Non-Governmental Organization (NGO) is an organization which works for welfare and betterment of the weaker sections of the Society. These are no-profit organizations which have no similarity with the profit-making organizations. The variety of interests of these NGO includes child welfare and education, health awareness, animal welfare, environment causes, raising awareness about different social activities or causes. In this article, we will discuss the NGO Registration Process in India.

What is NGO and How it Works?

NGO as an association includes institutions and groups which primarily work for the betterment of the underprivileged sections of the Society. These NGO are working for the upliftment of the economically weaker sections of the Society so that they stand equal in Society. These organizations help in development in the Society to live an improved life in the Society. NGO work to bring a positive change in the Society, area and situations.

There are two kinds of NGO:

- A private NGO – A non-profit private foundation is a charitable entity that is usually formed by a single benefactor, generally any individual or any business.

- A public NGO – a public NGO works like a charity and functions by using publicly collected funds to openly support and sustain its initiatives.

What are the Laws Applicable for NGO Registration?

In order to be clear about the whole process of NGO registration and its choices, you need to focus on these subjects:-

Trust under Public Trust Act of each State

There are different Trust Acts for all states in India. In case there is no Trust Act for a particular state, the general rules of the Indian Trust Act 1882 are followed. Usually, when there is property involved a charitable trust is formed. An Author or Settlor is the person who intends to form the Trust. An Author is the one who knows the main reason for the formation of Trust.

A minimum of 2 trustees is needed to form a trust. There is no limit on the maximum number of the trustees. The main document required for the formation of the Trust is the Trust Deed. In a Trust Deed the main aims and objectives of the Trust, how the Trust will be managed, appointment and removal of the Trustees, etc. should be clearly written. The Trust deed should be signed by both the trustees in the presence of two witnesses.

Society under Societies Registration Act, 1860

A society is a form of organization which is formed by a group of individuals who come together to promote literature, social welfare, social development, fine arts, useful knowledge, military orphan funds, maintenance of public museums, public libraries and any other social and charitable causes.

A minimum of 7 people of are needed to form a society under Societies Registration Act, 1860[1]. The name of all seven members should be mentioned in the Memorandum of Association (MOA), and the same names should also be filed with the Registrar of Joint Stock Companies to form Society under Societies Registration Act, 1860.

Section 8 Company under Companies Act 2013

- Section 8 Company registration formed under the Companies Act 2013 has the same purpose as the Trust and Society. Any company registered as a Non-Profit Organization (NPO) company under Section8 of the Company Act when such company has the motive of promoting charity, arts, education, protection of environment, commerce, religion, sports, science and social welfare intending to use its profits or other income for the purpose of promoting these objectives. The profit made under this section is used for welfare, research and development purposes only. Also the objective of the company under this section should mandatorily be that the company does not intend to pay any dividend to its members.

- A minimum of 2 directors is needed if the Section 8 company is to be incorporated as a Private Limited Company whereas, a minimum of 3 directors if incorporated as Public Limited Company. The maximum number required in case of Public Limited Company has no limit, but on the other hand, a maximum of 200 directors can be there in Private Limited Section 8 Company.

NGO Registration Process/ Requirements

Trust Registration Process

The first step to be followed before registering a trust is to form a Trust Deed. The main aims and objectives of the Trust should be clearly specified in the Trust Deed, along with the following pre-requisites:

- Name and Address of the Author

- Name and Address of all the Trustees

- Name of the Trust(minimum three preferences should be given)

- Address of Registered Office of Trust

- Beneficiaries

- Purpose of Trust

Once the Trust Deed is completed, the same is submitted to the Registrar for Trust Registration. The presence of the Author of the Trust, along with two witnesses, is required during registration.

