Financial statements are considered to be the mandatory practice which every company requires to be published yearly, and reports are sent to the stakeholder and other various interested parties. The report consists of Financial Statement, disclosure, board‘s reports and auditor’s report. Financial statements are the main means of communication between the Board of Directors and Shareholders.

The provision of section 137 of Companies Act, 2013[1] provides that copy of the financial statement shall be filed with the registrar. Let’s discuss the financial statements in brief in this blog.

What are the Financial Statements?

Section 129 of Companies Act, 2013 provides the preparation of a financial statement. Further, Financial statements are the written records that convey business activities and the financial performance of the company. Financial statement includes the balance sheet, profit and loss account/income, expenditure account, cash flow statement of changes in equity etc.

Section 129 provides that the financial statements shall give a true and fair view of the current condition of the company. Also, states that reports shall comply with the accounting standards mentioned in new inserted section 133.

Further, the financial statements shall be prepared in the form as prescribed in new schedule II of the Companies Act, 2013.

What are the kinds of Financial Statements?

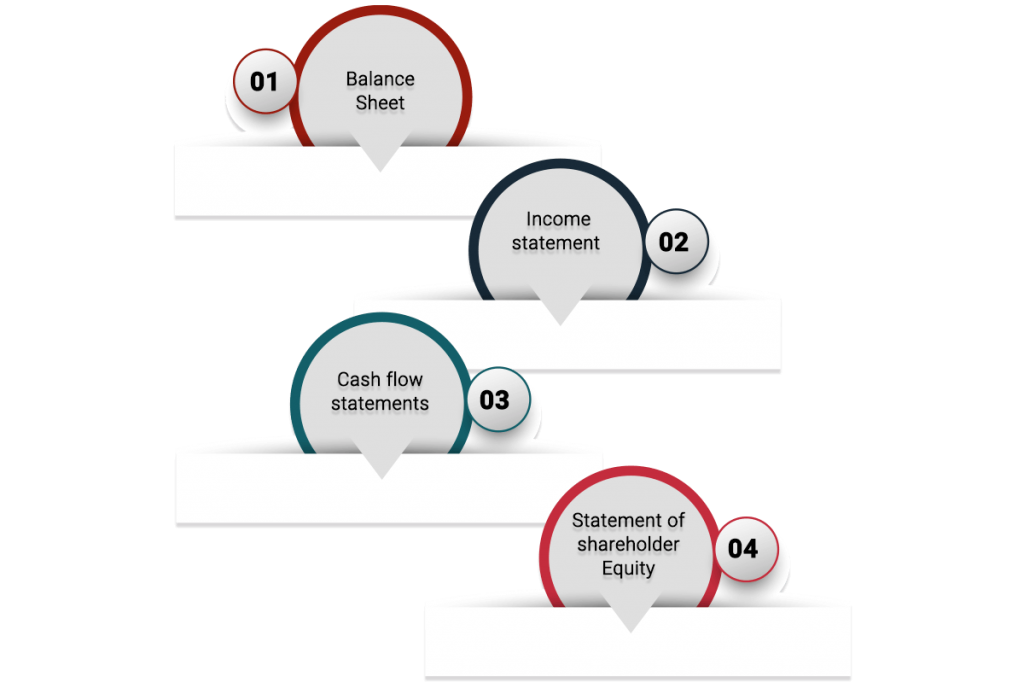

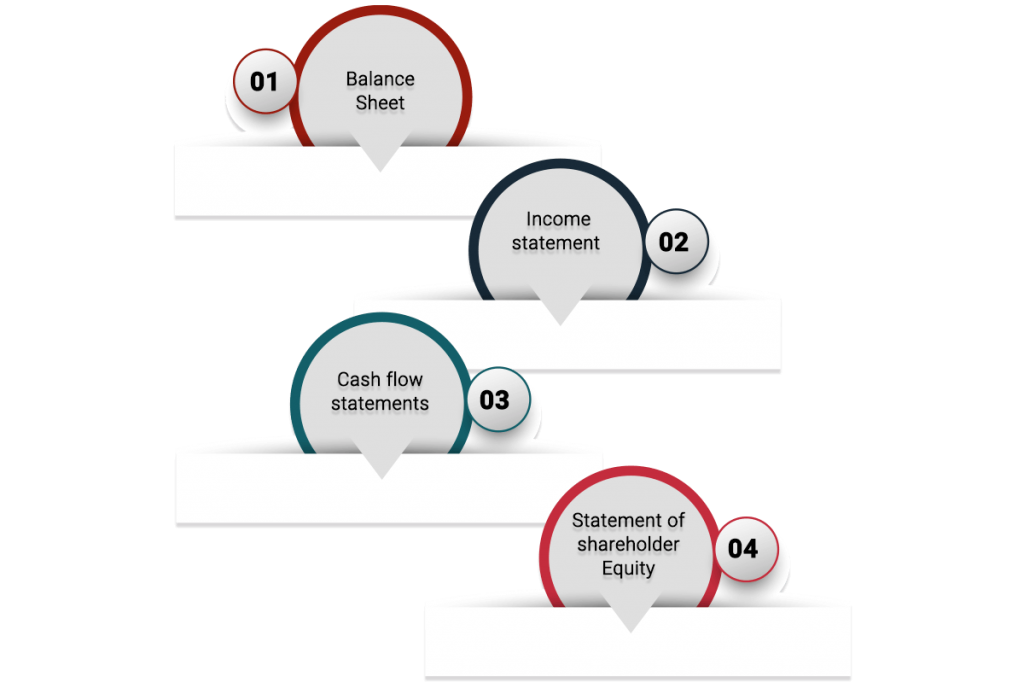

There are mainly four kinds of Financial Statement;

Balance Sheet;

A balance sheet shows the financial position of business till the date sheet was prepared. Information in the balance sheet is divided into the general classification of equity, assets and liabilities. Most issuance of the financial statement is included in the balance sheet.

Income Statement;

Income statements are the reports that provide the financial performance of the company. Statements begin with sales of the entire reporting period than all expenses incurred during that year are subtracted to take out the net profit and loss.

Cash flow statements

