Assembly income tax return treating and assessment simpler and more operative, the income tax department has refurbished Form 26AS to an ‘Annual Information Statement‘ to consist of share trading related transactions and real estate. Form 26AS is an annual amalgamated credit declaration issued by the income tax to aid assessees cross-verify tax deducted at source (TDS), income received, and tax deposited throughout a certain financial year.

What are the Core Highlights?

What CBDT Notifies in the Notification No. 30/2020 along with the Budget 2020-21?

- According to the “Notification No. 30/2020/F. No. 370142/20/2020-TPL”, the form will now encompass complete information relating definite payment of taxes, financial transactions, pending/accomplished proceedings, and demand/ refund in its new avatar. It should be commenced by a taxpayer in a specific financial year that has to be declared in the (ITR) Income tax returns.

- The income tax department declared that the new form will come into effect from June 1 which was publicized in the Budget. Then the taxpayers will be able to get the combined statement from the income tax department’s e-filing portal by means of their PAN card.

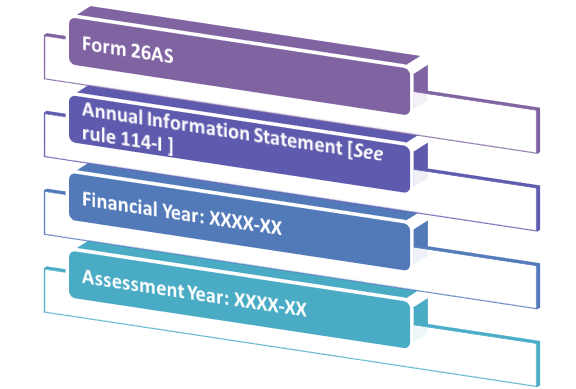

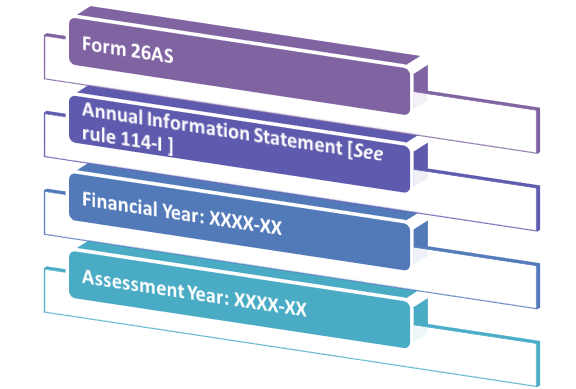

Annual Information Statement

- In pursuant to Finance Act, 2020,[1] and modification respectively, CBDT notifies Annual Information Statement in its Fresh Form 26AS. It supplements with new Rule 114-I which is to be operative from 1st June 2020 and neglects Rule 31AB accordingly.

New Section 285BB in Budget 2020-21

- New Section 285BB has introduced in Budget 2020-21 under the Income Tax Act to appliance reviewed Form 26AS.

- Revised Form 26AS shall now comprise statistics connecting to assessee’s specified financial transaction not together with the TDS / TCS details. Those include information of property and share transactions etc., demand completed proceedings or refund and pending /or payment of taxes.

