Indian masses have great admiration for high alcohol beverages. This is why the consumption of whiskey, vodka, and run never encounter a negative dip in growth. But in the recent past, crafted beers have made a special place in the Indian marketplace. Despite low alcohol content, a vast pool of consumers, particularly from metropolitan areas, is shifting towards crafted beer. Soothing flavour, exquisite taste, and form-rich appearance make crafted beer one of a kind that suits the wide consumer base. The ever-rising demand for crafted beers is encouraging the state government to broaden the microbreweries landscape. Now, this is where a business opportunity comes into picture for startups. If you are interested in making handsome revenue in the alcohol landscape, then this might be the right opportunity to dive into the microbreweries domain. This article aims to underline fundamental legalities for setting up a Microbrewery Business in India.

What is the microbrewery business?

A microbrewery, aka craft brewery, is a small brewery unit whose production rate or volume is lower than the main distilleries. The exact definition differs by the terms are commonly applied to breweries that are significantly smaller than larger counterparts and are independently owned. Such breweries are characterized by their emphasis on taste, quality, and brewing methods. The production volume of Microbrewery ranges between 5,000 and 50,000 litres/day. It takes roughly 7-8 hours to brew different types of beer via imported ingredients. None of it is bottled & being stuffed with preservatives during this process. The article will focus on the scope, requirements, and legalities of the Microbrewery business in India.

Read our article:Benefits of Startup India Registration in India

Analyzing the Potential of Microbrewery business

- The recent spike in beer consumption pan India has given the major push to the home-brewing community. Most of these units got the backup of several financial avenues, including venture capitalists. Bira91 that has nearly 6% of the market share, has procured almost $50 million from Sofina & $ 4.3 million from another venture, namely Sixth Sense, in 2018

- The Indian alcohol market has secured a third position in the world, and it is thriving at a rapid pace. This market is projected to grow by 25% to $41 billion by 2022, as per the latest report issued by Euromonitor.

- The alcohol market has been categorized into three major classes: Wine, Beer, & spirit. Beer is the second most-consumed alcoholic beverage after whiskey in India. About ten years back, the Indian craft beer industry was struggling to cement its place in the market and only managed to secure 3% of the Indian beer market ($7 billion).

- The All India Brewers Association projects sales of such beers to thrive at 20% y-o-y, which is more than 7% y-o-y growth in the beer market.

- More than 30% of the Indian populace belong to the urban regions that have seen optimal growth in pubs, restaurants, and the entirely new concept, the brewpubs. The development is triggered by the millennials who find craft beer more premium as well as authentic when contrasted with the regular lagers.

- The market for microbreweries is developing at a healthy rate in India. Although at present only five states have microbreweries units, a few more have been lined up and waiting for government signal to operate at full throttle.

- As per the existing industry estimates, the market for finely crafted beers accounted somewhere between Rs75 crore to Rs 125 crore, and it takes around 8-9 crore on average established a microbrewery.

- The NCR region has witnessed a great increase in the demand for various types of beers. According to the report, Gautam Budh Nagar has recorded a monthly consumption of 15 lakh bottles and more than seven lacs litre of overseas liquor.

Legalities for Setting up Microbrewery Unit in India

- Presently only a few Indian states have a completed excise policy, but Haryana & Maharashtra were the first ones in this domain. Excise norms deal with any type of intoxicants or narcotics in the liquor industry, for which they impose taxes on the production as per standards and guidelines.

- Typically, this is done for microbreweries where there is no packaging & per bulk litre for packaged beer in cartons.

- Such taxes are imposed on the weekly or monthly production & also depend on the ABV, i.e. alcohol by volume, which is standard for a tax rate & increases with the spike in ABV, but typically ABV in beers in microbreweries is permitted over 8%.

- A microbrewery license is granted by the state excise government which permits the unit to commence operations in its Microbrewery for commercial use.

- Previously, the license cost was over Rs 10 lacs/year, which was identical to the large-scale breweries, but it has come down to Rs 2, 50,000/year due to recent development. However, these figures may differ state-wise because the excise norms are state-regulated.

