Making India Self-reliant

[Aatmanirbhar Bharat Abhiyan to spur growth and to build a self-reliant India: Finance Minister]

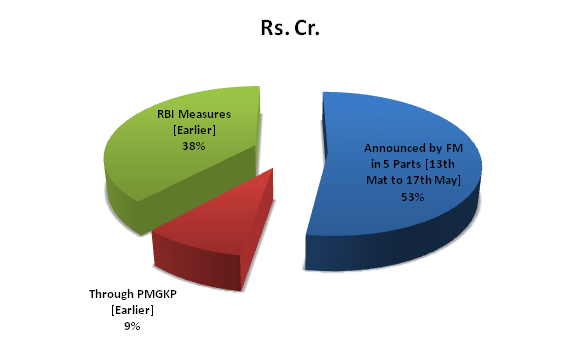

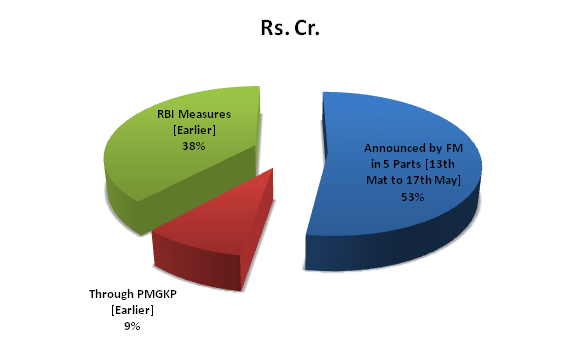

As we know, India is under lockdown for more than 50 days, which resulted in serious economic repercussions therefore Government of India has taken steps to combat economic battle. From 13th May, 2020 to 17th May, 2020 finance minister “Nirmala Sitharaman” addressed the media and declared economic package of Rs. 20 lakh crore [10% of GDP] to various sectors like cottage industry, MSMEs[1], laborers, and among others [mainly sectors which are highly affected by the pandemic]. This has been done to put into operation the Aatma Nirbhar Bharat Abhiyan declared by the Prime Minister “Narendra Modi” on 12th May, 2020. The motive behind this is to boost economy amid the Covid-19 pandemic. A series of announcements have been made to spur growth in MSME sector and to make India self reliant. In this article we are covering important announcements for the corporates.

FM focused on below-mentioned points:

- Allocation of money

- How the stimulus is being financed?

- Fiscal impact

- Package Implementation Time

- How the reforms will take shape?

