Selection of an appropriate M&A payment paves down the roadmap for successful M&A. Method of payments includes leverage payment, cash payment, & security payment. The different payment methods have different influences on the capital structure, financial status, & controlling of the purchasing entity after the mergers & acquisitions. Method of payment also affects the performance of Merger and Acquisition .

What are the Common Payment Methods for Merger and Acquisition?

Payment methods with M&A refer to the financial tools used by the companies to complete the business transaction. The payment method with M&A includes:-

Cash Payment

This payment method is extensively used across all business domains owing to its simplicity and transparency. For companies, putting cash upfront seems more reliable and straightforward as compared to other payment methods. Although cash is the most viable payment method, it loses its relevancy when the transaction costs are too high.

Security Payment

Security payment refers to a payment method under which the purchasing firm rolled out new securities for buying the assets or shares of the target firms. It includes the given forms:-

Share Payment

With such payment, the purchasing firm rolled out new stocks for buying the assets or stocks of the target companies. Among which, the most widely-used form is the share exchange through which purchasing firm pays the share directly to the target company to buyout assets and stock.

Bond Payment

With bond payment, the purchasing firms issue corporate bonds to purchase the assets or share of the target companies. As a payment method with M&A, this category of bonds has a higher credit rating and negotiability.

Leveraged Buyout (LOB)

Leveraged buyout refers to a payment method through which purchasing firms finance capital with M&A via increasing debts. Under this payment method, the purchasing firms take the future operating cash flow of the target firms as pledges to raise debts to finance capital via investors and then buy out the target firms’ ownership with cash payment. When contrasted with bond payment, LOB leads to a higher capital cost, as bank loans’ interest is significantly higher than the corporate bonds.

Read our article:Merger or Amalgamation of Company with Foreign Company: Complete Overview

