Minimum Alternate Tax comes under the Indirect Tax category. MAT was deployed by the government to control the organization’s urge to make a high profit by averting tax liabilities due to any exclusion. There are several types of taxes in our taxation system applicable to individuals and companies. The Indian government is putting their best effort to make the taxation framework transparent than ever.

The government is also paying attention to individuals or companies who are unwilling to comply with the taxation norms for the sake of additional profit. Currently, our taxation system is categorized into direct and indirect tax. Minimum Alternate Tax, aka MAT, is a class of tax that comes under the category of indirect tax. Let have a look at fundamental of this tax category.

What is the Minimum Alternate Tax?

Every company, regardless of its geographical location, needs to pay MAT on a predetermined period. This provision is mentioned under section 115JB of the Minimum Alternate Tax Act.

The rule aims to control tax-avoiding activities on account of deductions, exclusions, and credits. MAT primarily comes under the influence of the Income Tax Act of India, 1961[1].

Eligibility criteria w.r.t Minimum Alternate Tax or MAT

Minimum Alternate Tax or MAT is a type of tax that bears by companies rather than the individuals or partnership firms. The rules regarding section 115JA are applied to foreign companies that are operating in India.

Read our article:Relief Granted to KFC Franchise by ITAT

Features of the Current MAT Regime

The following list will explain the features of Minimum Alternate Tax or MAT.

Advance Payment of Tax

Every taxpayer is under the obligation of paying their tax in advance without delay as estimated in accordance with. However, this tax is only applicable to those entities those tax liability is Rs 10000 or more for a financial year. Likewise, all firms should mandatorily pay their tax in advance, as per section 115JB of the Income Tax Act.

MAT Credit

Any firm that makes a tax payment as per MAT clause rather than a regular tax, then if the tax paid exceeds the accumulated account, the excess amount will be rerouted to the company as a tax credit. Thus, MAT is nothing but a difference between the taxes paid as per the Income Tax Act and MAT provisions. The taxpayers are eligible to move forward this credit and set off in the year in which the firm has to address remaining tax liabilities w.r.t Income Tax Act.

The concept regarding MAT calculation

Suppose company A reaps a profit of RS.10 lac. The firm, in this case, obtains gross taxable income Rs—5 lac after relevant deductions, exemptions, and depreciation.

- In this case, Income tax = 30% of Rs.5 lac = Rs.1,50,000

- MAT = 18.5% of Rs.10 lac = Rs. 1,85,000

- So excess tax payable will be Rs.1,85,000 – Rs. 1,50,000 = Rs.35,000

Thus, the taxpayer can carry forward the tax credit of Rs 35,000 and set-off against future tax liabilities.

Steps to calculate MAT

- Estimate total income under the Income Tax Act,1961.

- Now estimate the book profit as per section 115JB.

- Total income is subjected to tax under the Income Tax Act. You need to compute this tax.

- Estimate tax at 15% on book profit.

- now the payable tax is equivalent to higher of Step 3 or Step 4

MAT Report

The companies under the obligation to pay MAT have to provide a MAT report as per Form 29B.

The submission of this report has to be done along the ROI filed.

MAT & Special Economic Zones (SEZs)

Initially, when MAT provisions come into effect, MAT directives did not apply to the profit earned by the companies in Special Economic Zones or SEZs. However, after some crucial amendments in 2011, it became mandatory for such firms to follow all the provisions under the MAT clause.

Future of MAT in India

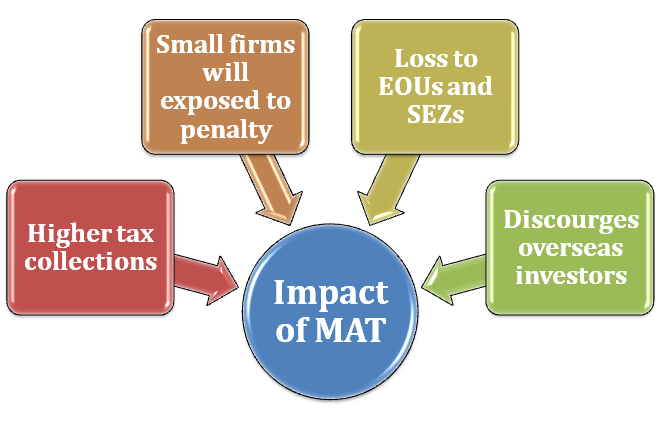

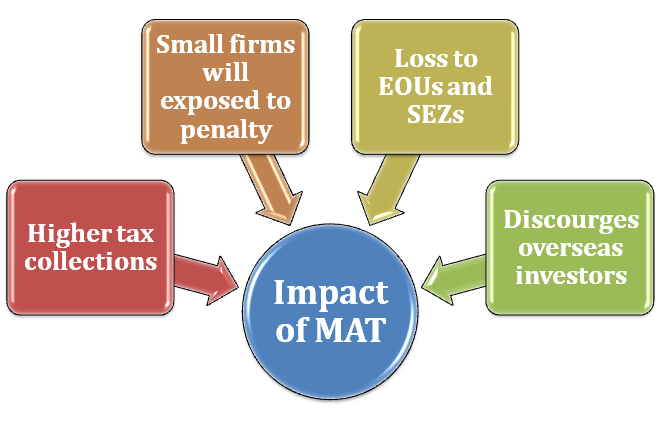

The majority of the firm deems MAT as a relentless form of taxation. Due to some stringent norms, the corporate sectors requested the government to make this tax form more inclusive and flexible through necessary amendments. Consequently, the Indian government, in response to this complexity, founded a special committee that will look into the disputes w.r.t MAT payment.

At present, the committee is not working to its full potential as it is now only focusing on government direction to address the resolution of MAT demands w.r.t foreign institutional investors. Several foreign investors, in the past, have received notices regarding the payment of MAT. However, that doesn’t mean the government is not responding to this complexity. Several attempts have been made by the government to make MAT more conducive for the taxpayer across the nation.

Points to remember

- The concept of (MAT) was deployed in the tax system with the aim to control the tax averting activities within the corporate sector.

- It primarily tackled the loopholes in the taxation system that occurs due to the non-payment of the taxes from the corporate sector.

- It hinders the company’s attempt to take advantage of incentives and exemptions with a goal to reap more profit.

- The MAT payable, as under the ITA, will be deemed as income tax.

Conclusion

Tax is like a fuel that triggers the country’s development. But whenever the taxation norms turn out vague and stringent, the companies suffer in the longer run. Presently, MAT provisions don’t seem favorable from the corporate viewpoint. However, the government’s frequent attempt in this direction implies that some changes are around the corner that will make MAT more flexible and inclusive for the taxpayers.

Read our article:Income Tax Slab and Rate for financial year 2020-21