund invested in a business, computed after adjusting any business losses (if any). NOFs, i.e. Net Owned Funds, are computed on the basis of the last audited balance sheet.

The Net owned Funds (NOFs) usually comprise of equity paid-up share capital. It does not entail preference share capital.

NOFs also encompassed any form of premium earned on reserves & shares. But, it does not entail any amount related to the borrower fund. The NOFs may also entail any gift received from the wife.

Total NOFs of an NBFC comprise of the Paid-up Equity Capital, Share Premium Account Balance, Free Reserves, Capital Reserve, & Premium Account Balance. The NOF of the company is computed by subtracting the Revaluation Reserves, Book Value of the Intangible Assets, & Balance of Accumulated Loss from the Total Owned Funds.

Also, if an entity has an investment portfolio in the forms of shares of any other NBFCs or share or debentures of a group & subsidiary entity more than 10% of the owned funds, the same is subtracted from its NOFs.

Conclusion

A minimum capital requirement for NBFC companies is a legal prerequisite that every NBFC must comply with. The Reserve Bank has revoked almost 1700 NBFC registration in “018 owing to their failure to fulfil the mini. capital requirements.

Read our article:RBI’s Guidelines on the Co-Lending Model between Banks & NBFCs