TRACES registration is compulsory for the taxpayer to file a correction statement. It enables the taxpayer to file web-based corrections. Once the taxpayer gets registered, he/she can access various facilities rendered by the TRACES (TDS Reconciliation Analysis and Correction Enabling System). Taxpayer can verify Form 16, view TDS/TCS, and access refund status, etc.

General Overview on TRACES

The TRACE is abbreviated form of the term TDS Reconciliation Analysis and Correction Enabling System. It is a web-based portal of the IT department[1] which helps connect all stakeholders engaged with the administration & implementation of TDS and TCS. The TDS TRACES online portal is used to track & download essential tax documents like Form 16, Form 16A, and Form 26AS.

What are the Services provided by the TRACES Website?

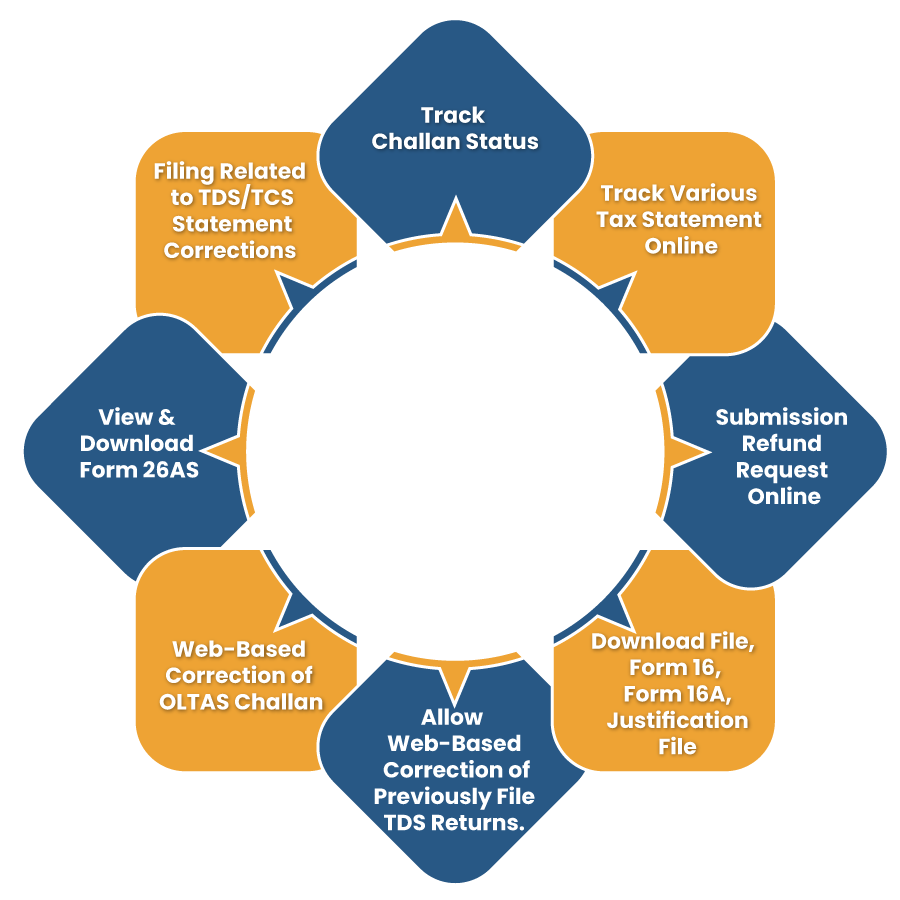

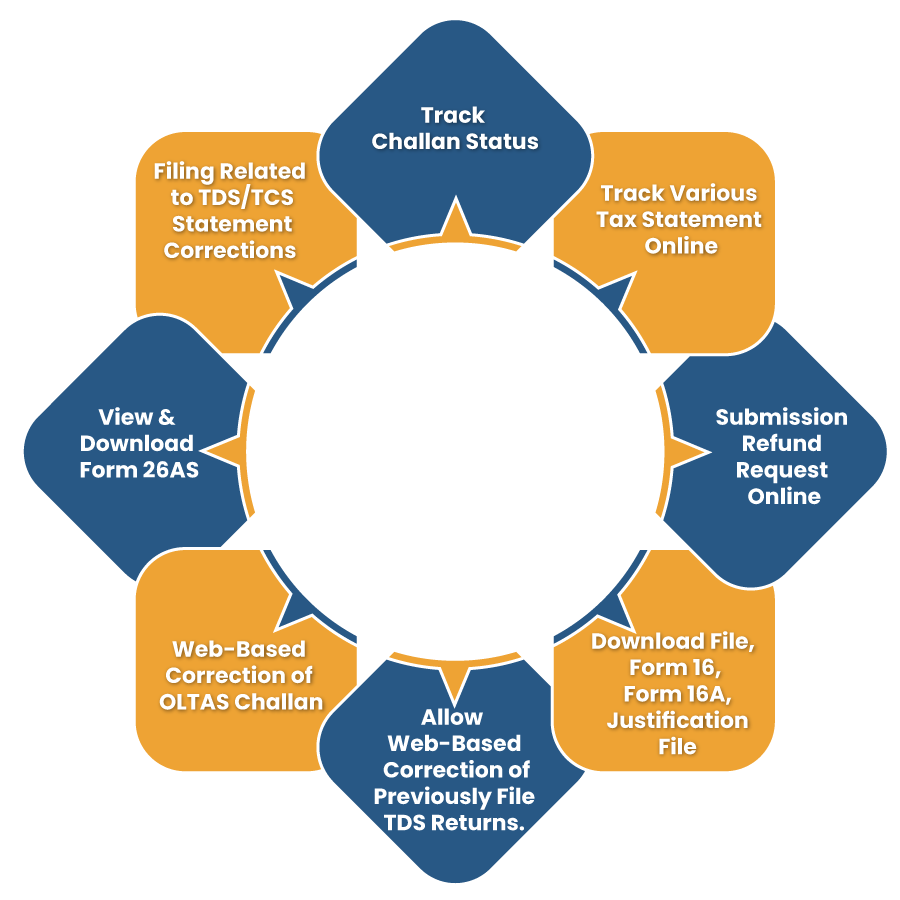

The TDS TRACES online portal enables taxpayer and TDS deductor to perform a range of activities including but not confined to the following:-

The online services accessible via the TDS TRACES online portal render a less intricate system to perform a wide range of tax-based activities. This has superseded the preceding paper-based systems, which were not efficient and time-saving. Through this web-based rectification system, challan and PAN information corrections can be made with negligible effort.

Read our article:An Overview on Budget 2020 Revised Income Tax Slabs FY 2020-21 (AY 2021-22)

What are the Key Links Available on the TRACES Web-Based Portal?

The following are the essential links available to those who log into the TDS TRACES website:

- Dashboard demonstrating the complete briefing of deductor’s account.

- Online registration Tax Deduction & Collection Account Number

- Web-based filing of TDS statements

- Web-based correction of TDS statements

- Default Resolution

- Tracking Form 26AS

- Complaint registration & resolution

The various services rendered by TRACES can be divided into three vital categories, which are as follows:-

- Deductor services

- Tax Payer services

- PAO (Pay and Accounts Office) service

Online Procedure to Register under TRACES

Following is the online procedure to register under TRACES:-

Step 1- Register as New User

Open the TRACES portal and select “Register as New User” followed by “Deductor” and Proceed.

Step 2- Details Submission

Provide detail regarding Deductor’s TAN, enter “Verification code,” and select “Proceed.”

Step 3: Token Number

Enter the Token number of the original statement in addition to the CIN/BIN & PAN details related to the financial year, Quarter & form type prompted on the computer screen.

Challan Details (CIN)

Challan amount, date, BSR code & CD record number Govt. deductor needs to provide the Deposit date & transfer voucher amount listed in the statement.

PAN Details

Maximum of three valid PAN & corresponding amount should be provided. If the number is less than the aforesaid requirement, you must enter all.

Step 4: Validating the KYC

The portal shall render the authentication code after validating the KYC information, which stays valid for the same calendar day against the same form type, financial years & quarter. You can proceed with TAN, code, and deductor’s name is prefilled, you will have to update person detail and address along with the PAN.

