If you are reading this blog then probably you are done with your incorporation process and looking ahead to cater to Post Incorporation Compliances. This write-up will throw some light on the process of incorporation of a company as well as compliances that come in a post-registration stage.

Setting up a company can be a thrilling process that ensures several rewards. But, there is a long list of compliances that entrepreneurs must be aware of before registering the business. The young blood of our nation seems to be more inclined toward entrepreneurship, thanks to several government schemes and platforms. The pace at which start-ups are growing at present is just phenomenal.

The Indian government has great admiration for the start-up ecosystem and has taken several steps that foster their growth. Catering to legalities in the pre and post-incorporation phase was somewhat complicated for start-ups a few years back. However, after the advent of the online registration system, things have become simpler now.

Read our article:Pvt. Ltd. Company: Things You Must Know

Post Incorporation Compliances in India for Companies

Here is the list of imperative post incorporation compliances that one has to address with subtlety.

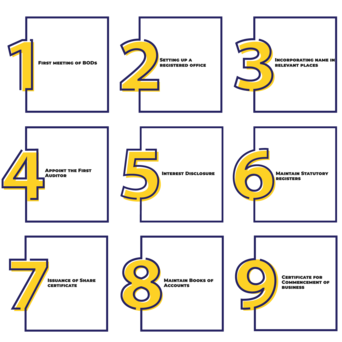

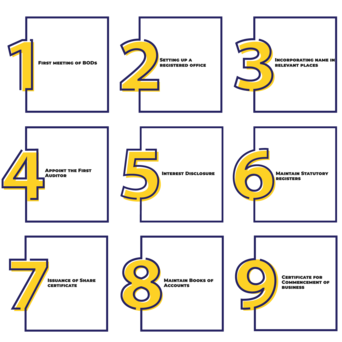

First meeting of BODs

Section 173(1) of The Companies Act 2013 mandates the company to hold the meeting of the BODs within 30 days from the incorporation date. Directors are allowed to join such a meeting either in person or via video conferencing.

Setting up a registered office

As per Section 12(1), a company is required to set up a registered office within 15 days from the incorporation date. This will be the place where the company is supposed to receive all official communication from the various authorities. The company shall communicate the same to the registrar within thirty days from the incorporation date.

Incorporating name in places that matter

Every company should mandatorily affix its name at relevant places that are supposed to be part of its operations. It should be manifested in the local language. Moreover, the letterhead and other printed medium should reflect the company name along with its seal.

Appoint the First Auditor

As per Section 139(1), BODs must appoint the first auditor within 30 days from the incorporation date. In case of failure, the said obligation should be addressed by the members within 90 days at an EGM (Extraordinary General Meeting). The auditor shall continue to serve his duties until the conclusion of the first AGM.

Interest Disclosure

At the very first board meeting, every director shall reveal his interest in any firm/establishment/company as cited in section 184(1) of the Companies Act 2013[1]. Any modification in the revelations shall be shared with the board in its first meeting occurred during each fiscal year. An autonomous director, if any, should render a declaration that he/she satisfies the criteria of independence during the initial board meeting as a director.

Maintain Statutory registers

This is one of the most important Post company registration Compliances. According to the Company Act, it is a compulsion for the company to maintain statutory registers at the registered premises. Since it is a legal obligation, such an activity must be recorded in the prescribed form. Failing to this could compel the company to encounter considerable penalties.

Issuance of Share certificate

The Company is obligated to issue the share certificate to its shareholder within 60 days from the incorporation date. In case some additional share being allotted, the timeline of 60 days is available to the company for issuing the certificate from the allotment date.

Maintain Books of Accounts

In light of Section 128, every company shall properly maintain books of accounts that shall reflect a subtle and unprejudiced view of the status quo of the company.

The company should foster a double-entry system and perform accounting functions on an accrual basis.

Certificate for Commencement of business

The prevailing bylaws mandate company to obtain a certificate of commencement within 180 days from the incorporation date. There is also a compulsion to file a disclosure being announced by the directors reflecting that every subscriber has paid any outstanding amount on the shares.

Conclusion

As you see there are plenty of post-incorporation obligations that one needs to cater to with authenticity. It’s needless to mention that any non-compliance in this regard can compel any company to face severe penalties. Make sure there is proper management in place to take care of these compliances so that the core members can focus on core competencies. Ping us in case you seek more clarification on Post Incorporation Compliances.

Read our article:All you need to Know about Private Limited Company