Prevention of Money Laundering Act, 2002 is an Act that was enacted during the NDA governance for the confiscation of property derived via fraudulent activities including money-laundering. PMLA came into the force from 7/7/2005. The Act imposes several regulations on the financial institutes, banking companies to check the ID of clients, manage records for the same, and render details to Financial Intelligence Unit* – India (FIU-IND). In this blog, we will unfold the PMLA policy for NFBC.

Read our article:What are the Key Differences between NBFCs and Banks?

Objectives of PMLA Policy for NFBC

The PMLA was enacted to overcome money laundering in the country. It revolves around three objectives:

- To control the confiscation of property derived via fraudulent activities including money-laundering.

- To rein money-laundering

- To deal with other attributes associated with money laundering in India.

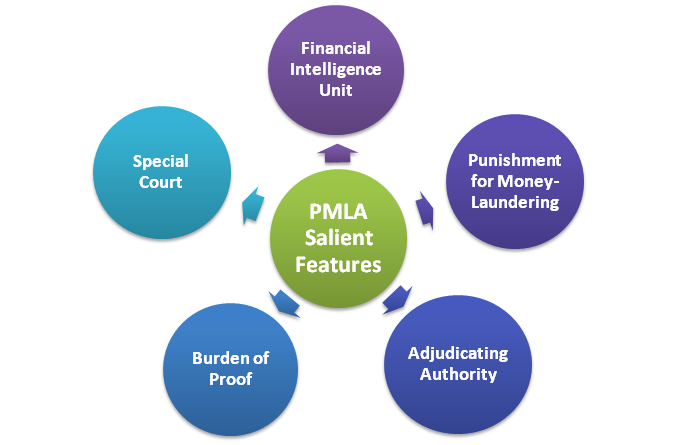

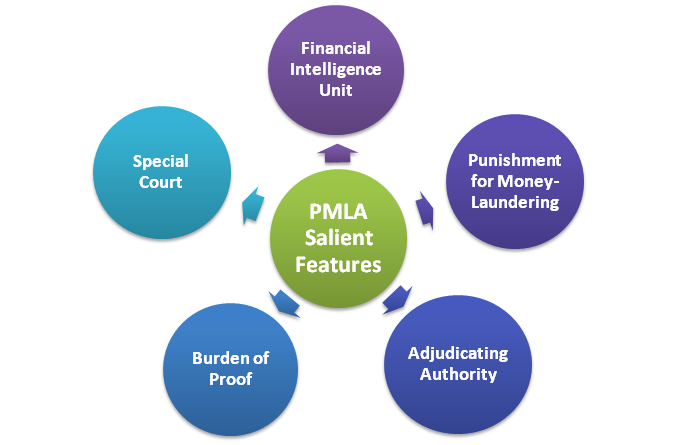

Financial Intelligence Unit

- India (FIU-IND) was introduced by the government on 18/11/2005 as the centralized authority accountable for obtaining, compiling, verifying, and propagating details in the context of fraudulent transactions.

- FIU-IND is accountable for cushioning the other intelligence agencies and work in tandem with these agencies to pursue the effort against money laundering.

- Being an autonomous body, FIU-IND report directly to the Economic Intelligence Council (EIC) managed by Finance Minister.

Preventing Financing of Terrorism

In terms of PMLA Rules, suspicious transactions are those which offer reasonable doubts that these might involve financing to terrorism. Therefore, NBFC must setup a suitable mechanism via policy framework for in-depth monitoring of accounts suspected of being engaged with terrorist links and making an illustrative report to the Financial Intelligence Unit[1] on a priority basis.

Security Council Committee

As soon as the list of entities and individuals sanctioned by the Security Council Committee established following several United Nations Security Council Resolutions (UNSCRs) are obtained from the Indian Government. RBI circulates these to banks operating across the country including NBFCs. NBFC, on the contrary, must update the extensive list of entities and individuals as circulated by RBI. Further, the same list can be accessed on the official website of the United Nations. The NBFCs should make sure that the name of the proposed customer should not appear on the list before opening a new account.

Verify the Existing Accounts

Moreover, NBFC also needs to verify the existing accounts to make sure that no account is associated with any individual or entities enclosed in the list. The company must communicate with RBI and FIU-IND upfront in case of the detection of any suspicious account.

Screening Mechanism

To make to banking channel safe, NBFCs are required to set up a cutting-edge screening mechanism to detect the suspicious candidate during the hiring process.

Enclosed Suspicious Activities

In regards to generating awareness in the context of KYC/AML among the workforce, NBFCs might take reference to the list of suspicious activities enclosed in Annex-V of the CC no.126. These instructions are available under Section 45K and 45L of the RBI Act, 1934 and any infringement with the same might lures severe penalties mentioned under the Act.

Internal Reporting Of Superficial Transactions

NBFCs should appoint a principal office and establish a system regarding the internal reporting of superficial transactions and cash transactions of rupees ten lakh and above. In this context, the Department of Revenue, Ministry of Finance, issued a circular dated July 1, 2005, notifying the rules under the PML Act, 2002. Section 12 of PLMA, 2002 imposed certain accountability on the NBFCs in the context of preservation & reporting of the information related to the customers. Therefore, NBFCs are directed to take reference to the provisions of PMLA, 2002, and take relevant actions to ensure compliance with the provision of section 12 of the Act ibid.

Maintenance of Transaction’s Records

NBFCs must incorporate the system that effectively managed the record of transaction mentioned under Rule 3, as given below:-

- The consolidated value of all the cash transaction exceeds the minimum threshold value i.e. 10 lakh

- The entire series of transactions (in cash) connected having an aggregate value of ten lakh rupees or its equivalent in foreign currency where such nature of transactions have been executed within a month and the consolidated worth of such transactions surpasses Rs 10 lakh.

- All cash transactions revolve around counterfeit currency and where the criminal activities have taken place against the valuable security.

- All suspicious transactions irrespective of their nature are not made as per the rules enacted by the Indian government under PML Act, 2002.

Information to be Preserved

NBFCs should mandatorily enclose the given details w.r.t transactions mentioned under Rule 3:-

- The nature of the transactions as well as their amount

- The type of currency

- Transaction date

- The parties engaged with the transaction.

Maintenance and Preservation of records

NBFCs should take relevant measures to develop a system for better management of account details. The system should be capable of retrieving the account information whenever the need arises. Moreover, NBFCs must maintain all the relevant data of the transaction for at least 10 years from the date of termination of the transaction between the client and the NBFC. This would allow the reconstruction of the individual transaction to render the proof for the prosecution of a person engaged with criminal activities.

NBFC should preserve the record of the customers along with their address for at least ten years after the cessation of the business relationship. The ID proofs and data related to the transaction should be made available at the disposal of relevant authorities upon request.

Conclusion

PMLA policy for NFBC was introduced to confiscate the transfer of an illegal asset at any cost. The financial institution needs to implant these policies within their framework and also accountable for reporting to Financial Intelligent Unit, India for sharing client records upon request. PMLA ensures transparency within the system and controls the movement of fraudulent money.

Read our article:Ombudsman Scheme for NBFCs – A Complete Overview