Nidhi Scheme is a government-based scheme that primarily focuses on setting up a business with less capital. The scheme renders countless benefits to the individual. But there are some exceptions to this scheme that won’t allow the user to do certain things. Anyone willing to associate with such a business model must have detailed knowledge of its down. There is common misconception among many start-ups in India is that Nidhi Company and NBFC are alike or operates under the same framework. In this blog, we will unfold some key fact regarding these companies.

Nidhi Company and NBFC may seem like an identical entity but they bear some significant differences. The following section will explain these entities individually.

Companies operating under the Nidhi scheme are governed by the MCA i:e Ministry of Corporate Affairs along with the Reserve Bank. This business model advocates a sense of saving amongst people. The source of funding in such a company depends on the contribution of its members. The consolidation of funds in Nidhi companies is typically lower than that of financial institutions like banks.

Read our article:NBFC Registration: Step by Step Procedure

Meanwhile, the Non-Banking Financial Institutions (NBFC) are engaged with financing services as they provide quick loans to the individual with a nominal interest rate. NBFCs are also involved in the business of stock acquisition. NBFCs work complementary to the banking sector and primarily focussed on providing client-oriented services. Reserve bank is a regulatory authority of Non-Banking Financial Institutions.

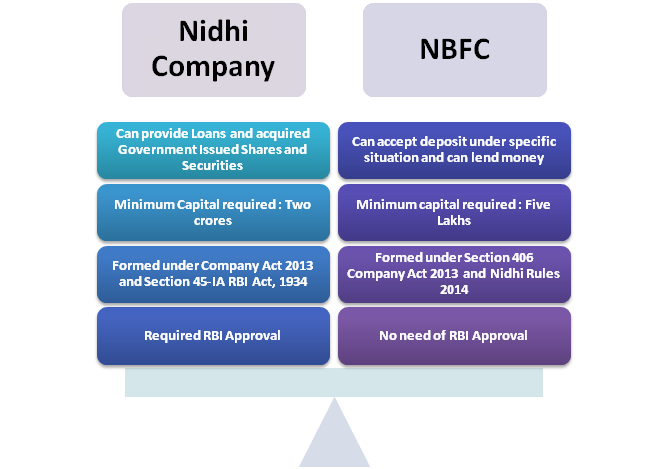

Nidhi companies serve as the most conducive way to NBFC registration in India. While NBFCs require a net worth of two crores rupees to operate, Nidhi companies can be established with a capital of just Rs 5 Lakhs. While Nidhi Companies seems advantageous in the same aspects, they possess some downsides as well.

No Diversification

Nidhi companies are liable to steak around with principal business only. That means they cannot opt for diversification even if they wish to do so. They cannot engage with hire leasing business, or chit fund business. They are also not permitted to purchase finance insurances of any sort. They do not possess the right to acquire securities in the form of a share issued by the corporate body.

These companies are specialized ones and have their working protocols and are henceforth not permitted to engage with any form of business. Microfinance Company Registration and chit fund based companies need autonomous paperwork and approval (in the form of license) issued by the Reserve Bank. Nidhi Company and NBFC are the two different entities altogether and they operates in the distinctive framework.

Current Account

As the Nidhi Company is deemed as a mutual benefit institution, the government is a reluctance to commercialize such companies and therefore does not render it the approval to open the current accounts. Hence, the companies under the Nidhi scheme are not permitted to open the current account in the bank.

No advertisement

Nidhi Companies are not permitted to solicit anyone or advertise for the sake of gaining a deposit. However, they can publicize their strength of granting loans through advertisement. Numerous meetings have been held in the past concerning this matter because the law does not restrain these companies from performing such activities.

Debentures or Preference Share Capital

A Nidhi Company has been restrained by the law to perform fundraising activities through debentures or preference Share Capital[1]. As these companies can accumulate funds in the form of deposits via the public, they are legally permitted to gather funding through any other methods.

Brokerage

Nidhi Companies cannot provide any sort of brokerage for purpose of granting loans or mobilizing deposits. However, they are eligible to hire an individual on a fixed salary basis.

Membership

A Nidhi Company doesn’t reserve the right to accept the deposit from outsiders or the non-members. Lending and deposit facilities is only limited to the members of the company and hence the transaction or the movement of the money occurs within the organization.

Service Charge

As per the prevailing law, the Nidhi Company has been restrained from charging the service charge from its member for acquiring membership of the company. Also, the company is not allowed to issue shares to its members. However, the company does reserve the right to charge processing fees against the credit/loan.

Branches

A Nidhi Company is not liable to open a subsidiary branch in the country in a non-profitable state. As per the law, to serve the aforesaid purpose, the company has to remain in profit for three years consecutively.

Limitation on Membership

A Nidhi company is not liable to incorporate any corporate body as its member and therefore taking deposit from such entities are strictly forbidden. They are not allowed to silicate members to acquire inter-corporate deposits.

Boundary

A Nidhi company is not allowed to operate on a global platform as they are restrained by the prevailing law to carry out their business activities within the state of origin of the country. Although Nidhi companies are bound to operate under the influence of countless limitations, they are emerging as valuable entities, particularly in the south region of the country.

Despite all these irregularities, Nidhi companies are still the best option for someone who wants to carry out business activities in a controlled environment. Below are some pros that exhibits why this business model so popular in India in the current scenario.

- The formation process is easy.

- Low-cost Registration.

- Less RBI compliances.

- Low level of risk related to repayment of loans.

- Perpetual succession.

- No outsider’s interference.

Conclusion

The convenience of investment and ease of formation makes this business model a conducive option for entrepreneurs who seek stable growth and fewer operating hassles to ensure uninterrupted earning. Nidhi Company and NBFC adhere to some significant differences whether it’s a matter of compliance or operating framework. Indeed, they are as good as NBFC when it comes to financing services, they still hold substantial value, particularly in terms of ease of business and compliances. In case if you are wondering about how to avail Nidhi company registration without hassle, feel free to connect with our professional at CorpBiz’s helpdesk. It is one of those platforms that provides a wide array of financial, compliances, and government license registration services at an unprecedented price point.

Read our article:All you need to Know about Nidhi Company Registration Procedure in India