In year 2004, a manual process of collection of taxes was replaced by an OLTAS (Online Tax Accounting System). It was introduced with the intention to minimize human intervention and reducing errors and also facilitating online transmission of all details of tax collected, deposited, refunded etc.

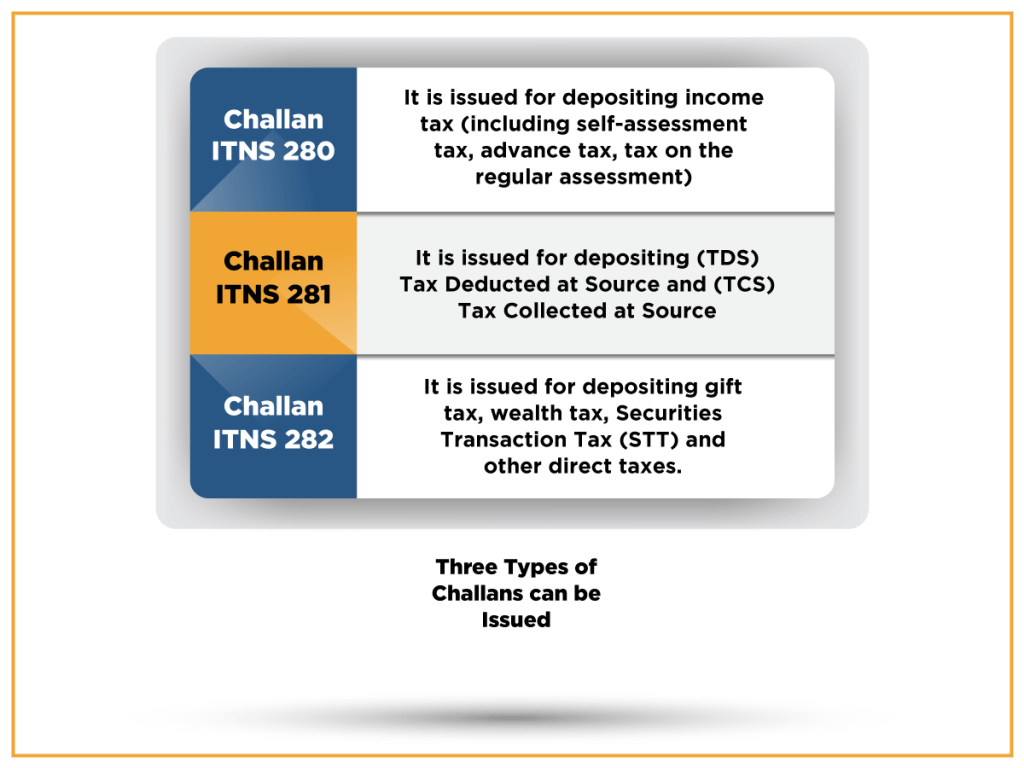

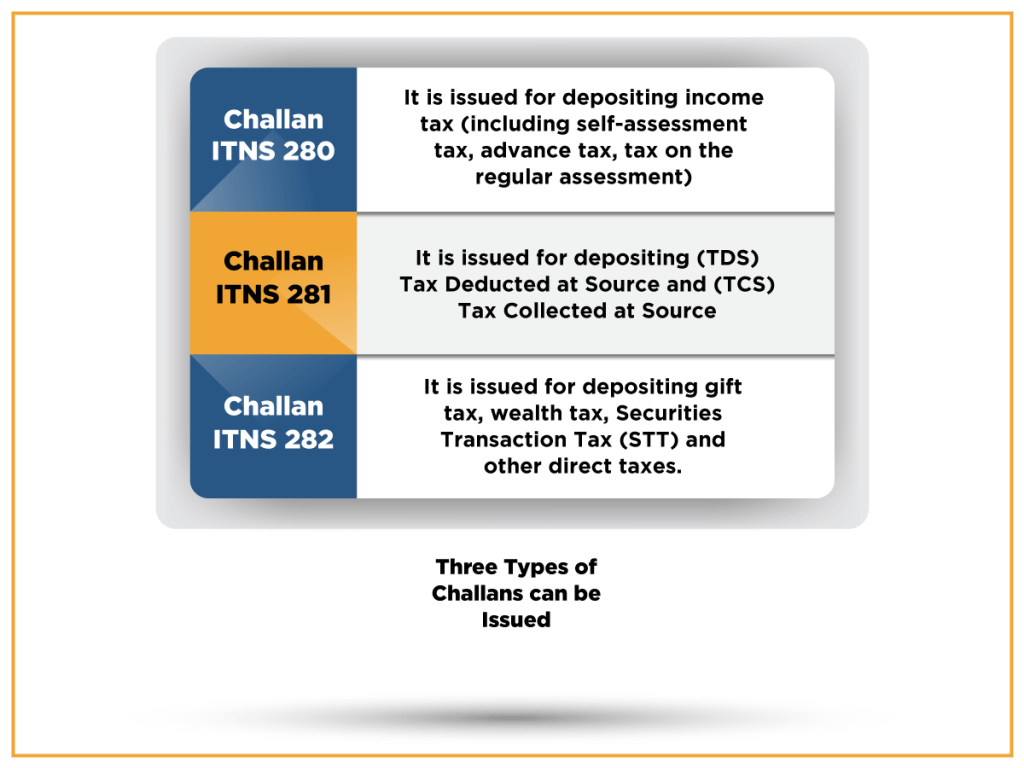

OLTAS issues the single copy of Challan and enables taxpayers to track status of their challans or e-challan deposited in banks online. Now, one can file online TDS with e-payment tax such as for TDS Challan ITNS 281. Three

Types of Challans can be Issued

Read our article:TDS Applicable on Payments made to E-Commerce Operators

Steps for e-Payment Tax

- Step-1: To pay the taxes online, login to http://www.tin-nsdl.com. Pay Taxes Online or click on the tab “e-pay taxes” provided on a website. Provide proper link of the e-payment

- Step-2: Select a relevant challan i.e. ITNS 280, ITNS 281, ITNS 282, ITNS 283, ITNS 284 demand payment (only for the TDS on sale of property).

- Step-3: Enter PAN/TAN and other mandatory challan details like accounting head under which payment is made, address of a taxpayer and the bank through which payment has been made.

- Step-4: On submission of entered data, a confirmation will be displayed. If TAN/PAN is valid as per Income Tax Department, then full name of the taxpayer will be displayed upon the confirmation.

- Step-5: On confirmation of data so entered, a taxpayer will be directed to the net-banking site of bank.

- Step-6: The taxpayer has to login to net-banking site with the user id and password provided for net-banking purpose and enters payment details at bank site.

- Step-7: On successful payment the challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. The counterfoil will be the proof of payment being made.

Compliance for the TDS Challan ITNS 281

Challan ITNS 281 is issued when a taxpayer deposits TCS and TDS. Therefore, it must comply with timelines laid out for deducting and depositing tax.

Due dates for Payment of the TDS

- TDS deducted on payments (excluding a purchase of property): 7th of subsequent month.

- TDS deducted on a purchase of property: 30th of subsequent month.

- TDS deducted in a month of March: 30th April.

In case of delaying in deposit of tax, an interest is levied at the rate of 1.5% per month or part from the date of deduction.

Process of Filing TDS Challan ITNS 281

The process for filing Challan ITNS 281 those are:

Online Process

