The takeover of NBFC means the purchase of NBFC by another organization, which can only exist if both the acquirer and the target are operating under the provisions of the Companies Act. In this writeup, we will cover everything about NBFC Takeover, so let get started.

In the past few years, takeovers and mergers have become more inevitable than ever. It has emerged as a viable option for businesses seeking expansion. The efficacy of the takeover process made the Reserve Bank give emphasis to the incorporation of the NBFCs takeover.

The takeover of NBFC can be a fruitful proposition for those organizations grappling to register an NBFC of their own. The RBI lays down the procedures and rules for the NBFCs takeover.

What are the types of NBFC takeover in India?

Following approaches are commonly used in the business arena for NBFC Takeover. Those are as follows:-

Friendly Takeover

A friendly takeover usually takes place with the mutual consent of both parties. In this form of takeover, the acquirer buys out the target company after obtaining its permission through the legal process.

Hostile Takeover

In the event of a hostile takeover, an acquire looks to purchase the target entity through a covert strategy. This form of takeover usually takes place when a company strives to acquires the target organization without the permission of the Board of Directors of the target company.

Read our article:NBFC Takeover: Know the Pros and Cons, Procedure and RBI Guidelines

Points worth remembering related to the Takeover of NBFC

Before you dive into acquisition formalities to takeover an NBFC, make sure to keep the following pointers in mind.

Due Diligence

Before you acquired an entity, make sure to have a check on the company’s background. You must also outline a detailed checklist associated with the process of acquisition to envisage the company goals & look out how the acquisition will benefit the company to meet the goals.

Probe the Suitability

An acquirer must verify the list of an eligible individual for takeover prior to offering takeover to any entity. During the process, the company shall narrow down the list by picking up the right candidates to serve the purpose of acquisition.

Examine the Financial Standing

You must examine the financial standing of the company through a deliberate approach. Obtain an accurate estimation of the cost required to acquire the company. Also, pay attention to the cash flows and figure out the most appropriate model for financing the takeover.

Benefits related to the Takeover of NBFCs

The takeover of NBFCs reserves the given benefits, which are as follows:-

- It escalates the profitability of the company.

- Lower down the competition.

- It can ramp up revenue and sales.

- It enables the expansion of the distribution market.

- It can broaden the scale of the economy

When the RBI Approval for NBFC Takeover is needed?

The RBI has drafted some norms for the NBFCs takeover which are as follow:-

- An NBFC seeks RBI’s[1] approval if there is any alteration in the management.

- The acquisition of the listed NBFC seeks the approval of the Reserve Bank.

- Reserve Bank permission is also needed in the event when there is any alteration in the management, which will result in more than thirty percent of the director.

When the RBI Approval for NBFC Takeover is NOT needed?

The reserve bank’s permission is not required in the following circumstances:-

- Shareholders of the company surpass beyond twenty-six percent due to share reduction in the capital or buyback of shares. It can only be implied after availing permission from the relevant judicial court.

- There is an alteration in management by thirty percent including the independent director or by the rotation of directors included in the board.

Application & Documents to Avail RBI’s Approval

In the case where the RBI’s approval is mandatory before the Takeover, the following particulars must be enclosed in the application:-

- Detail regarding the directors and proposed shareholders.

- Detail related to the source of funds to be used by shareholders for obtaining shares in NBFC;

- Bank report related to the directors and proposed shareholders;

- Declaration showing no linkage of your company with other entity that has refused the certificate of registration by Reserve Bank; and

- A statement related to the offensive background and non-conviction u/s 138 of the negotiable instrument act by all shareholders and proposed directors.

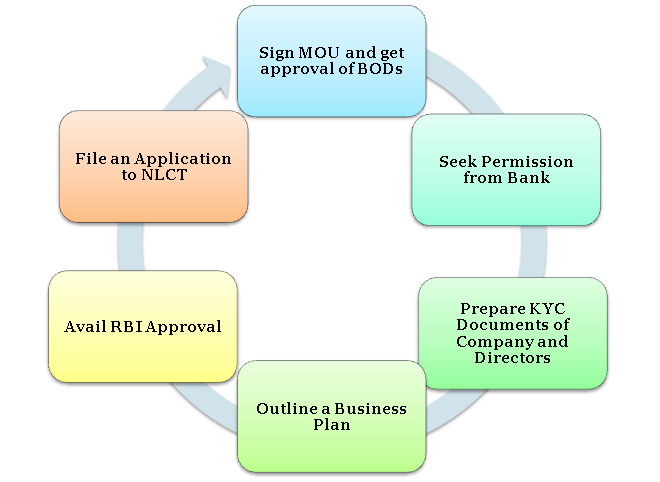

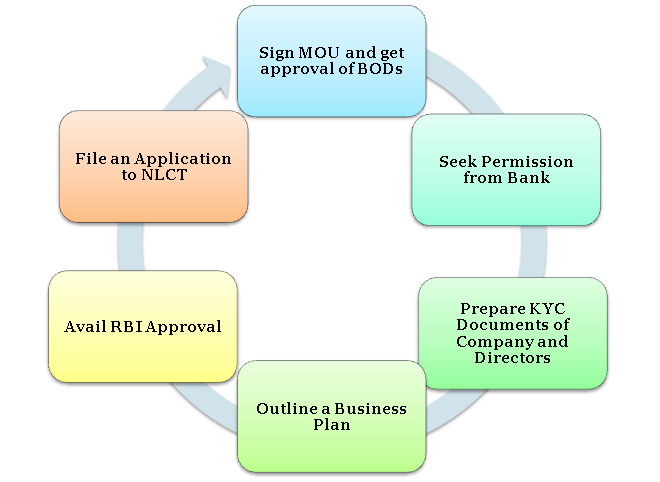

Post-RBI’s Approval Formalities for NBFC takeover

After obtaining the Reserve bank’s permission follow these steps:-

Promulgate a Public Notice

The first steps demand the promulgation of public notice. The Public notice should be made publicly available to the general masses in two regional languages i.e. English & vernacular language. The notice should be communicated with the general public after thirty days of the RBI’s approval.

Formal Agreement

This is the second stage in the process where an acquirer is required to enter into a formal agreement with the target company to ensure complete possession of the shares and transfer of management.

Promulgate another Public Notice

When the company reaches near the completion of thirty days timeline of agreeing, a second notice ought to be made available to the general public. Needless to mention that the said notice should be published in recommend languages as the first one.

Transfer of Assets

Soon after the RBI’s approval, the asset transfer will take place without any legal hassles.

Conclusion

As mentioned earlier, the NBFC takeover is generally taking place for expanding the existing footprint of the company or to increase the customer reach. The reserve bank has taken certain measures to reduce the complexity regarding the procedure of NBFCs takeover. Taking the dominance of NBFC in the market today, the RBI has simplified the compliances and legal prerequisites for the process.

Call CorpBiz’s today if you need professional-grade help for NBFC registration. Our experienced and proactive experts can guide you through extremely irritating paperwork and tedious process with a holistic approach.

Read our article:Procedure for Appeal against Cancellation of NBFC Registration by RBI