Section 406 of the Companies Act, 2013 set out the operational guidelines for the Nidhi companies in India. Generally, you can relate Nidhi companies to a community where a set number of individuals work cohesively for their mutual well-being. The Company Nidhi Rules, 2014, promotes this very concept and advocates the habit of saving amongst the members. The overall financial activities, i.e., deposit-taking and lending, occur in between the members. Thus, the funds contributed for such an entity are not accessible to a person other than Nidhi company’s shareholders. In this write-up, we will explain the process of Nidhi company incorporation in detail.

An Overview on Nidhi Company

Nidhi Company is a class of Non-Banking Financial Companies, and Reserve Bank oversees their activities regarding deposit acceptance. In light of the fact that these entities are group-focused and deal with their members only, Reserve Bank has exempted registered Nidhis from the major provisions of the RBI Act. Hence, Nidhi Company is a conducive business model for those who intend to work with a group-focused mindset and confined financial activities in between the members.

Pre-Registration Requirement for Nidhi Company Formation

- As per the prevailing Company Act, a minimum of 7 members and three directors are required to form a Nidhi company in India.

- INR 5 lakhs is the minimum capital requirement for such an entity.

- DIN for Directors

- Adherence to non-issuance of preference share is mandatory.

- The company must abide by the existing bylaws that promote the habit of saving amongst the members for their collective benefit.

Read our article:What is Nidhi Company? Know it’s Registration Procedure

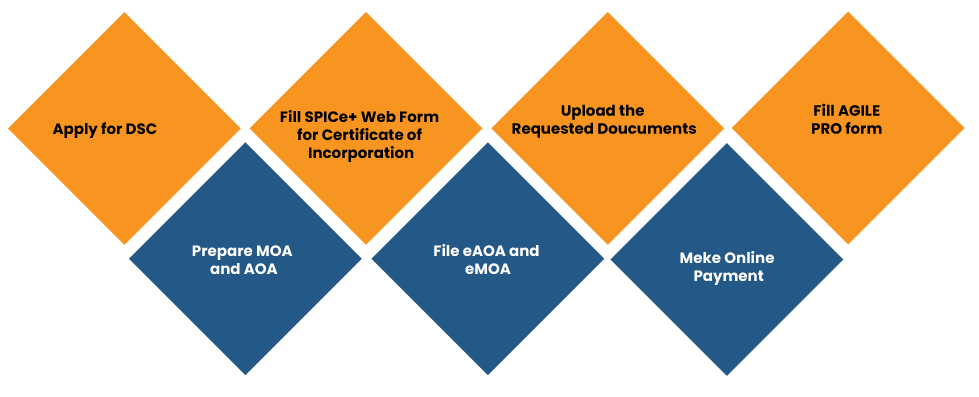

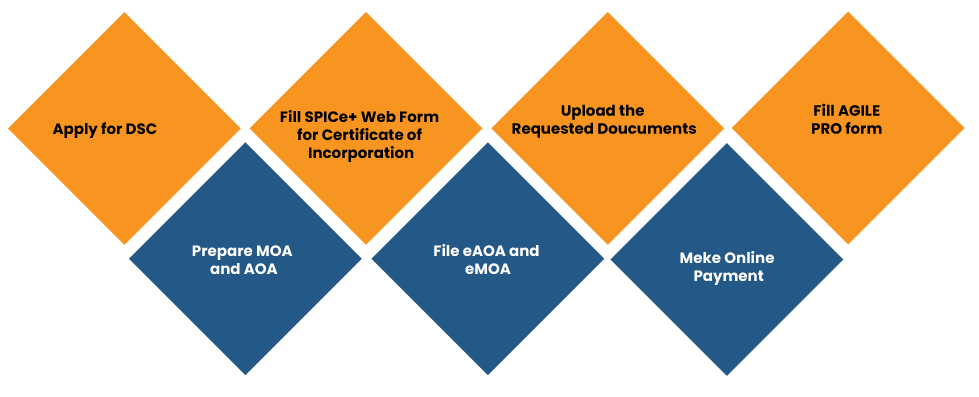

Nidhi Company Incorporation: A Detailed Procedure

Here is the detailed procedure regarding Nidhi Company incorporation. The users are required to pay due attention to each step to avert any future discrepancies.

Step 1: Apply for DSC

DSC stands for Digital Signature Certificate that enables Directors to e-sign the important documents for business-related matters. The MCA’s online portal provides that the Applicant can avail of DSC from the MCA’s certified authorities (mentioned below) against predetermined fees.

