Numerous interpretational issues lead to unintended disputes between taxpayers and tax administration and in order to provide certainty to taxpayers and to avoid future litigation, ‘Advance Ruling’ is one of the most prevalent Dispute Resolution Mechanism. It helps the applicant in planning his activities which are liable for paying for GST Registration, well in advance.

This ruling is binding to the applicant as well as the government itself. The procedure followed is inexpensive and expeditious. Hence, it provides a certainty to the taxpayers with respect to an issue which might cause a dispute with the tax administration. Authority for Advance Ruling (AAR) is a legally constituted body which is authorized to give a binding ruling to the applicant who is a registered person. This ruling can be appealed before an Appellate Authority for Advance Ruling (AAAR).

Meaning of Advance Ruling Under the GST Act

“Advance ruling” means a decision that is provided by the Authority (AAR) or the Appellate Authority(AAAR) to an applicant inclusive of matters that are mentioned in section 97(2) or section 100(1) of the CGST Act, 2017 which is related to the rendering of goods and services to be undertaken by the applicant. Hence, the challenges in the interpreting of law gave birth to Advance ruling and since, to avoid litigation the facility has been provided to the GST. Advance Ruling Under GST necessary

Read our article:Procedure for Appeals under GST

Advance Ruling Under GST necessary

Objective Mechanism of Advance Ruling under GST

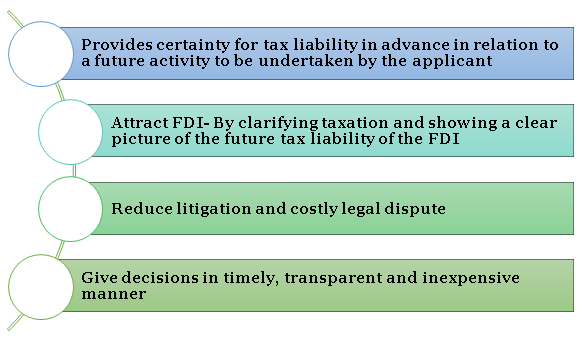

The comprehensive objective of including the mechanism of Advance Ruling is:

- To provide in advance, the certainty and transparency in tax liability when an activity is proposed to be undertaken by the applicant,

- To attract foreign direct investment (FDI),

- To lower the number of litigations,

- Pronounce ruling to be more expeditious, inexpensive and transparent.

Powers of AAR and AAAR

Both the AAR and AAAR are entrusted with the powers of a civil court under Code of Civil Procedure, 1908, for the purpose of discovery and scrutiny and also enforcing the attendance of a person and examining him on oath, and encouraging production of books of account and other records.

Both the authorities are presumed to be a civil court for the purposes of section 195 of the Code of Criminal Procedure, 1973[1]. Any proceeding that is presented before the authority is considered to be a judicial proceeding under sections 193 as well as section 228 of the Indian Penal Code, 1860. The AAR and AAAR are incorporated with the power of modulating their own procedure.

Procedure for Obtaining Advance Ruling

An advance ruling as pronounced by AAR or AAAR is binding only on the applicant who has registered for the advance ruling and on the concerned officer or the jurisdictional officer with respect to the applicant. This clearly indicates that an advance ruling is not applicable to similarly placed other taxable persons in the State. It is limited to the person who has applied for an advance ruling.

An applicant who is desirous of obtaining the ruling is supposed to make an application to the AAR in a prescribed format. The format of the form and the procedure for application have been prescribed in Rule 104 of the CGST Rules, 2017. An application in order to obtain an advance ruling under section 97(1) of the act is supposed to be made in form GST ARA-01 and shall be submitted along with a fee of five thousand rupees, is to be deposited in the manner specified in section 49 which deals with the mechanism of payment through electronic cash and credit ledgers.

The application and the verification is contained therein and all the pertinent documents accompanying such application shall be signed. Rule 26 provides for the manner of document authentication through e-signature as it is specified in the Information Technology Act. Upon receipt of an application, the AAR is supposed to send a copy of application to the officer under whose jurisdiction the applicant falls and is required to call for all relevant records. The AAR later scrutinizes the application along with the records and also hears the applicant.

Thereafter, the AAR will pass an order regarding whether the application is rejected or accepted. If in case of rejection of the application, the opportunity of being heard is to be provided to the application and the reasons for which the application is being rejected are to be specified.In case of acceptance of the application, within 90 days of its receipt, the AAR should pronounce the ruling. But before pronouncing the ruling, the application should be well scrutinized and the AAR hears the applicant or his representative as well as the CGST/SGST officers.

If there is a conflict of thoughts between the two members of AAR, they shall refer to the point or points on which they differ to the AAAR in order to hear the issue. If the members of AAAR are incapable of coming to a common conclusion in regard to the points referred by the AAR, then it shall be presumed that no advance ruling can be given in respect of the question on which the difference continues at the level of AAAR.

GST law treats a person having a number of registrations in same or different states as distinct persons. The first dispute to erupt was whether a person who is registered with GST authorities in different states, can seek separate ruling in each state. In the case of HINDUSTAN COCA COLA BEVERAGES PVT LTD, the taxpayer’s application was refused by the AAR under section 98(2) of the CGST Act on the ground that the same was already answered by the Gujarat AAR in the taxpayer’s own case.

Conclusion

There is a comprehensive provision made by the law in order to ensure that there are minimal disputes by incorporating the mechanism of Advance Ruling. The taxpayer is given obligations under the GST Act along with certainty and expeditious ruling for the smooth functioning of the relationship between the taxpayer and the administration and to avoid unnecessary litigation.

Read our article:Latest: Selective Applicability of GST Regulation by AAR