- If the microbrewer intends to open a pub on the premise, he needs to avail a separate bar license so that it can align with the established state regulations where he wishes to set up the brewery.

- Importing fabrication machinery from different states attracts some excise over the stainless steel used. Further, the customs duty does come into play in the case of importing equipment from China or some European nations. Customs duty will be imposed on foods from 10-30% of the total shipment, based on the type of machinery, the shipment location & their use.

- In the case of the importation of raw material, the importer needs to pay excise duty and the customs duty for the nature of material utilized in the alcohol production.

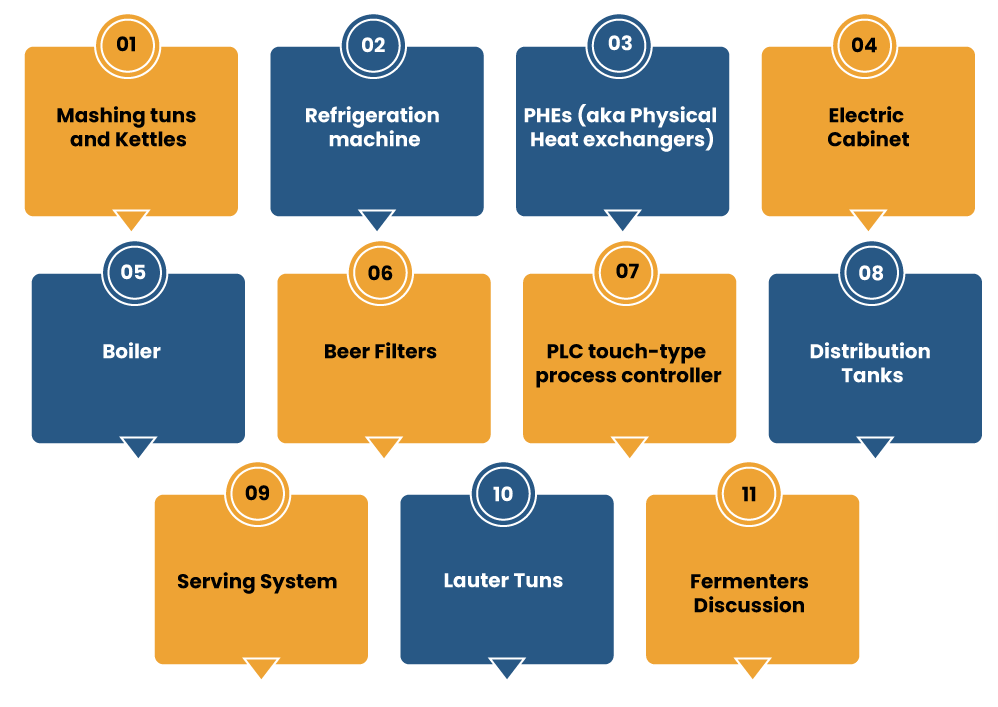

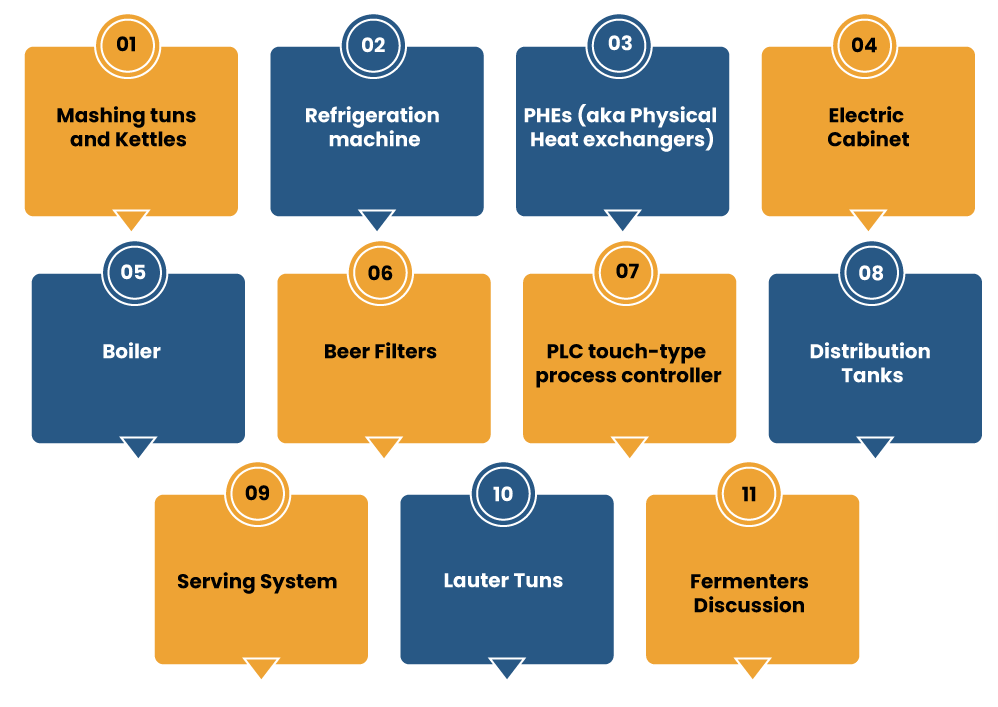

Typical equipment required to set up a full-fledged Microbrewery unit in India

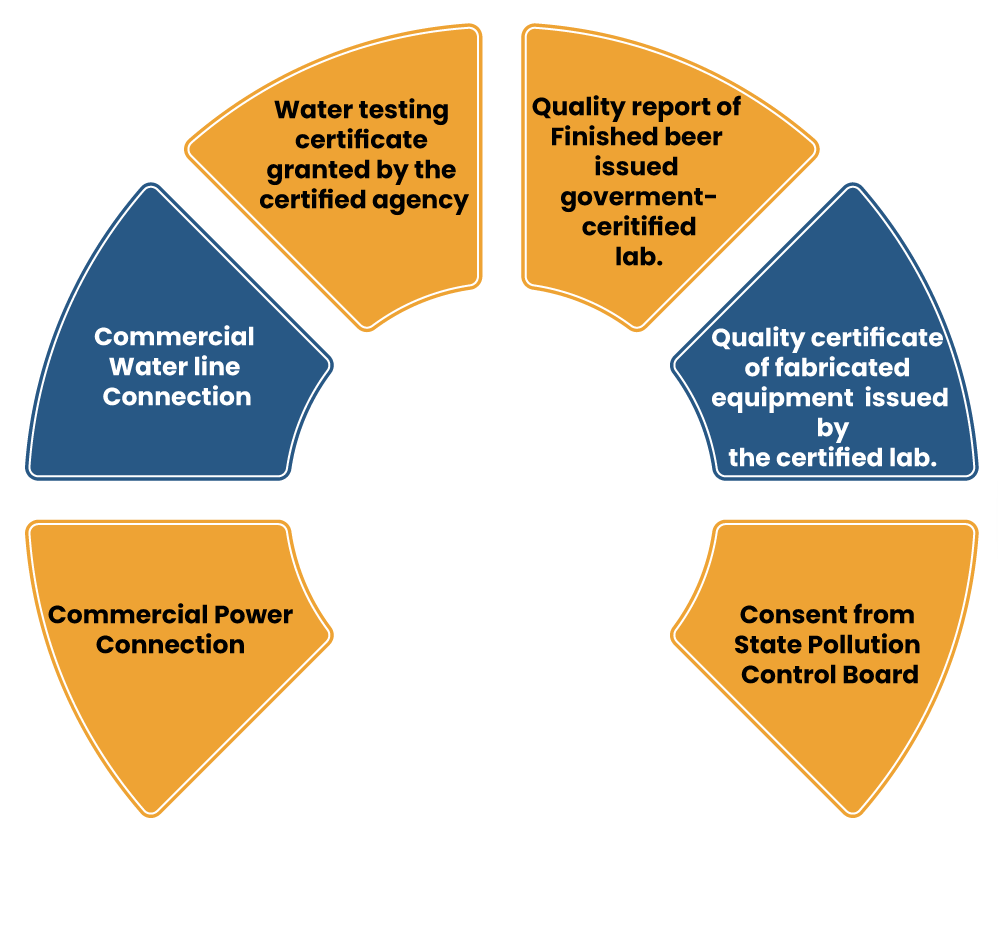

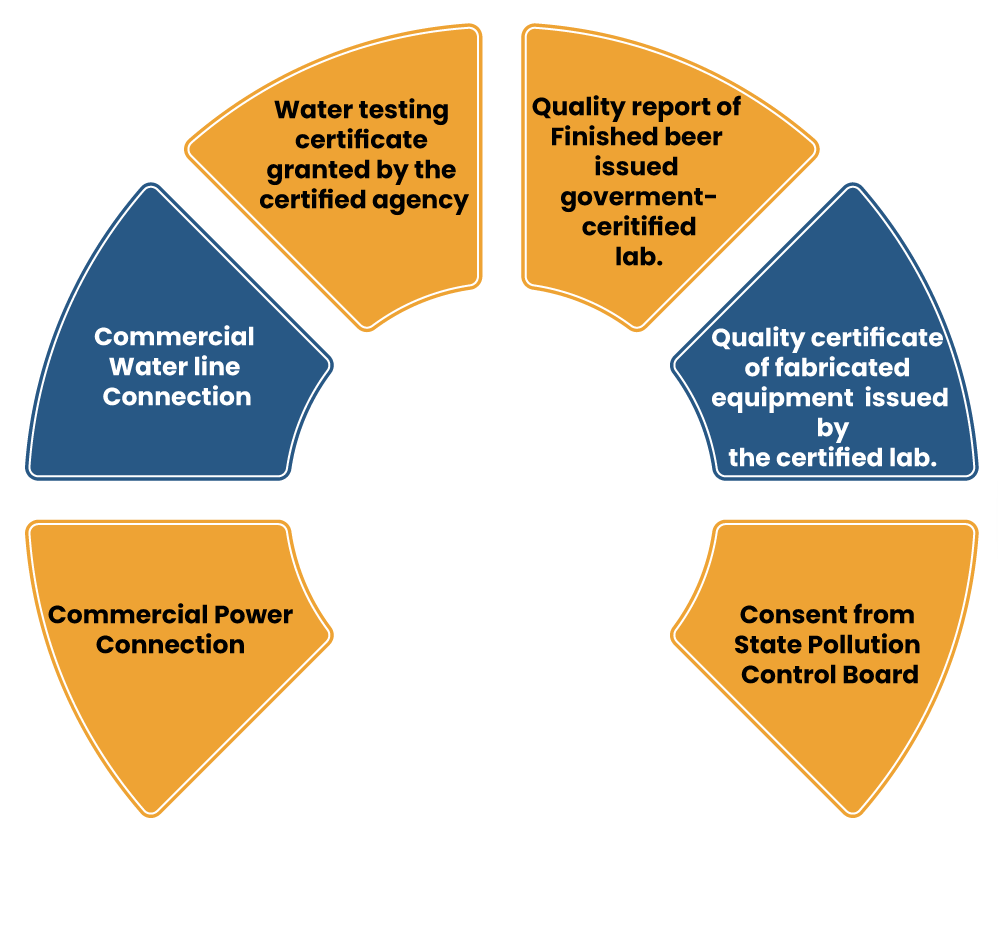

Mandatory Requirements for the establishment of Microbrewery business in India

State-wise Excise Policies in India for Microbrewery units

Following are the excise policies drafted by various states for the establishment of the Micobrewery Units

WEST BENGAL (came to effect in 2007)

The norms underpinned by the Excise Department of West Bengal are given below:

Rule 79 provides that.

“(1) Breweries may be set up for production of beer for—

(a) sale within West Bengal region via wholesale;

(b) export outside West Bengal;

(c) supply out of Indian territory; &

(d) for all or any of the aforementioned purposes.’

As per Rule 80 “Any individual wishing to avail license to operate a microbrewery in any region of West Bengal shall apply to the Excise Commissioner with receipted challan highlighting deposit of application fee of Rs 50,000/-for the large brewery & Rs 25,000/- for a microbrewery.

