A Start-up is a business that has an association of person or a group of few people that manage to solve the problems related to such business. Basically, the formation of such a start-up can be seen on the grounds when the founders of any existing company find the problems in the existing system of a company and intend to resolve such problems by creating a new company or entity of their own. Moreover, a start-up registration can be done when the founders of the company come up with a potentially great idea or they might come to the conclusion that the start-ups provides services currently exist in inferior or does not want to sustain it further.

Eligibility Criteria for Start-up Registration in India

- The business must be incorporated as:-

- Private Limited Company under Companies Act, 2013[1]

- Limited Liability Partnership under the Limited Liability Partnership Act, 2008

- Partnership Firm under the Partnership Act, 1932

- The business turnover does not exceed 25 crores for any financial year since incorporation.

- The business is working towards innovation, development, processes or improvement of products and services, or if it is a scalable business model with high ability for employment generation etc.

- Any business will be termed under the definition of a Start-up is for a period of 7 years only from the due date of its incorporation/registration. While in the case of a Start-up in the sector of Bio-technology, the period shall be up to 10 years from the date of its registration.

- The business will be recognized as Start-up is for a period of seven years from the date of its registration; moreover, if Start-ups deals in the biotechnology sector, the period shall be up to 10 years from the date of its registration.

Read our article:Process of Startup India Registration: A Step by Step Guide

How to get Funding for Start-ups Registration?

One of the major challenges facing many start-ups is access to finance. Due to lack of experience, security, or existing cash flow, entrepreneurs fail to attract investors. In addition, the high-risk nature of start-ups, failing to take-off as a significant percentage, turns many investors off.

To provide funding support, the government has set up an initial fund of INR 2,500 crore and a total fund of INR 10,000 crore over a period of 4 years (i.e. INR 2,500 crore per year). The fund is in the nature of ‘Fund of Funds’, which means that it will not invest directly in start-up registration, but will participate in registered venture funds in the capital of SEBI.

We can see that the government is making efforts to support start-ups in every way, including the process of registering easier and less time-consuming items. In this way, it is helping young entrepreneurs to develop their entire economy by providing a platform to showcase their innovative

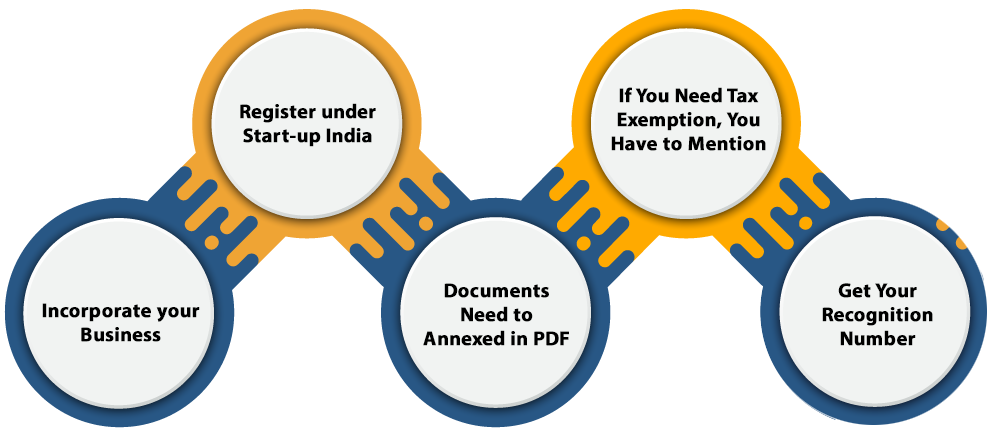

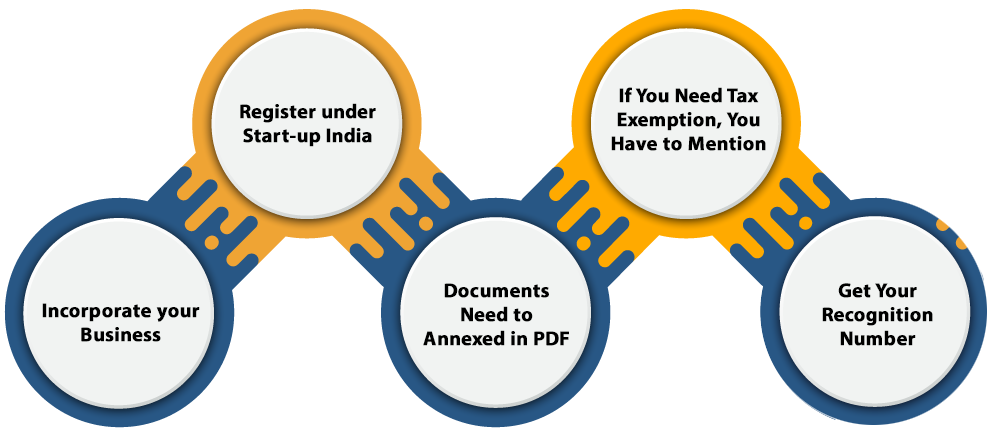

Procedure for Start-up Registration in India

Incorporate your Business

Initially, you need to get incorporation of your business as a private Limited company or a Limited Liability Partnership or in a Partnership firm. You have to follow the procedure that helps you filling up to get the registration for your business.

Register under Start-up India

After the successful completion of your first stage of incorporation for your business, you have to get enrolled your firm or company listed under the Start-up India Scheme of government as a Start-up. For such you have to fill the form available on the website of Start-up India and upload the required documents accordingly.

Documents Need to Annexed in PDF Format

There is a requirement of a recommendation letter along with the registration form. You can avail types of such recommendation letter provided below and required a single letter of recommendation of any type.

- A known incubator from any of the post-graduate college in India authorized recommendation letter under the duly approved format of DIPP. The said letter must be about the innovative nature of the business; or

- Recommended letter from the incubator that the Government of India fund as part of any specified plan to promote innovation; OR

- A letter from any of the Incubators, recognized by the Government of India, in DIPP format.

- A letter of funds of less than 20% is registered with SEBI Incubation Fund, Private Equity Fund, Angel Fund, Accelerator, Private Equity Fund, which supports the innovative nature of the business.; OR

- A recommendation by the Central or any State Government of India; OR

- A patent which is filed and published in the Journal of Indian Patent Office in areas connected with the nature of promoting business.

- Required to upload the certificate of incorporation of your company or LLP, or the registration certificate for a partnership company.

If You Need Tax Exemption, You Have to Mention at the time of Start-up Registration

The Start-ups in India allowed with the relaxation for not paying the Income tax for a period of three years from the date of its registration. In case you wish to avail such benefits, your company must be Inter-Ministerial Board (IMB) certified. It is where companies registered with DIPP get relaxation as the registration is enough to get the benefits.

Get Your Recognition Number

On Startup India registration application, you will get a recognition number immediately. You get a certificate of registration or incorporation only after the authority has verified all your uploaded documents.

You should be attentive and careful while uploading the data, as any mistake can cost a huge fine of 50% of your paid-up capital or Rs 25,000 at the very least.

Concluding Remarks

To apply your luck in start-ups business, you must know about the start-ups provisions and regulations provided by the government of India and approach accordingly with the specified steps. Since the government of India has allowed the start-ups to avail benefits in the income tax for a fixed tenure but people who does not have knowledge are still deprived to avail such benefits.

Connect with the experts for the same. Kindly associate with the Corpbiz expert to know more about the procedure for start-up registration India

Read our article:Benefits of Startup India Registration in India