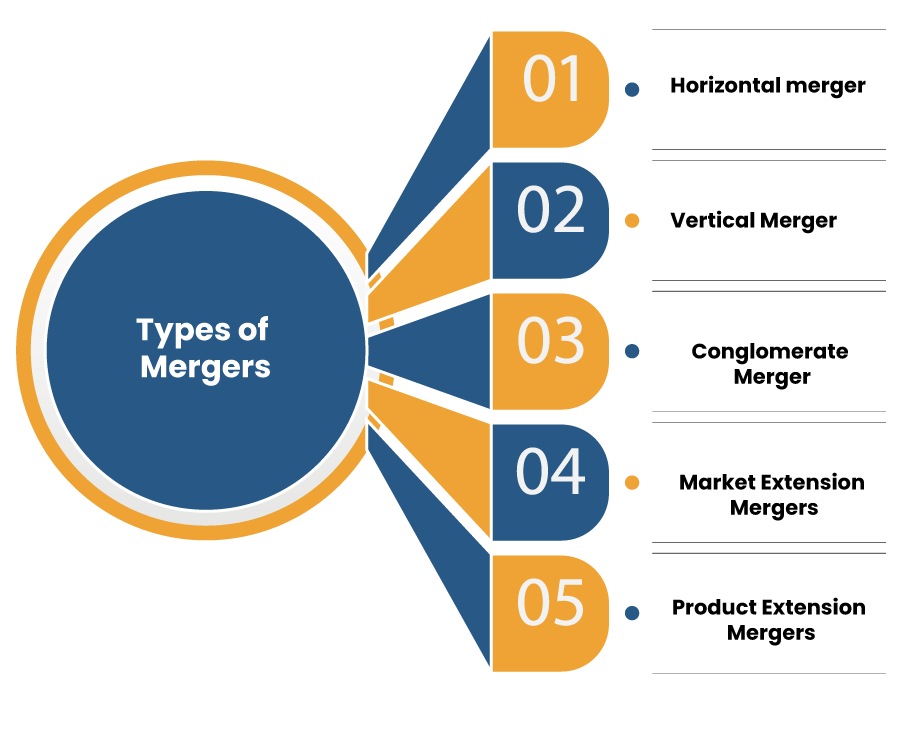

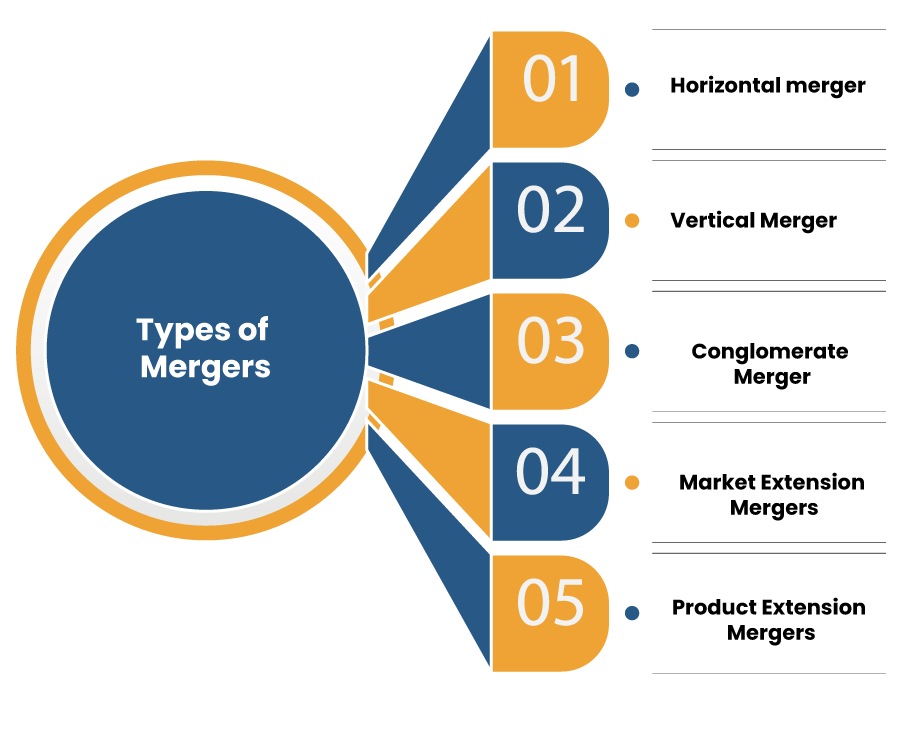

What ar M&A payment e the Types of Merger in Companies?

There are various types of M&A (merger and Acquisition) transactions. A merger is commonly classified as statutory, where the target is entirely fused into the acquirer by dissolving all of its assets; consolidation, where the two firms integrate to become a new firm, or subsidiary, where the target turns into an acquirer’s subsidiary. Amidst the acquisition process, the acquirer might strive to buy out the target firm in a friendly takeover or hostile takeover.

Horizontal Merger

A horizontal merger comes to light when firms operating in a similar industry combine together. This merger aims to utilize economies of scale & exploit cost-based synergies effectively.

Vertical Merger

A Vertical merger refers to a merger of two or more firms that provide multiple supply chain functions for a common service or good. Generally, the merger is effected to escalate synergies, acquire more control of the supply chain process, and increase its footprint.

Conglomerate Merger

A Conglomerate Merger refers to a merger between organizations that are engaged with different business activities. A conglomerate merger includes companies serving different operation areas, while mixed conglomerate mergers include firms seeking market or product extensions.

Market Extension Mergers

A market extension merger takes place between two firms that deal in the same products but in different markets. The main aim of the market extension merger is to ensure that the merging companies can get access to a bigger marketplace.

Product Extension Mergers

A product extension merger takes place between two firms that deal in products that are identical & operate in the same market. The product extension merger enables the merging companies to group together their products & get access to a bigger market. This makes sure that they earn higher profits.

Relevancy of M&A Payment from Investor and Acquirer Viewpoint

These different mergers and Acquisitions can be formulated by an investor to comprehend management’s goal and vision. An acquirer may opt for M&A to unlock undisclosed value, access new areas, implement new technology, or avert unfriendly government policies. Likewise, an investor can access the method of payment and value an acquirer offers for the prospect/target firm.

How M&A Payment Executes in the Real World Scenarios?

A firm can be purchased using stock, cash, or a mix of the two. Share purchases are widely known as a form of Acquisition; however, the greater the management believes in the Acquisition, the more they will wish to pay for stocks in cash. This is because the management strongly thinks the shares will ultimately be worth more than any other form of assets after synergies are realized from the merger.

Given this, the target firm will wish to be paid in stock. If payment is made via stock, the target firm turns into a partial owner in the acquirer and a beneficiary of expected synergies. Conversely, weak clarification of an acquirer about the target’s valuation would lead to sharing risks with the seller. Therefore, the acquirers will intent to pay in stock.

The company should take various factors into account when preparing an offer. These factors include tax implications, impact on the structure, transaction cost, and other bidders’ presence, the target’s intent to sell & payment preference.

Once the bid is placed before the seller, the public can reap productive information about how insiders of the acquiring firm see the stock’s value, the value of the target, and the positivity they have in their ability to perceive value via a merger.

Significance of a Share for M&A Payment Methods

Market conditions play a crucial role in merger and acquisition transactions. When an acquirer’s shares are overvalued, management might pay with an exchange of share for stock. These shares are fundamentally deemed a form of currency[1].

Since the shares are considered to price relatively higher than their existing value, the acquirer is getting more profit by paying with stock. If the acquirer’s share is considered undervalued, the management might end up paying for the Acquisition with cash. By considering share as equivalent to currency, it would acquire more shares trading at a discount equivalent to intrinsic value to pay for the purchase.

In reality, there may be some additional factors as to why a company would opt to pay with share or cash, and why the Acquisition is being considered (i.e., acquiring a company with tax losses so that the same can be recognized promptly, and the tax liability of the acquirer is reduced drastically.

- In a merger, two firms enter into a contract to form a new entity; in an acquisition, one firm purchases another.

- How an M&A is paid often discloses how an acquirer sees the relative value of the share price of the firm.

- M&A (merger and Acquisition) can be paid by equity, cash, or a combination of the two.

Conclusion

Where cash is not practically applicable, there are other ways to finance an M&A, many of which result in a seamless transaction. The best payment alternative to use depends on the seller and the buyers their respective asset values, share situations, and debt liabilities. Each method of financing an M&A comes with its own risks and commitments, and it is the parties’ responsibility to leverage due diligence during a transaction.

Read our article:Mergers and Acquisitions: SWOT Analysis