Rice is extensively consumed in our country and its production and demand are always on the higher side. Thus, setting up a Rice Business could be a winning proposition for anyone seeking a stable source of revenue. One can enter into the rice business in any form such as wholesale, retailing, production, farming, and export. Each form seeks different licenses and government-based registrations. In this write-up, we will talk about the legality aspects of starting the Rice business in India and other important aspects.

An Overview on Rice production and demand

Rice is one of the most vital commercial food crops which satiate the hunger of half of the world population. The annual production of Rice stands at 535 million tons. India[1] & China are the world’s leading rice producers which collectively contribute to 50% of the global overall production.

The rice export in Southeast Asian nations is considerably low, & their collective yearly production rate accounted for 9-23 million metric tons. More than 300 million acres of cultivated land in Asia is being used for Rice production. Rice is a kind of staple food that has a connection with Asian culture.

Last year India’s rice production was stood at 102.36 million tonnes in the Kharif season. This figure was marginally better than the preceding year, i.e. 2019, where the rice production stood at 101.98 million tonnes.

Read our article:Process of Startup India Registration: A Step by Step Guide

Reasons to venture into a Rice Business

- Stable Demand throughout the year

- Widespread reach because of the massive consumer base

- Exporting opportunities owing to ever-growing customer-base in an overseas location

- There is a great demand for Rice by products in India as well as abroad.

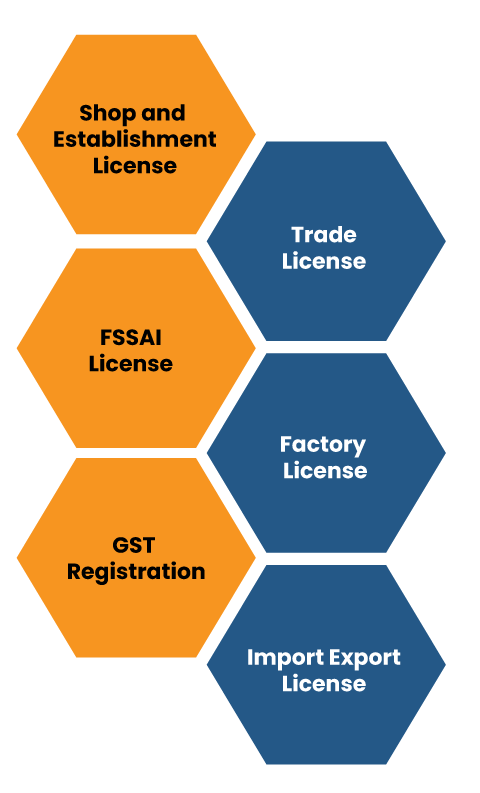

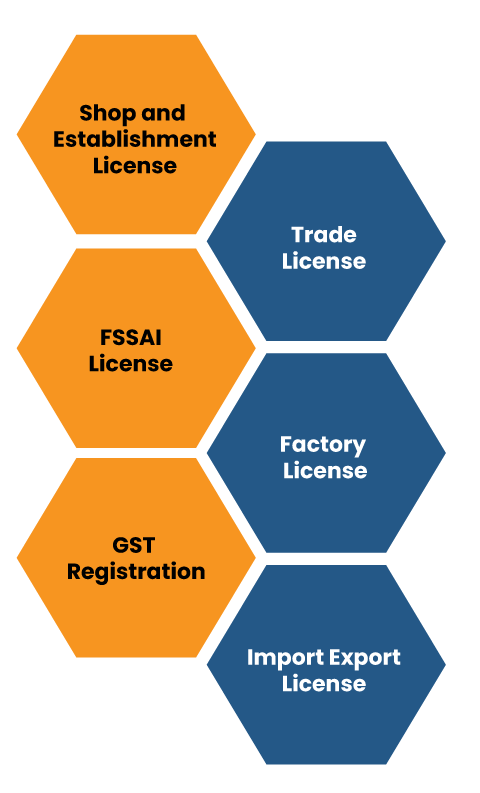

Licenses required to operate a Rice business

Here is the list of common licenses and registrations that one has to secure before starting the Rice Business.