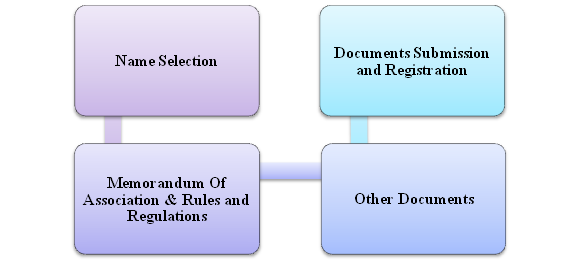

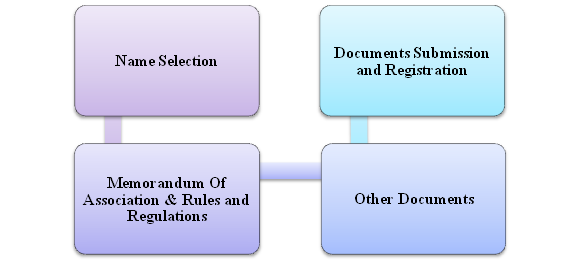

Name Selection

The name selected should be a unique one and should not resemble to any society Registration already registered with the Societies Registration Act, 1860. The other exemption which should be followed while finalizing the name of a Society is the restricted name list under the Emblems and names Act, 1950.

Read our article:NGO Registration – Step by Step Procedure

Memorandum of Association & Rules and Regulations

The Memorandum of Association (MOA) and the Rules of the Society must be signed by each member of the Society, witnessed by the Chartered Accountant, Gazette Officer, Notary Public, Oath commissioner or a First Class Magistrate.

The MOA includes the following clauses:

- Name Clause

- Registered Office Clause

- Objectives Clause

- Liability clause

- Capital clause

The Rules and Regulations include the following clauses:

- Membership clause

- Meeting clause

- Dissolution

- Legal procedure

Other Documents

The other documents required for the Registration process of Society are:

- A cover letter with a request to register the Society

- ID Proofs of all the members

- Minutes of the meeting

Documents Submission and Registration

The MOA with the Rules and regulations document is submitted to the Registrar of the Societies in the State. The Registrar if is satisfied with the documents and the terms and conditions mentioned, then he can certify your Society to be registered under the Societies Registration Act 1860.

Registration Process of Section 8 Company

The Companies under Section 8 can be incorporated in part A of Spice+ form by reserving the names followed by filling the part B of Spice+ form. During the incorporation of the company under section 8, the License number shall be given to that company. As stakeholders already having license can fill up the form with ease.

- Digital Signature Certificate (DSC) – the digital signatures of all the proposed directors of the company are required during filing up the company incorporation form. DSC is issued by the certified agencies as recognized by government.

- After receiving the DSC, the directors shall file Form DIR-3 for getting the Director Identification Number with the ROC.

- Directors Identification Number (DIN) can be applied directly through SPICe+ form.

- It is helpful if one opts for two different choices of a name as sometimes the proposed name for the Company does not get selected.

- After name reservation SPICE Form 32 will be filed with the Registrar of Companies (ROC) for the incorporation of the Company with the required documents. The documents to be attached are as follows:

- INC-13- Memorandum of Association

- Draft Articles of Association

- List of Promoters and Directors

- Passport size photo and ID proofs like Aadhaar Card or Voter Id.

- Utility bill as an Office address proof.

- No Objection Certificate in case the premises are leased or rented

- Estimated Income and Expenditure

- Declaration as per Form INC-15 (Declaration of each person making Application)

- If the ROC is satisfied with the form, he will issue the Certificate of Incorporation (COI) along with the License.

What are the Benefits of NGO Registration?

- Exemption from Income Tax

- Land from Government

- Separate Legal entity

- Limited liability

- Legal protection from other companies using the same name

- No Minimum Capital Requirement

- 80G Certificate Benefit

- People can quickly transfer the title or ownership to other

- NGO are also exempted from paying stamp duty like other entities

Conclusion

The NGO Registration done in any form is done for the welfare of the underprivileged sections of the Society. The profits earned are used for promoting art, literature, science, commerce and many more. Forming an NGO in India is not a very difficult process. If one is having all the documents for NGO Registration, then there is no difficulty in getting an NGO Registration.

Read our article:Society Registration in India: Know the Entire Procedure and List of Documents Required