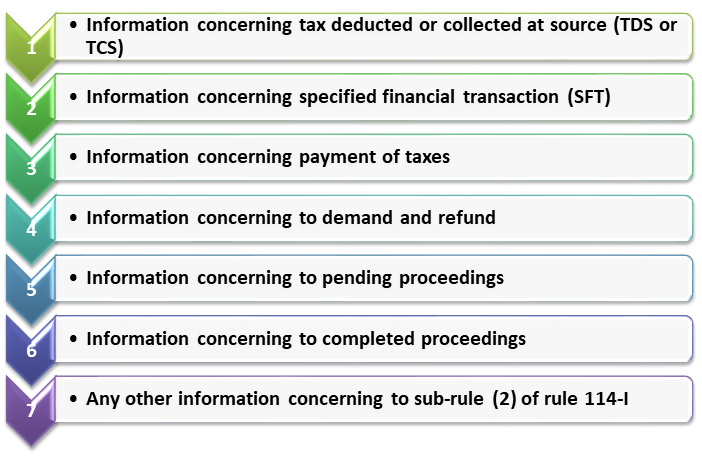

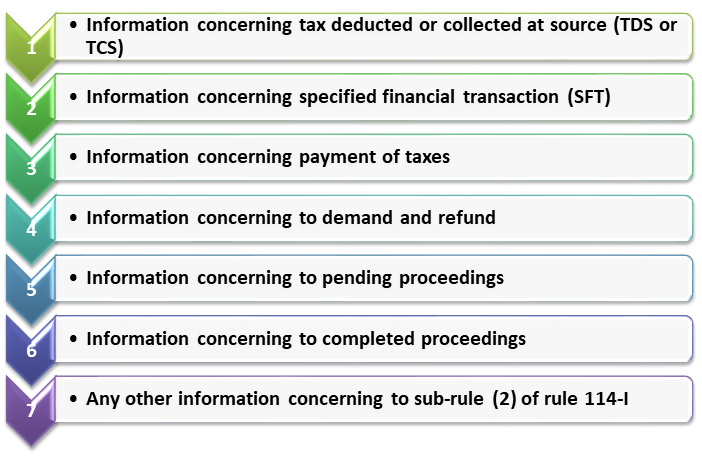

Information in New Form-26AS: FY 2020-21

The succeeding information shall comprise in the New Form-26AS relating to Financial Year 2020-21.

Those are as follows:-

Read our article:ITAT: On Excused Absence, Plea U/s 12AA & Reflex Disallowance: Income Tax – May, 2020

What is the role of Principal Director General of IT or Director General of IT?

Bullet Points under section 285BB of the Income-tax Act, 1961:-

- Upload annual information statement (Within three months)

- Containing the information specified

- Upload the information relating interest of the revenue

- Specify the procedures, formats and standards

Role Under 114-I

- Under section 285BB of the Income-tax Act, 1961, they can upload an annual information statement in Form No. 26AS in the registered account of the assessee.

- It will be based upon the information specified which is in his possession within three months from the end of the month in which the information is acknowledged by him.

- The Board may also give permission to upload the information in reference to section 90 or section 90A of the Income-tax Act,1961.

- It may also act upon the information acknowledged from any other person to the extent as it may consider fit in the interest of the revenue in the annual information statement mentioned in sub-rule (1).

- They can lay down the procedures, formats, and standards for the purposes of uploading of annual information statement mentioned to in sub-rule (1).”

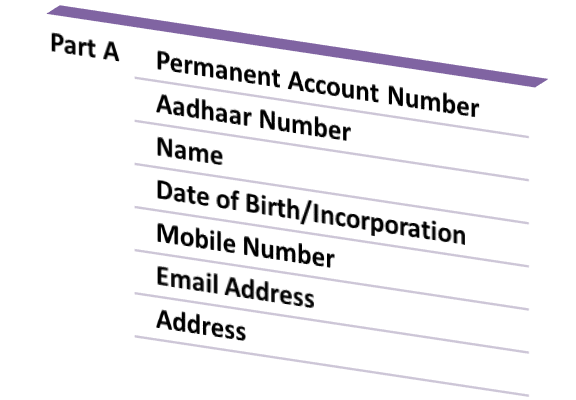

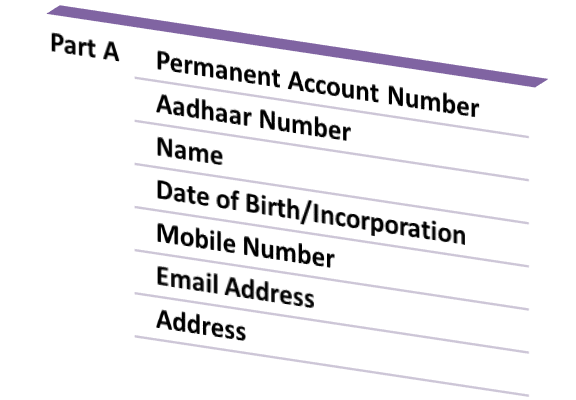

- Form 26AS shall be substituted by the following information in as ‘Appendix II’.

Those are as follows:-

Overall Assumption

- It will assist tax authorities doing e-assessment with all the information/ details available at one place, and having no/ limited interaction with taxpayers. It is because the tax authorities now will be able to easily compare information available in Form 26AS in terms of the information reported by taxpayers in income tax return filing.

- Slight mismatch may be easily highlighted by the structure to tax authorities. In case any improper information is described in Form 26AS, it will also support taxpayers in identifying and attractive remedial feats.

Conclusion

The Form 26AS has been made more comprehensive pursuant to the announcements made earlier on several occasions. It would also comprise details about financial transactions approved by the taxpayer and would promote easiness the tax filing procedure as much of the information would be mined from this.

Our Corpbiz group will be at your disposal if you want expert advice on any aspect of Income Tax issues. We will help you to ensure complete compliances concerning all the issues related to Annual returns or Taxations-based as per your desired activities, ensuring the fruitful and well-timed completion of your work.

Read our article: GST Applicability on Works Contract for NCBS & Food Services for Exempted Institutions: AAR