Shop and Establishment License

Who needs this: Retailer and Wholesaler

A shop and Establishment license is mandatory for commercial establishments like shops, retail outlets, godowns, hotels, storerooms, warehouses, etc. The Labour department usually issues this license after receiving the application for the same via its appointed officers.

Details to be submitted in the Shop Act License form

- Name of the commercial establishment.

- Name and the detail of the employer as well as workers serving the establishment.

- The address of the commercial establishment, annexed with a copy of the rent agreement.

- PAN card of the business owner.

Trade License

Who needs this: Wholesaler

A trade license is a way to administer a specific business form located in a particular locality. Businesses with trade licenses are entrusted with the responsibility of averting unfair practices that hampers the interest of people in any way. Having a trade license indicates that the firm is committed to following relevant rules, standards & safety guidelines as prescribed under this license.

The state government has underpinned the provisions of the trade license. Also, it is entrusted with an obligation to monitor and administer the trade within a city. Trade license is granted by the Municipal Corporation of the district where the place of business is located.

Business owners are required to avail of this license for the commencing their operation. However, some state governments have granted some buffer time (15 days-3 months to be specific) in this regard in case the applicant fails to comply with the said requirement.

FSSAI License

Who needs this: Wholesaler, Rice Mill owner.

FSSAI food license is strictly meant for businesses operating in the food sector. Businesses that come under the ambit of the FSS Act, 2006 are required to obtain this license. One can make an online application for the same by visiting FSSAI’s online portal.

Key takeaway: Food license is issued by the FSSAI under the 3-tier system as given below:

- Basic registration

- State Food License

- Central Food License

During such a process, the applicant will be prompted to upload the following documents.

- Address proof of the Authorized person.

- Passport size photo of the Authorized person.

- Proof regarding Business name as well as address.

- Nature of business.

- FSSAI declaration form.

Factory License

Who needs this: Rice Mill owner

Factory License is typically bestowed by the municipal institution of the respective state. Such a license is issued under the Factory Act. During the submission of a web-based application, the applicant must upload the documents as shown in the list below:

- Form-1 (Particular of Room in the Factory)

- Stability’s certificate

- No Objection Certificate (NOC) issued by the pollution control board

- Questionnaire to Form-1

- Process Flow Diagram

- Fire NOC.

- No Objection Certificate bestowed by the Local Authority.

- Building Drawing Copy

- No Objection Certificate issued by Electrical Safety

- No Objection Certificate issued by Explosive Department

- Ownership’s proof of the factory building premises

- Notification of Site

- Safety Report

- List of Directors

- On-Site Emergency Plan

- MOM and AOA

- Resolution for declaration of Occupied

- Photograph of premises

- Health & Safety Policy

- Treasury Challan/Bank Name

- Identity Proof

- DIN/PAN Card

GST Registration

Who needs this: entities earning more than the threshold limit

In the GST regime, an entity whose yearly revenue surpasses Rs 40 lacs (Rs 10 lacs for NE and hill states) is mandated to avail GST registration as a normal taxable person. For certain entities, GST registration is an absolute mandate. Carrying out business operations in the absence of GST registration is a punishable offense. The defaulters have to confront heavy penalties as per GST Act for non-compliance.

Common documents required for GST registration

- Company PAN Card.

- Incorporation certificate

- MOA (in case of a private & public limited company)

- Signatory’s appointment proof.

- Signatory’s Aadhaar card.

- Signatory’s PAN card.

- PAN card of existing directors (in case of a private & public limited company)

- Address proof of existing directors (in case of a private and public limited company)

Import Export Code

Who needs this: Entities engaged with exporting activities

Businesses intending to ship rice to other nations will need this code because it is mandatory. Directorate General of Foreign Trade issues the IEC to the eligible applicant against the web-based application and submitted documents.

Conclusion

In light of the above fact, it is safe to say that setting up a Rice business in India is a winning proposition for any start-up. From production to marketing, wholesaling to export, there are multifarious ways to get started with this business model. However, one should be aware of legal obligations (mentioned above) before entering into the Rice business.

Read our article:Startup India Seed Fund Scheme: Objectives, Guidelines, and Eligibility Criteria