The Controller General of Patents, & Trademarks, the Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce and Industry, has revised the statutory fee for all related patent filing fees a notification released on February 2014.

The overall patent filing fees of obtaining a patent include the statutory fees that have to be paid to the patent office and the professional fees paid to the patent service provider. The professional fee may vary based on the service provider one may select.

Categories for Patent Filing Fees

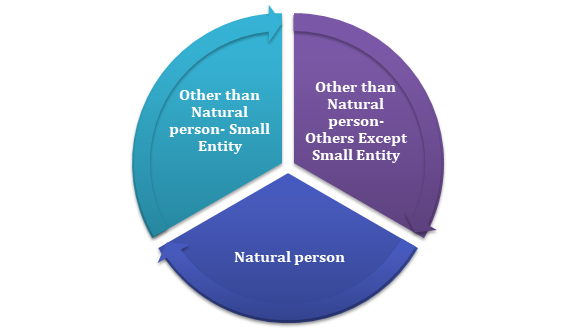

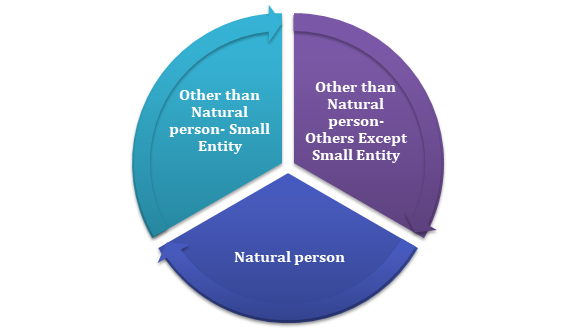

Further, a significant change has been dividing the applicants into three categories:

Natural person

An individual applying for the patent is considered as a natural person. In case the applicant is the Natural person, the fee is the lowest in all three categories. However, a fee has been increased by 60% of the previously applicable fee before the 28th day of February 2014. The new fee is effective from the 28th day of February 2014.

Other than a Natural Person

Non-individuals such as companies and legal entities are categorized under other than natural persons. Before the notification, dated 28th day of February 2014, there existed a single category under ‘Other than a natural person’. The patent office by the notification has divided the category of Other than natural person into the following categories:

- Other than Natural person – Small Entity

- Other than Natural person – Others except for a small entity

The patent office has fixed the different fee structures for the category of a small entity and others except for a small entity. The fee for the small entity is between the fee for a Natural person and the fee for other than a natural person (except a small entity). The fee for other than a natural person (except a small entity) is the highest, and the fee for Natural person is the lowest.

What are Small Entities in Patent Rules?

According to the Patent Rules, 2014 under Rule 2 clause (fa), “small entity” means the following:

- If an enterprise engaged in a manufacture or a production of goods, the enterprise where an investment in plant and machinery does not exceed the limit specified under clause (a) of sub-section (1) of section 7 of Micro, Small & Medium Enterprise Development Act, 2006

- If the enterprise engaged in providing or rendering of services, an enterprise where the investment is not more than the limit specified under clause (b) of sub-section (1) of section 7 of Micro, Small & Medium Enterprise Development Act, 2006.

Qualifying as a Small Entity

- According to rule 2 of the Patent Rules, 2014, to qualify as a small entity, an applicant engaged in the manufacture or production of goods pertaining to any industry should not have an investment limit of over Rs 10 crores.

- Similarly, an applicant engaged in providing or rendering services classified under the Micro, small and medium enterprise development Act, 2006, should not have an investment limit over Rs 5 crores.

- Further, as per rule2 of the Patent Rules, 2014[1], while calculating the investment in plant & machinery, the cost of pollution control, research & development, industrial safety devices, and other such things. Those things are specified by notification under the Micro, Small and Medium Enterprise Development Act, 2006, shall be excluded.

Procedure for Declaration as Small entity

An applicant wishing to be declared a small entity has to file a declaration in Form 28, and furnish proof relating to the status of being a small entity. If an applicant wishes to submit a new patent application, he must file in Form 28 must along with Form 1. However, if the applicant has already filed the patent application and wishes to file any other forms that attract a fee, Form 28 should be filed at least once accompanying the form that the applicant requires to file.

Read our article:Procedure for Registration of Patent Agent in India

Accepted Proof for Small Entity

The accepted proof, as prescribed by the Indian Patent Act, is as below:

Applicants have Indian nationality

Indian applicants need to furnish evidence of Patent registration under the Micro, small and medium enterprise development Act, 2006. If applicants wish to claim small entity status, he needs to register under the MSMED Act, 2006. Further, the patent office can accept other proof, such as a balance sheet in the future.

Non-Indian Applicants

Non-Indian applicants are required to provide proof relating to the investment capital to claim the small entity status. The applicants must provide any document which pertains to this, such as Latest filed balance sheet.

Conclusion

The applicants other than natural persons have been divided into two further categories of a small entity, and Other than a natural person (except a small entity), wherein an applicant of small entity status attracts a lower fee, which is half of the patent filing fees for an applicant of status Other than the natural person (except a small entity).

Read our article:Patent in India: Registration and Filing Process