With the digital India and the increase of online shopping in India, it has immensely increased the benefits of flexibility and ease of online payment which is offered by this platform. The term Payment Gateway signifies a financial service that is granted by way of an application which is an e-commerce service provider. In this article, we will continue to read about the Payment Gateway License in India and other related details.

What is Payment Gateway License?

RBI has issued certification called Payment Gateway License which allows the applicant to set up and run a payment gateway. In simple terms, a payment gateway means a gate by way of which all the electronic transactions take place. It is first done by establishing a secure and safe line between the seller and the customer and then it gives a confidential pathway through which the customers can enter their personal information and bank details to complete their transaction. All through this process, it makes sure that the payment gateway has securely connected either the bank account to the bank of seller bank or the digital payment wallet of the customer or his accounts and only after then, it allows the transaction to take place. However, before starting a Payment Gateway service in India, it is important to obtain the Payment Gateway License from the Reserve Bank of India[1]. RBI has promoted this license to:

- For promoting secure transactions online.

- For making sure that these payment gateway does not compromise the personal information of the sellers or the customers.

- To make sure that no information is vulnerable.

- To make sure that no additional payment gateway charges are imposed on the users.

How does the payment gateway work?

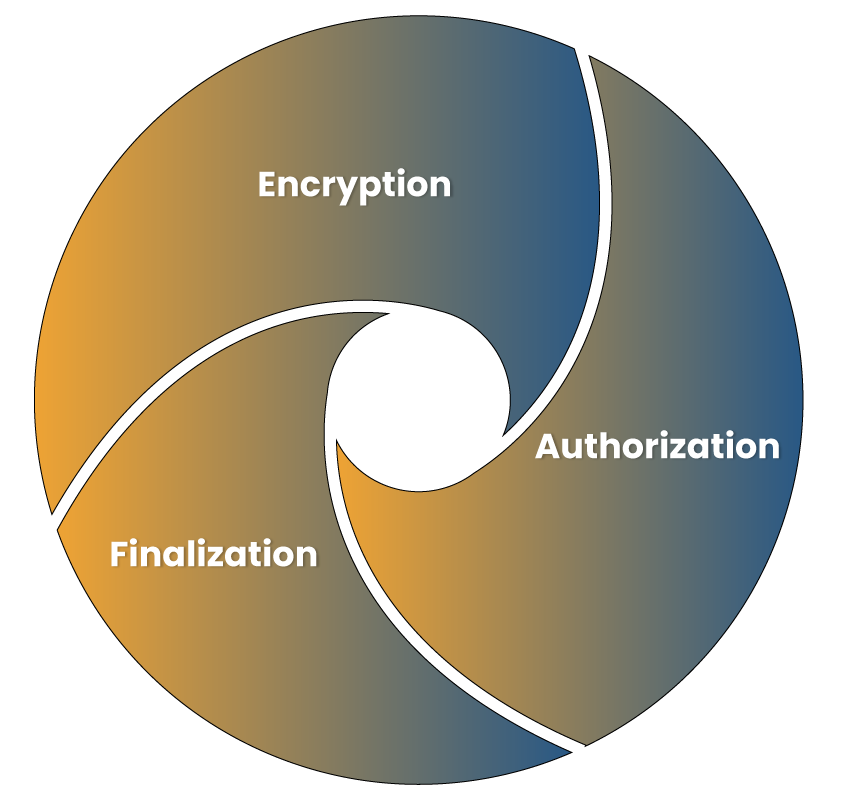

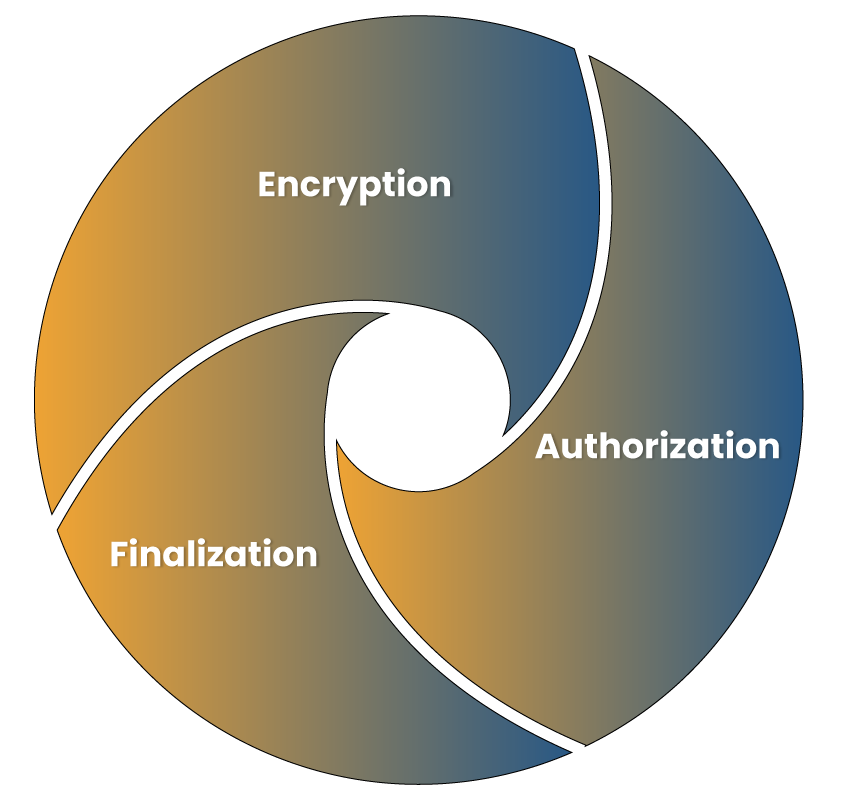

The payment gateway process work in three stages:

- Encryption:

Encryption takes place when the customer enters his information and details in the browser of the payment gateway. That information’s are encrypted with the purpose to give protection from the prying eyes.

- Authorization:

Those encrypted information is then forwarded to the banks which does the decryption of the same with their private key to check whether the details provided are correct or not.

- Finalization:

If all the details are found to be true and correct, then the initiation of transaction process is done through the payment gateway.

Read our article:A Complete Outlook of Payment Bank License