5 Pillars of the Self-Reliant India

- Economy

- Infrastructure

- System

- Demography

- Demand

Atmanirbhar Bharat Package

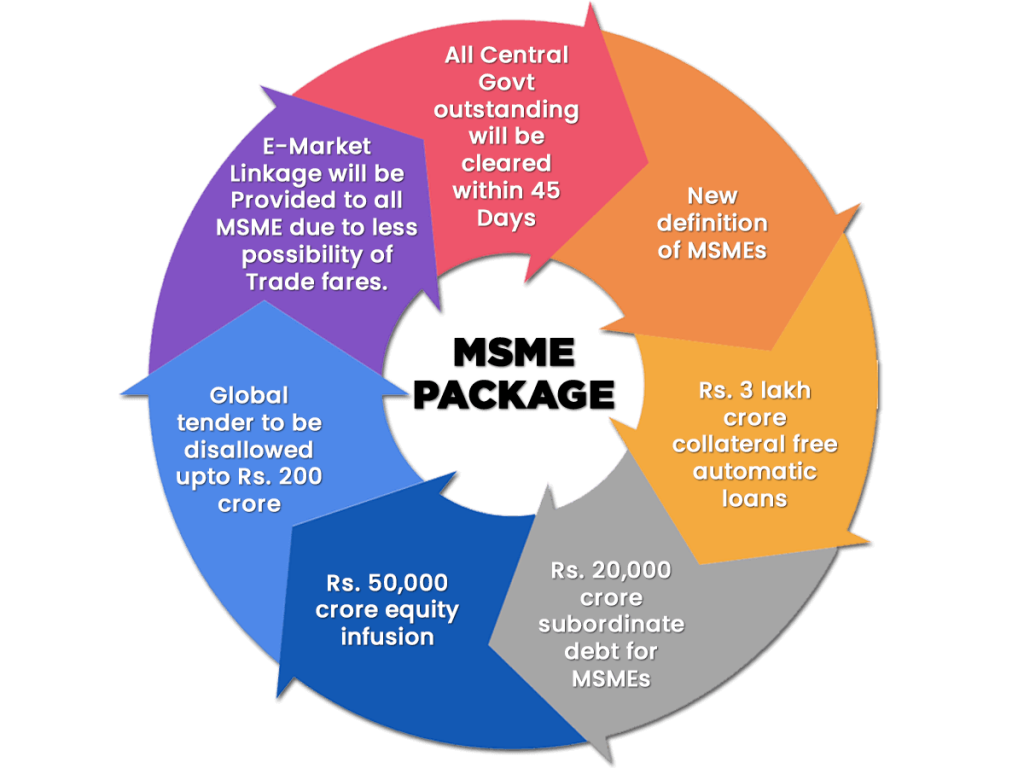

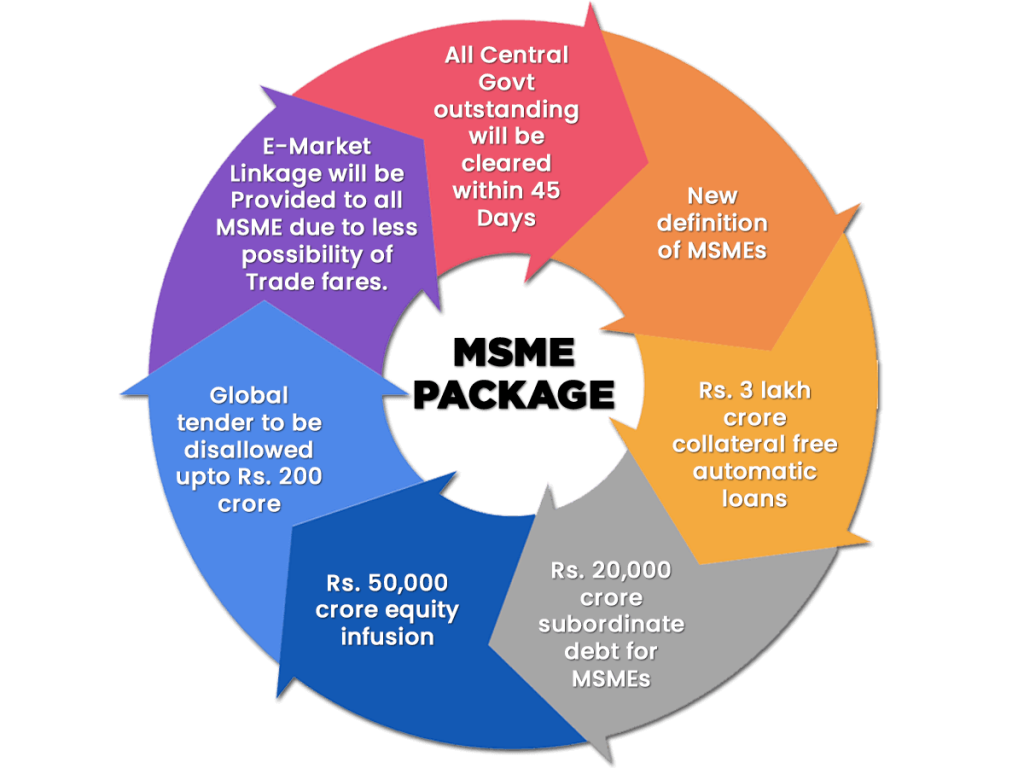

Now let us tell you what’s in the box for MSME Sector;

Introduction of MSMEs New Definition

It has been seen that there was a significant demand for revising the definition of MSMEs as there was a fear among MSMEs of not getting benefits due to prescribed limits which was restricting their growth.

Revisions are as follows taking MSME relief package:

- Upward revision of Investment limit

- Additional criteria of turnover

- Same benefits for manufacturing and service – based MSMEs – There shall be no distinction between the two

- Necessary amendments in the law may take place.

|

Existing MSME Clarification |

|||

|

Criteria: Investment in Plant & Machinery or Equipment |

|||

|

Classification |

Micro |

Small |

Medium |

|

Manufacturing Enterprises |

Investment <Rs. 25 Lakh. |

Investment <Rs. 5 Cr. |

Investment <Rs. 10 Cr. |

|

Service Enterprises |

Investment <Rs. 10 Lakhs |

Investment <Rs. 2 Cr. |

Investment <Rs. 5 Cr. |

|

Revised MSME Clarification |

|||

|

Classification |

Micro |

Small |

Medium |

|

Manufacturing & Services |

Investment <Rs. 1 Cr. and Turnover <Rs.5 Cr. |

Investment <Rs. 10 Cr. and Turnover <Rs.50 Cr. |

Investment <Rs. 20 Cr. and Turnover <Rs.100 Cr. |

Read our article: RBI Extends Deadline for One – Time Restructuring of MSME Loans

Rs. 3 Lakh Cr. Collateral-free Automatic Loan for Businesses/MSMEs

- Rs. 3 lakh crore loans;

- For businesses having Rs. 25 crore outstanding loans and annual turnover is not more than Rs 100 crore;

- Loan Tenure – 4 years;

- Moratorium of 12 months;

- On principal and interest, 100% credit guarantee to banks and NBFCs;

- Offer valid until October 31, 2020;

- No extra fee to be charged;

- No fresh collateral required;

- Around 45 lakh MSME units will get benefit from this MSME Relief Package.