In the case of proprietor & individual, Deductor’s PAN and PAN of a legit person may be the same. In the rest of the cases, both may be different. Now you can provide ID, password & tap on “Create an Account.”

Step 5: Confirmation Page

You will be directed to the confirmation page. Here you will need to check the entire details once. Tap on the “Edit” tab to alter the detail, and click on the “Confirm” tab to register.

Step 6: Activate the Account

Now you will come across activation links and codes routed to your registered email id and contact number. As soon as you activate the account, the portal will confirm that the registration process is completed successfully.

What are the TRACES Services Rendered to deductor?

A deductor is an individual who deducts taxes at source (place of business) on specifies payment made. The tax deducted by such an individual using the TDS mechanism must be deposited with the IT department within the given timeline. The TDS deductor is also liable to provide details regarding tax deducted in a statement.

Following individuals are compulsorily needed to file an online TDS statement:-

- Government Offices

- Companies

- Individuals needed to get their accounts scrutinized under section 44AB of the IT Act, 1961.

- Deductors providing report concerning more than 20 deductee for any quarter in the financial year.

Essential services that the deductor can access on TRACES are:

- Registration of Admin User for a TAN.

- Creation of sub-users by Admin User.

- Viewing of challan status.

- Download Justification Report

- Download Form 16 / 16A

- View TDS – TCS credit for a PAN.

- View PAN Master for the TAN.

- View Statement Status.

- Provide feedback.

- Manage user profile and change password.

- Validate 197 Certificates

- Online Correction.

- Declaration for Non – filing of statement.

- TDS Refund.

- Offline Correction.

What is TRACES Justification Report?

The TDS TRACES Justification Report entails information regarding errors/default pinpointed by the IT department while processing the statement during a particular quarter of the financial year.

This document encloses brief detail regarding the error/defaults that require to be rectified by the deductor. This rectification can be finished using the correction statement & making payment of fees and other applicable dues. On the contrary, deductors can leverage the report’s information to clarify any error pinpointed by the concerned authorities.

Conclusion

The TRACES Portal is a mechanism that allows taxpayers to ascertain the taxes pending on their account as self-assessment taxes paid or TDS. The TRACES portal has been implemented by the TDS Centralized Processing Cell of the IT department. The ultimate objective of TRACES is to provide facility regarding the reconciliation and correction of TDS.

Furthermore, it facilitates individuals to keep track of challan & statement status, download key forms, submit refund requests, and view annual tax credit statements. Also, it allows a taxpayer to make web-based corrections of the already file returns.

Read our article:TDS Penalty and Late Filing Fees for Tax Deduction at Source