- Go to tin-nsdl website: Select Challan No./ ITNS 281. At a time of payment of taxes the details have to be filled in the Challan ITNS 281.

- Select Deductees: Select an appropriate deductee i.e. on whose behalf a payment has been deducted. There are two options:

- Company deductees

- Non-company deductees

3. Assessment Year: The relevant assessment year for which the payment has been made. For example, If a payment is made on 30th June 2019 (i.e. relating to FY 2019-20), the relevant AY will be 2020-21

4. (TAN) Tax Deduction Account Number: TAN is 10-digit number issued to persons who are required to deduct or collect tax.

5. Type of Payment:

- Select if the TDS/ TCS is a regular transaction, or,

- Select if a payment is being made for the demand raised by the income tax authorities.

6. Nature of the Payment: The section under which TDS/TCS has been deducted must be selected from the drop-down list.

7. Details of Payment: Enter income tax, surcharge and late filing fees along with the date & bank branch.

8. Post-filling all details click on to submit and it will be redirected to bank’s portal to process the payment. Once a transaction is successfully processed, the challan counterfoil will be displayed containing the CIN No., payment details, and bank name by which e-payment has been made.

Offline Process

For offline process, the taxpayer can make a payment by personally by visiting the bank and submitting a challan. The payment can be made via cheque or cash. On submission of a challan, bank[1] will issue a counterfoil receipt back-stamped as a proof of submission.

Process to Check status of Challan ITNS 281

For taxpayers to check the status of the Challan online, one can visit to the tin-nsdl portal. There are two modes for viewing the status:

- CIN based view

- TAN based view

To view status through the CIN based mode, enter the following details from your challan:

- BSR code

- Challan date

- Challan serial number

- Amount

To views status through the TAN based mode, enter the following details from challan:

- TAN

- Challan date

Conclusion

TDS challan ITNS 281 is used for depositing TDS and TCS by corporate as well as non-corporate entities. The challan can be generated online or offline as well. (CIN) Challan Identification Number is a unique number issued to acknowledge a payment of tax. It consists of three parts, 7 digit BSR code of bank branch where tax is deposited, Date of Depositing tax and Challan’s Serial Number. If you get confused then contact the professionals at Corpbiz.

Read our article:Let’s Understand the ways to Make TDS Payment Online