When an organization buys out goods on credit which requires to be paid back in a specific period of time is recognized as Account payable Service. Account payable is treated as liabilities and it used to be mentioned under the current liabilities of the balance sheet. In short, the account payable is a debt payment that requires to be paid to avert default.

What is the Notion of Account Payable in India?

We use the services like telephone, cable TV, and electricity quite consistently. Depending on the utilization, the service provider generated the bill and then sends it to us at the end of the month. It means we are liable to pay the amount against the said bill before the due date, or else you will have to confront additional charges in the form of penalty. This particular notion is known as account payable.

Now let’s understand the concept of Account payable from an organization’s perspective. Suppose you are an organization A, who buys out goods from, organization B on credit. You are agreed to pay the outstanding amount in 30 days as per the terms of the contract. Organization B will record this transaction in the form of accounts receivable and organization A i.e. you will record the purchase as accounts payable, it’s because company A is liable to pay the outstanding amount to company B.

As per the general accounting standard, this will be considered as sales even in the state of Nil transaction. The accounts department needs to adopt a cautious approach while handling the matter like this. Here, time is the key in the view of the fact that the short-term debt needs to be paid out within a specified timeline.

Apart from time, accuracy also plays a pivotal role here, which advocates the inclusion of the supplier’s name for the said transaction. Accuracy is crucial because it will affect the company’s financial[1] standing.