Rs. 20,000 Cr. Subordinate Debt For Stressed MSMEs

- Through subordinate debt-based scheme – Rs 20,000 crore liquidity;

- Government will provide Rs 4,000 crore to CGTMSE;

- CGTMSE will render partial credit guarantee support to banks;

- NPA or stressed MSMEs are eligible;

- Banks will give debt to MSMEs which will be infused as equity by the promoters;

- 2 lakh MSMEs will get benfit of this.

Rs. 50,000 Cr. Equity Infusion through FOF – Funds Related

- Infusing Rs. 50,000 crore equity into MSMEs for eligible;

- Through mother-fund and daughter-fund framework – Corpus of Rs. 10,000 crore;

- MSME Relief Package expansion and to get listed.

Global Tenders Disallowed up to Rs. 200 Cr.

- It has been seen that MSMEs faced unfair competition from foreign companies;

- To prevent this, government has disallowed global tenders in government procurement tenders up to Rs. 200 crores;

- This MSME relief package will surely help MSMEs in becoming self-reliant.

Other Important Measures of MSME Relief Package

Rs. 2500 Cr. EPF Support

- Under the Pradhan Mantri Garib Kalyan Package (PMGKP), contribution of 12% of the employer and 12% of the employee made into EPF accounts of eligible establishments;

- Previously it was declared for the months of “March, April and May” now it has been extended for 3 more months “June, July and August 2020”;

- Its benefit will be taken by 3.67 lakh establishments and 72.22 lakh employees.

Rs. 6750 Cr. Liquidity Support through Reduction in EPF Contribution

- Statutory PF contribution of both the employer and employee will be reduced to 10% each from the existing 12% each for the period of next three months;

- Its benefit will only be taken by workers who are not eligible for 24% EPF support under PMGKY;

- Central Public Sector Enterprises (CPSEs) and State PSUs will continue to contribute 12% as employer contribution;

- It will benefit 6.5 lakh establishments and around 4.3 crore employees.

Analysis: This measure will not only give major relief to workers but as well as to employers as it will ease the compliance norms for 6.5 lakhs establishments and will save them from paying hefty penalties. On the other hand, Reduction in the employee’s contribution from 12% to 10% will increase cash in hand salary of the employee.

Rs. 50,000 Cr. Reduction in TDS/TCS Rates

- The TDS rates in respect of non-salaried specified payments made to residents and TCS rates in respect of specified receipts shall be reduced by 25% of the existing rates;

- Who will be eligible? – Payment for contract, professional fees, interest, rent,dividend, commission, brokerage, etc;

- Applicable from 14th May 2020 to 31st March 2021.

Rs. 30,000 Cr. Special Liquidity Scheme for NBFCs / HFCs / MFIs

- As per this, investment will be made in both primary & secondary market transactions in investment grade debt paper of NBFCs / HFCs / MFIs;

- Fully guaranteed securities by the government.

Direct Tax Measures

Due dates have been extended in respect of the following:

- ITR Filing – 30th November 2020

- Vivaad se Vishwas Scheme – 31st December, 2020

- Tax Audit Report – 31st October 2020

- Date of Assessment [barred as on 30th September, 2020] – 31st December, 2020

- Date of Assessment [barred as on 31st March 2021] – 30th September, 2021

Change in Compliances

Income Tax

- Income Tax Return filing date extended for (FY 18-19) from 31st March, 2020 to 30th June, 2020.

- ITR Filing – 30th November 2020

- Aadhaar-PAN linking date extended from 31st March, 2020 to 30th June, 2020.

- Vivad se Vishwas Scheme – Without making payment of additional amount of 10% for settlement if payment made by June 30, 2020

- Due dates for issue of notice, intimation, notification or any other documents where the date dates are expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

- For delayed payments of advanced tax, self-assessment tax, regular tax, TDS, TCS, equalization levy, STT, CTT made between 20th March 2020 and 30th June 2020, interest rate reduced for this period at 9% instead of 12 %/18 % per annum. No late fee shall be levied for delay.

- Necessary circulars shall be issued in this regard.

GST

- Those having aggregate annual turnover less than Rs. 5 Crore can file STR-3B by the last week of June, 2020 due in March, April and May. No interest, late fee, and penalty to be charged.

- Others can file returns by last week of June 2020 due in March, April and May but it would attract reduced rate of interest @9 % per annum from 15 days after due date. No late fee will be charged, if filed before till 30th June 2020.

- For opting for composition scheme due date is extended till the last week of June, 2020. And, for making payments for the quarter ending 31st March, 2020 and for return filing it has been extended till the last week of June, 2020.

