In India, income tax is levied on the basis of an individual’s income, and the tax rates based on the range of income are known as tax slabs. India has continuous methods for taxation; this means higher the income higher the individual Tax needs to pay.

Income tax slab and rate tend to go through a change in every year’s budget[1]. Under this blog, we will discuss the latest slab for the financial year 2020-21.

What does Income Tax slab mean?

As an Individual’s income increases, he is supposed to contribute more from the portion of his income to the government. The government utilizes the funds collected from taxpayers for the betterment of the society at large.

Under this tax regime, income is categorized into different groups and criteria. Such a group is known as Tax Slab, and Tax is charged at different rates on the different range of income falling under different tax slab. Income Tax slab and rate depends on various factors such as;

- Total Income

- Residential Status

- Type of taxpayer and age

What is the Income Tax?

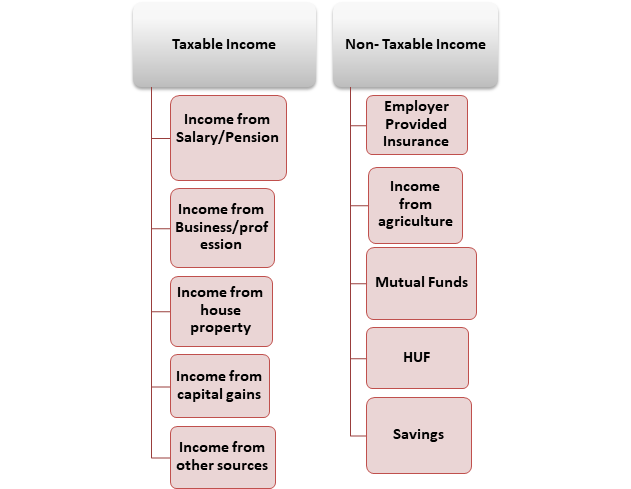

The Tax imposed by the government on the income generated by businesses and individuals within their jurisdiction is called income tax. Meaning of Income stands different for different individuals, which can be generated through business, exchange of sale goods or service, or through capital investment.

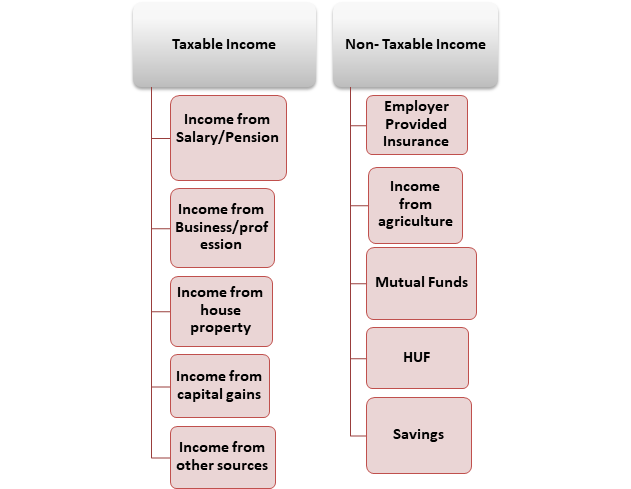

According to income tax, there are two types of income ;

What is the existing income tax regime in India?

In India there are three types of individual taxpayers;

- Individuals (below the age of 60) years)

- Resident Senior Citizens (above 60 years and below 80

- Resident super senior citizens (Above 80 years)

Tax slab is different for each category of taxpayer, and undergo a change during every budget.

| Income Tax Slab | Tax Rate |

| Up to Rs 2.5 lakh | NIL |

| From 2.5 lakh to Rs 5 lakh | 5% (Tax rebate of Rs 12,500 available under section 87A) |

| From 5 lakh to Rs 7.5 lakh | 10% |

| From 7.5 lakh to Rs 10 lakh | 15% |

| From 10 lakh to Rs 12.5 lakh | 20% |

| From 12.5 lakh to Rs 15 lakh | 25% |

| >Rs 15 lakh and above | 30% |

Income Tax Slabs for all Individuals

Following is the list deductions and exemptions that taxpayer will have to give up in new tax regime;