Cash Flow statements reveal the cash inflow and outflow experienced by the company. The cash flow statements are further divided into three classifications;

- Operating activities

- Investing activities

- Financing activities

Statement of Shareholder Equity

A change in equity during the reporting year is mentioned in the statement of shareholder equity. Changes such as issuance and purchase of shares, dividends issued, and profit and losses are defined in this report.

Filing of adopted financial Statement of companies

According to Section 137, subsection (1), one copy of the financial statements, including consolidated financial statement, if any, together shall be filed with the registrar along with the all documents. Statements shall be duly adopted at the annual general meeting of the company.

Within 30 days of the date of the annual general meeting, such statements are required to be filed. For standalone statements, Rule 12 has prescribed Form AOC-4 (for standalone statements) and AOC-4 CFS (for consolidated statements). Forms are required to be filed in Extensible Business Reporting Language (XBRL) format.

Read our article:What are the Basic Financial Statements?

Filing of unadopted financial statements of companies

First proviso to Section 137 subsection (1)provides that in case where financial statements are not adopted in annual general meeting such un adopted financial than such statements along with the documents which are required to be annexed to the financial statement shall be filed with the registrar within 30 days from the date of annual general meeting. Such filings will be taken on record as provisional till the filing of the adopted financial statements.

Filing of financial Statement by one Person Company

The third proviso of Section 137 (1), states that a One Person Company shall file a copy of financial statement duly adopted by its members, within 180 days of closure of the financial year.

Filing of Financial Statement of Company having Subsidiary {Section 137 (1)}

A Company shall file the financial statement of its subsidiary or subsidiaries which have been incorporated outside India or which are not established at their business place in India.