- Date for filing GST annual returns extended till the last week of June 2020.

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, or any other documents, where the due date is expiring between 20th March 2020 to 29th June 2020 extended to 30th June 2020.

- Necessary circulars shall be issued in this regard.

- Under Sabka Vishwas Scheme, payment date extended to 30th June, 2020.

Customs

- 24X7 Custom clearance till 30th June, 2020

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, or any other documents etc., under the Customs Act and other allied Laws where the time limit is expiring between 20th March 2020 to 29th June 2020 extended to 30th June 2020.

Financial Services

- Debit cardholders to withdraw cash for free from any other banks’ ATM for 3 months

- Waiver of minimum balance fee

- Reduced bank charges for digital trade transactions for all trade finance consumers

Corporate Affairs

- No additional fees shall be charged for late filing with MCA during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement etc;

- Prescribed limit of holding board meetings within prescribed time under the Companies Act 2013, extended by a period of 60 days till next two quarters i.e., till 30th September;

- Applicability of Companies (Auditor’s Report) Order, 2020 shall be applicable from the financial year 2020-2021 instead of from 2019-2020 notified earlier.

- If Independent Directors have not been able to hold even 1 meeting, it shall not be viewed as a violation while as per Schedule 4 to the Companies Act, 2013, IDs are required to hold at least one meeting without the attendance of Non-independent directors and members of management.

- Non-compliance of minimum residency in India for a period of at least 182 days by at least one director shall not be viewed as violation.

- Requirement to create a Deposit reserve of 20% of deposits maturing before 30th April 2020 shall be allowed to be complied till 30th June 2020.

- Requirement to invest 15% of debentures maturing before 30th April 2020, can be done before 30th June 2020.

- Additional time of 6 months provided to newly incorporated companies to whom it is required to file a declaration for Commencement of Business within 6 months of registration.

- Threshold raised of default under section 4 of the IBC 2016 to Rs 1 crore (from the existing threshold of Rs 1 lakh). This will by and large prevent triggering of insolvency proceedings against MSMEs. If the current situation continues beyond 30th of April 2020, govt may consider suspending section 7, 9 and 10 of the IBC 2016 for a period of 6 months so as to stop companies at large from being forced into insolvency proceedings in such force majure causes of default.

Ease of Doing Business – Corporate Law Measures

- Simplified web based incorporation form [SPICe+]

- Withdrawal of more than 14,000 prosecutions under the Companies Act, 2013.

- Companies to conduct board meetings and shareholders meeting [AGM & EGM] digitally

- Minimum threshold to initiate insolvency proceedings rose to Rs. 1 crore (from Rs. 1 lakh).

- Under Section 240A of the IBC, Special insolvency resolution framework for MSMEs considering under MSME relief package

- Suspension of fresh initiation of insolvency proceedings up to one year

- Decriminalization of Companies Act violations concerning minor technical and procedural defaults like shortcomings in CSR reporting, inadequacies in board report, filing defaults, delay in holding shareholders meeting.

- Majority compoundable offences to be shifted to internal adjudication mechanism (IAM) and powers of RD for compounding enhanced.

- Direct listing of securities by Indian public companies in permissible foreign jurisdictions

- Private companies which list NCDs on stock exchanges will not be termed as listed companies.

- Including the provisions of Part IXA (Producer Companies) of Companies Act, 1956 in Companies Act, 2013.

- Power to create additional/specialized benches for NCLAT

- Lower penalties in case of defaults for Small Companies, OPCs, Producer Companies as well as startups

Other Announcements – Part-Wise

- Part 1

- Liquidity Injection for DISCOMs

- Extension of Project Completion Timeline for contractors in real estate sector

- Part 2

- Free Food grain Supply to Stranded Migrant Workers for a period of 2 months

- Interest Subvention for MUDRA Shishu Loans

- Special Credit Facility to Street Vendors

- Housing CLSS-MIG

- Additional Emergency Working Capital through NABARD

- Additional credit through KCC

- Part 3

- Food Micro enterprises

- Pradhan Mantri Matsya Sampada Yojana

- TOP to TOTAL: Operation Greens

- Agri Infrastructure Fund

- Animal Husbandry Infrastructure Development Fund

- Promotion of Herbal Cultivation

- Beekeeping Initiative

- Part 4 & 5

- Viability Gap Funding

- Additional MGNREGS allocation

In connection with the next phase of lockdown, finance minister Nirmala Sitharaman tweeted:

Our Opinion on MSME Relief Package

This reform is taking India towards attracting global investment on a large scale. Rather than having an adverse effect, this crisis is taking us towards transformation. This is to make the country more reliable as self-reliance implies the shifting of production and manufacturing units to India.

Read our article: Can Startups Benefit From MSME Registration For Better Govt Support?