What are the components of payment gateway license?

There are two components of an online payment gateway:

- Merchant Agreement:

It is important for those with the payment gateway license to enter into an agreement with the concerned merchant who uses the gateway.

- Secure electronic transactions:

The security system is responsible to verify the information of the user but without any peeking into it. By doing so it verifies and authenticates the data’s without any compromise with the user’s Debit card/ Credit card/net banking information.

What are the Benefits on Obtaining Payment Gateway License?

The benefits of obtaining the Payment Gateway License are as given below:

- White Label Wallet

It is important to note that few of the payment gateways allow customers to do digital transactions from the applications of mobile wallet. It is the most recent trend, as it permits the users to perform all their operations and transactions from one place.

In additional, one can without any difficulty transmit the amount from his bank account to the mobile wallet application and then can utilise the same for doing payments on different mobile websites or applications.

- PCI – DSS Wallet

The compliance of the PCI – DSS Wallet grants security to everyone who is the user of the application by securing their personal information in the gateway for the recurring payments.

- Fraud Screening Tools

Some of the payment gateways give their customer the advantage of Fraud Screening Tool with the purpose to lessen the risk of losing personal data.

The term Fraud Screening Tools consists of the Card Code Value, Address Verification Service, and Card Verification Value.

Further, it is imperative to note that the most important objective of these tools is to validate that there is no transactions of fraud going on. Furthermore, one more significant advantage of a payment gateway is that it allows dealings and transactions and from numerous users and at the same time. This on its own makes the same possible for any customer to sell or buy goods & services whenever he wants.

Conclusion

The basic requirements of getting the Payment Gateway License in India should be qualified before getting the license and after following the registration procedure one shall be eligible to get the license. It is important to follow all the procedures correctly and submit the required documents for obtaining the license in time.

Read our article:A Complete Outlook of Payment Bank License