- Leave Travel Allowance

- House Rent Allowance

- Conveyance

- Daily expenses in the course of employment

- Relocation allowance

- Helper allowance

- Children education allowance

- Other special allowances [Section 10(14)]

- Standard deduction

- Professional Tax

- Interest on housing loan (Section 24)

- Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2) and 80JJA)

Note; No change in old and new tax regime in;

- Health and education cess@4%

- Rate of surcharge (is an additional tax imposed on a person or entity if turnover exceeds the prescribed limits)

- Rebate u/s 87A(no tax will be applicable on total income up to 5 lakh )

Income Tax Slabs & Rates for Individual Tax Payer & HUF

| Income Tax Slab | Tax Rate for Individual & HUF Below the Age Of 60 Years |

| Up to ₹2,50,000* | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% of total income exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

| Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

- No income tax is applicable upon the individual whose income is less than 2, 50,000;

- 0% to 5% tax upon different age group with the income of 2.5 lac to 5 lac;

- 20% tax is applicable with the income of 5 lac to 10 lac;

- 30% tax is applicable with the income above 10 lac;

- A tax rebate u/s 87A is applicable if taxpayer income is ;

- Up to 3.5 lac for FY 2018-19, rebate amount will be 2,500 on total income;

- Up to 5 lac for FY 2019-20, rebate amount will be 12,500

Income Tax Slabs for Senior Citizens

| Income Tax Slabs | Tax Rate for Senior citizens of 60 Years and less than 80 Years |

| Income up to Rs 3,00,000* | Nil |

| Income of Rs 3,00,000 – Rs 5,00,000 | 5% |

| Income from Rs 5,00,000 to 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

Income Tax Slabs for Super Senior Citizens

| Income Tax Slabs | Tax Rate for Super Senior Citizens (Aged 80 Years And Above) |

| Income up to Rs 5,00,000* | No tax |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

Income Tax Slab For Domestic Companies

| Turnover Tax Rate |

Tax Rate |

|

| Gross turnover up to 400 Cr. in the FY 2017-18 | 25% | |

| Gross turnover exceeding 400 Cr. in the FY 2017-18 | 30% | |

| Where the company opted for Section 115BA | 25% | |

| Where the company opted for Section 115BAA | 22% | |

| Where the company opted for Section 115BAB | 15% |

Along with this cess and surcharge is levied follows;

CESS; 4% of corporate Tax

Income Tax Slabs for Non – Resident Individuals

|

Income Tax Slabs |

Tax Rate for Super Senior Citizens (Aged 80 Years And Above) |

|

Income up to Rs 2,50,000* |

No tax |

|

Income from Rs 5,00,001– 7,50,000 |

10% |

|

Income from Rs 7,50,001– 10,00,000 Income from10,00,000 12,50,000 Income from 12,50,00- 15,00,000- Income above 15,00,000 |

15% 20% 25% |

Note;

- No change in old and new tax regime in

- Rate of Surcharge

- Health and Education Cess @ 4%

- Certain income tax exemption and deductions will not be available under new tax regime.

Income Tax Slab for Co-operative Society

- Income tax on companies with gross receipt more than 400 crores, Tax Imposed will be @ 30% + 4% +Surcharge at applicable rate.

- Income Tax on companies with gross receipt up to 400 Crore, Tax imposed will be @25% +4% =Surcharge at applicable rate.

- Section 115BAA (domestic companies) – tax would be levied @22% + 4% Cess + 10% Surcharge;

- Section 115BAB (manufacturing companies)- tax would be levied @15% + 4% Cess + 10% Surcharge;

- A Manufacturing generating company can now opt for Section 115BAB as proposed by the Budget 2020;

- Certain exemptions and deductions + provisions of MAT (Alternate Minimum Tax) will not be applicable in case of these reduced rates.

Income Tax Slab for Foreign Company

- In case where royalty has been received from the government or technical fee is as per the central govt., the Tax rate imposed will be @50%+ 4% cess +Surcharge at applicable rate.

Takeaway

Income tax slab and rate tends to get change in every new FY. According to estimate, about 71% of total government revenue is collected through the Tax paid by the individuals or entities. In India, income tax is calculated on the basis of determined by the government for an assessment year.

Read our article:Income Tax Return Filing without Form 16