The provisions under rules 4 & 6 shall apply mutatis mutandis to said license application. In the case of Microbrewery business, the above-mentioned fees shall be at the rate of Rs 0.10/ bulk litre expose to a minimum of Rs 30000.

HARYANA

Haryana excise department has underpinned the given provisions of microbrewery projects in clause 9.10 of the “Excise Policy for the year 2013-14 & 2014-15.”

L-10C LICENSE MICRO BREWERY PROJECT

To advocate healthy drinking habits of low alcoholic beverage, a licence forms L-10 is accorded for retail and sale of beer to be produced by Microbrewery Project. The license shall be conferred to L-4 license holders which deals with ‘Retail vend of overseas liquor in a Restaurant’ & L-5 license which revolves around Retail vend of overseas liquor in a bar cum restaurant” on payment of license fee worth Rs 2,50,000.

The excise duty shall be levied depending on the daily installed capacity, i.e. @ at Rs 18 per Bulk Litre (BL).

KARNATAKA (came in effect in 2010)

In 2010, Karnataka was the first state in the country to inculcate corresponding rules and policies. Presently the state has more than dozens of microbreweries operating in the Bangaluru region.

Certain amendments have been done in the Karnataka Brewery Rules, 1967, allowing bars, hotels, & clubs to open microbreweries. Apart from submitting a one-time permit fee of 2.5 lakh, such units are mandated to pay an excise duty of Rs 17.5/litre. The excise department levied a tax on

The excise department levied a tax on 50% of the installed capacity @ Rs 5/bulk litre. The Rules also clarify that the mini. space between the ceiling & floor of the microbrewery unit should be 14 ft.

MAHARASHTRA

For a microbrewery producing up to 2 lacs litre of beer/year, a license in Form BRL will be conferred. The BRL license holder producing beer up to 2 lacs litre/year in a microbrewery will be permitted to sell the beer produced in an unpackaged form in the facility.

Conditions set out by the State Excise Department for Microbreweries

- The license shall observe norms as underpinned by the State Government or order passed by the Excise Commissioner from time to time pertaining to the production, possession, & Serving

- The license holder must abide by the order passed by the State Government or Excise commissioner related to the manufacturing and quality of beer being produced at the unit.

- The licensee can only use an Excise-approved thermometer and saccharometer for the testing of gravity of warts.

- A certified hydrometer (approved by the Excise commissioner) shall be used by these breweries to test the drought beer’s strength.

- The alcohol content has been maxed out at 8% v/v for beer production.

- The microbrewery units must record the temperature, pH, & gravities of the brews up to the maturation stage. The authority can make some legal checks regarding the same during their surprise visit.

- The brewing unit and the serving area must adhere to utmost hygiene and proper ventilation.

- The entire brewing area, including storage vicinity, should be fumigated on the set period.

- The licensee should conduct periodic fumigation of the brewing area and the storage vicinity. The record for the same should be maintained without a lag.

- Serving beers to an under-aged person is a punishable offence

- The serving timing of the beers should not deviated from the recommended timeline, i.e. 10 AM to 11:30 PM

- The units are liable to maintain legit documents pertaining to the manufacturing and selling of beers. The authority can scrutinize these documents without prompting the licensee.

- The applicant seeking authorization for establishing a micro-brewing unit is liable to submit fees + excise duty in advance.

Typical details to be added in the application for the grant of Microbrewery business

- Name of the applicant along with the full address

- The exact figure of the proposed investment

- The name & the details of the area in which the Microbrewery is located

- Declaration regarding the submission of project report and obtainment of a clearance certificate from SPB.

- List of apparatus and vessels

- Production capacity of the unit per day/per annum

- Declaration regarding the inclusion of treasury challan

Conclusion

Microbrewery Business in India is gaining prompt impetus in the Indian marketplace owing to the ever-rising demand for freshly made crafted beer. Although the majority of the Indian populace has great admiration for high-alcohol beverages such as Whisky, Rum[1], and Vodka, craft beer is slowly but steadily solidifying its presence in the highly dynamic alcohol market. The ever-rising demand for craft beer is now compelling state government to broaden the marketplace by allowing more ventures to jump into the microbrewery business.

Read our article:What is the Procedure for Start-up Registration India?