Filling of Financial Statements if AGM has not held {Section 137 (2)}

In case where AGM has not been held for any year, the statements along with the reason for not holding the meeting shall be filed along with the required documents within the 30days of the date when annual meeting shall be held with the ROC.

Penalties for not filing financial statement

Under section 137(1) or section 137 (2), if the company fails to file the Financial Statement they shall face the following mentioned penalties;

- The company shall be punishable with fine 1000, and if the failure continues then not fine shall be not exceeding the amount more than 10 lakhs;

- Managing director of the company, or chief financial officer of the company, or a person who is responsible for complying with the provision of section 137 shall be punished with

- Imprisonment for the time of 6 months which may extend;

- Fine, not less than 1 lakh rupees, which can extend to 5 lakhs;

- Both fine and Imprisonment.

Filing of financial statements using XBRL Taxonomy Format

According to rule 3 of companies rule, below mentioned companies should file their financial statements and other documents with the registrar in e- form AOC XBRL for the financial year using XBRL Taxonomy format; namely

- Companies listed with any stock exchange and their Indian subsidiaries

- Companies having their paid-up capital 5 crores or above ;

- Companies having a turnover of 100 crores and above;

- Companies covered under the Companies (Filing of documents and forms in extensible business reporting language)rule, 2011.

However, companies in Banking, Insurance, Non- banking financial companies and power sector companies are exempted from XBRL Filing.

Additional Compliances for Listed Companies

Along with the above, the listed company, according to Regulation 34 of SEBI shall submit the annual reports to the stock exchange with 21 working days after receiving the approval in AGM.

Points to remember while filing Financial Statement by XBRL

Following Points are required to be considered while filing

Part A, Particulars in respect of Balance sheet

- Firstly enter the Company’s CIN.

- In the next step, you will find the pre-filled button where the Name, registered office, email ID and date of incorporation will be pre-filled. The change in any information can be updated. Number of Members and authorized capital as on the date of filing will be automatically filled.

- Now, enter the start date and end date of the financial year.

- Further, enter the Date of the Board of Directors’ meeting in which the financial statements and Boards’ report duly approved.

- Now, enter the date of signing of reports on the financial statements by the auditors.

- In this step, furnish the details date of signing of reports on the financial statements by the auditors in AGM.

- The particular of subsidiary companies has to be entered.

- Details of auditor such as Name, membership number of the auditor/auditor’s firm’s registration number and address has to be filled in.

Information in respect of Balance sheet

This part consists of various details in regards to the balance sheet and the financial parameters of the balance sheet.

Information and Particulars in respect of Profit & Loss Account

- Particulars related to Profit & Loss Account and the financial parameters have to be filled here.

Reporting of Corporate Social Responsibility

- As per Section 135 of the Companies Act 2013, mention the applicability of CSR as per and the rules along with the turnover and net worth.

- Report the average Net profit of the company for the last three financial years.

- Information on expenses in tabular format needs to be furnished.

- If the expenses are related to the assistance provided to the implementing agencies, the Name, address and email address of such agencies have to be mentioned.

Disclosure about related party transactions

- Details of the contracts company have entered into on arm’s length basis and where the company has entered without arm’s length basis the details should be furnished in a detailed manner.

Auditor’s Report

- According to section 143 of the Companies Act 2013, if the audit report has commented/supplemented, the report has to be mentioned. (only in case of govt. company)

- Adverse remarks made by the auditor and the applicability of CARGO to the company needs to mention.

Miscellaneous

- Under section 134(3), detailed disclosure of director report and applicability of secretarial audit needs to be covered.

Conclusion

The financial report is information provided to potential investors, which make them understand how the company is performing. It also determines the health and stability of the company, which can even help the company to understand how the company conduct it’s business. For taking investment decision financial statements are one of the major tools. Hence, the company should file its financial report within the prescribed manner and in time.

Read our article:Voluntary Revision of Financial Statement