Read our article:An overview – Outsourcing of Accounts Payable Services

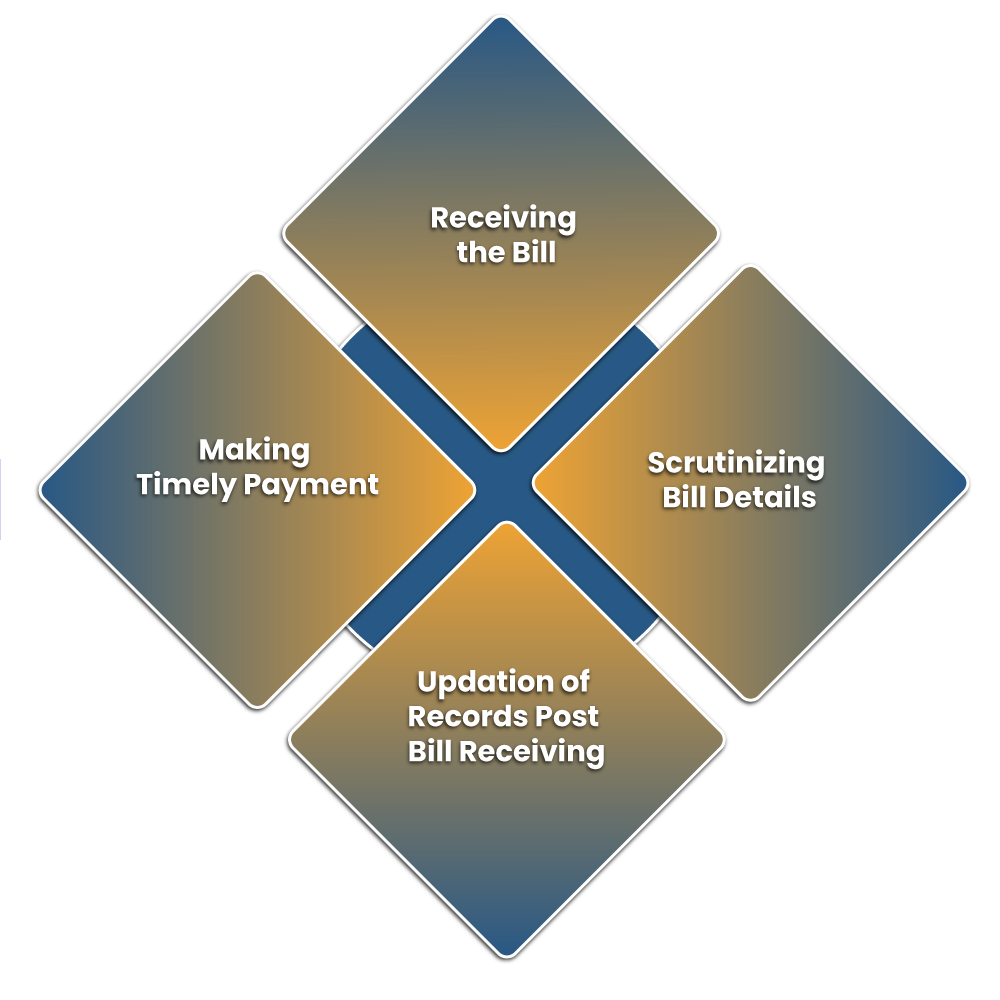

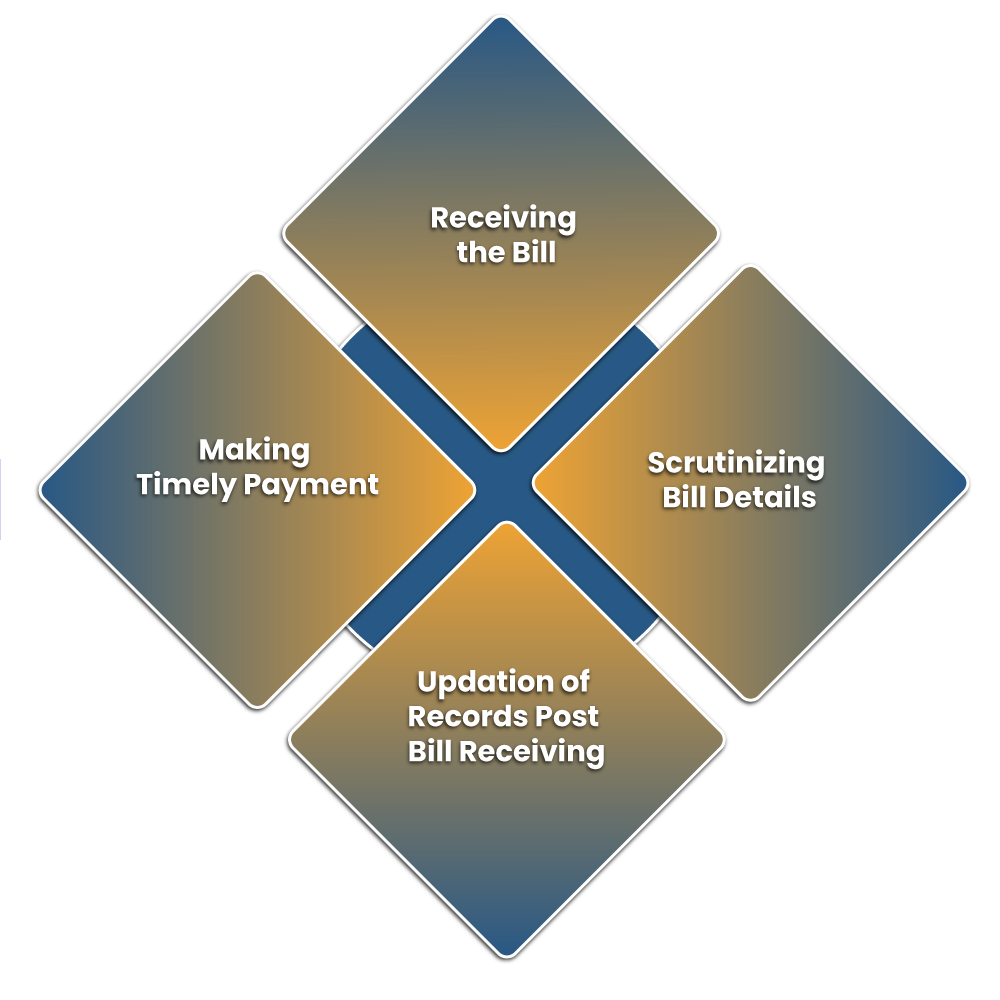

Process of Account Payable in India

The accounts payable department requires following a set procedure before making payment to vendors. Set procedures are critical and important due to the volume and value of transactions during any period of time. The process involves the accounts payable are as follows:-

Receiving the Bill

If goods were bought, the bill helps trace the quantity of the same along with the validity factor.

Scrutinizing Bill Details

Ensure that the bill encloses the date, name of the vendor, authorization, and verified requirement to the purchase order.

Updation of Records Post Bill Receiving

Ledger accounts require to be updated depending on the received bill & expense entry is typically required. Managerial approval is compulsory in such an event.

Making Timely Payment

All payments ought to be processed before or at their due date as per the contract’s terms. Required documents require be drafting and scrutinizing. Particular mentioned on the cheque, payment voucher, vendor bank details, purchase order, and the original bill requires to be checked.

To ensure a company’s assets and cash are protected, the account payable process must possess internal control to:-

- Prevent a fraudulent invoice

- Prevent an inaccurate invoice

- Prevent dual payment for the same invoice

Recording Accounts Payable (AP)

Proper double-entry bookkeeping seeks to offset for debit and credit into the general ledger. In order to get a record account payable, the accountant credits the said account after receiving the invoice. The debit offset for such an entry is basically to an expense account. However, debit can also be to an asset account in case of a purchase of capitalizable assets. As soon as the bill is paid, the accountant debits the account payable to lower down the liability balance. Likewise, the offsetting credit is also made to cash account for the same purpose i.e. to decrease the cash balance.

For instance, suppose a business receives an Rs 10,000 invoice for office supplies. As soon as the accounting department gets the invoice, they record the amount in the account payable and into the expense section of the book. The Rs 10,000 debit to expense navigates through cash statement even in the state of non-payment. This is in the view of accrual accounting, where expenses are acknowledged when incurred instead of when cash changes hands. The company then paid out the bill, and the accounting department records a Rs 10,000 credit to the cash account and a debit for Rs 10,000 to the account payable.

An organization may have several open payments due to vendors. Such outstanding payments go into an account payable. Consequently, if anyone scans the balance, they will see the amount of business owes all its short-term lenders and vendors. This total amount would be visible on the balance sheet. For instance, if the aforesaid company also received an invoice regarding lawn care services of Rs 2000, the total entry in account payable would be equivalent to Rs 12,000 prior to the payment of those debts.

Accounts Payable vs. Trade Payables

There is a common misconception that “accounts payable” and “trade payables” are similar terms. Indeed, they do appear alike but they bear a marginal difference. The trade payables contain the money a company owes its vendor, meanwhile account payable is refers to short-term debt and obligations.

Understanding the differences through an Example

If a gym owes money to a supplement company, those items fall under the category of inventory and thus part of its trade payable, On the other hand, obligations to other entities, for instance, the company that deals with the cleaning of staff member uniforms comes under the account payable category. Either of the categories comes under the larger accounts payable category, and many organizations infuse both under accounts payable.

Accounts Payable vs. Accounts Receivable

Account payable and account receivable are opposites, Account payable is the money an organization owes its vendors; meanwhile account receivable is the money that is owed to the organization, particularly by customers. When one organization transacts with another company, one will post an entry to account payable in bookkeeping record meanwhile other records the entry to account receivable.

Conclusion

Account payable is regarded as a liability in the accounting term. It comes into the existence when a company order goods or services without paying money upfront, which imposes a liability on the company. Account payable is not confined to the organization only; it applies to an individual as well.

Read our article:Prerequisite of Outsourcing Accounting Services for Business