- IDSIGN

- NSDL

- E-Mudra

- CDAC

- Code Solutions CA

- Capricon

- Pantasign

- SafeScrypt CA Services

- National Informatics Center

- IDBRT Certifying Authority

Step 2: Prepare MOA and AOA

It is immensely vital for an organization to draft the company charter, i.e., Article and Memorandum of Association. These documents define the company’s scope of operation & its internal management.

Since these are deemed as supreme legal documents, you must draft them with clarity & precision. The MOA encloses seven different clauses as per section 4 of the Company Act, 2013. The AOA, on the other hand, entails rules and regulations regarding the internal administration of the company.

Step 3: Fill SPICe+ Web Form for Nidhi Company Incorporation

A certificate of incorporation i.e. COI, is a legal document that encloses a company identification number (CIN), reflecting that company is registered and posses a legal status. To simplify the incorporation process, the MCA has introduced an integrated online form, viz SPICe+. This form is parted into two sections, i.e., Part A and Part B.

Part A deals with the Name reservation, whereas Part B offers the following services.

- Incorporation

- DIN Allotment

- Mandatory allotment of PAN

- Mandatory allotment of TAN

- Mandatory allotment of EPFO registration

- Mandatory allotment of ESIC registration

- Opening of Bank Account

- Allotment of GSTIN

Filing Part A

While filing part A, make sure to provide at least three names of your liking. MCA follows the robust protocol for authenticating the proposed name.

It usually crosschecks the suggested names with their vast database to check whether they are legit or not on account of uniqueness. The portal will perform this task in real-time as soon as you provide the following details.

- Type of the company

- Class of the company

- Category of company

- Sub-category of company

- The main division of the company and description of the same

- Particulars of the proposed name

As you proceed further to fill the Part B, you will come across a detailed form that seeks the following information from you.

- Registered or Correspondence Address

- Subscribers and Directors Details

- Information about the capital

- Source of Income, Area code, AO Type, and Range code while applying for PAN and TAN

Documents to be Uploaded by Applicant

- Memorandum of Association

- Articles of Association

- Declaration by First Subscribers and Directors

- Copy of Utility Bills such as electric, gas, or water bill (not older than 2 months)

- Consent of Nominee (INC-3)

- Address + Identity proof of Applicant

After uploading these documents, the screen will prompt a declaration form seeking your confirmation. Once you confirm the relevant declarations, tap on the pre-scrutiny tab followed by Submit button. The screens will then prompt a confirmation message regarding the successful form submission.

Fill AGILE Pro and e-MOA, e-AOA

- Next, you were required to fill an AGILE-PRO form, i.e., the remaining information in Part B regarding allotment of GSTIN, ESIC, EPFO, and bank account number.

- Proceeding further, the screen will then prompt you to file Electronic Memorandum of Association (eMOA) followed by (eAOA) i.e., electronic Article of Association.

- Based on the particulars of Directors and Subscribers provided in Part B, INC-9 declaration e-form will be auto-populated and accessible on Dashboard to download and affix DSCs.

- Once done, tap on the upload form option.

- Upload Part B along with the relevant linked form.

- Upon successful uploading, the portal will generate Service Request Number; kindly note it down for future reference.

- Next, make an online payment as prompted on the screen.

Key Points to Remember Regarding Nidhi Company

- Section 406 of the Companies Act of 2013[1] and the Companies (Nidhi Companies) Rules of 2014 set out the operational structures/norms for Nidhi companies in India.

- Reserve Bank of India manages the regulatory aspect of Nidhi companies. These aspects revolve around financial activities and investments.

- Since Nidhi companies are involved with the business of deposits and loans, RBI has exempted them from requirements that are imposed on other financial institutions, including NBFCs.

- Nidhi Company provides easy financial credit to its members at a lower interest rate, unlike banks. However, the applicability of loan is limited as their members cannot allocate such money for a purpose other than manufacturing/renovation of houses or child’s education, etc.

- Members of such companies often reap low interest on deposited amounts as compared to the organized banking sector.

- The Act of lending and borrowing is not accessible to a person other than the company’s member. Due to this, Nidhi companies are also recognized as Mutual Benefit Societies.

Conclusion

The arrival of the SPICe+ web form has eased out the incorporation process for all entities, including Nidhi companies. Unlike the past method, where Applicant has to cater to a heap of requirements to register a company, the new process is time efficient and agile. Write to us in case you seek more information on Nidhi company incorporation.

Read our article:A Comprehensive Guide to Nidhi Company Rules and Regulations