Are you wondering how to pay the income tax? If so, then you have come to the right page. Remember, you can file Income Tax return only if you have cleared your tax dues. There are two ways through which you can pay your taxes. You can either use net banking or visit the designated bank and fill Challan 280 to pay income tax.

Online Method to Pay Income Tax via Challan 280

The section below will let you file the income tax electronically with the help of challan 280.

1. Instructions to Pay Income Tax Due

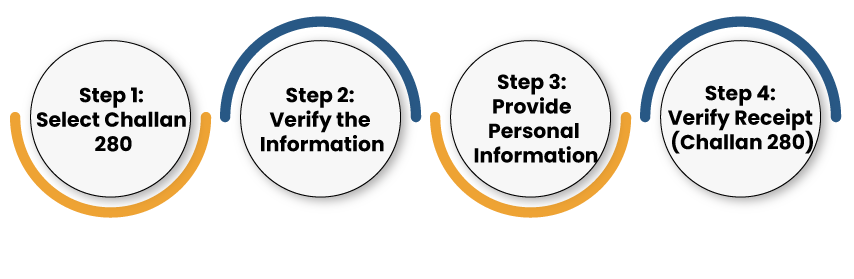

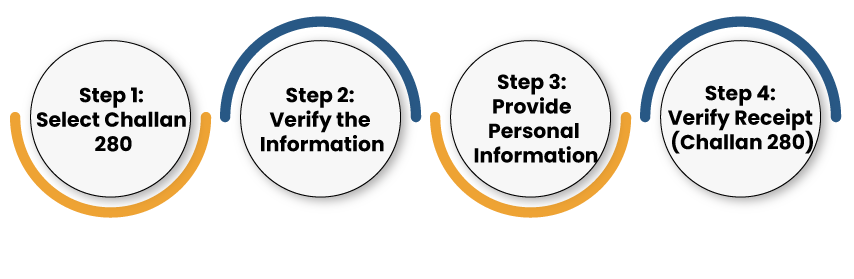

Following are the step by step instructions to pay the tax online. Make sure to follow them carefully without skipping any of the steps.

Step 1: Select Challan 280

Challan 280 allows a taxpayer to pay the regular assessment tax, advance tax, additional charges, self-assessment tax, etc. Head over to the tax information network of the IT department & tap on the Proceed tab under Challan 280 option.

Step 2: Provide Personal Information

For Individuals Paying Tax:-

- Select the option “(0021) Income Tax”. Next, opt for the correct payment type from the following option.

- (100) Advance Tax

- (102) Surtax

- (106) Tax on Distributed Profit

- (107) Tax on Distributed Income

- (300) Self Assessment Tax

- (400) Tax on Regular Assessment

Go ahead and opt for the ‘Self-assessment tax’ option if you have taxes due to pay while filing your IT returns.

- Choose the correct mode of payment. You can either choose a debit card or Net banking.

- Select assessment year.

- Provide the complete address.

- Complete Captcha verification and tap on the “Proceed” option.

Step 3: Verify the Information

Make sure to double-check the detail prompted & you will have to furnish the request to the bank. Then the portal will route you to the bank’s payment page.

Step 4: Verify Receipt (Challan 280)

After making the payment, the portal will generate the tax receipt, which entails the payment details. You can view the BSR code (Basic Statistical Return Code) along with challan serial no. on the right section of the challan. Save the tax receipt on your system by taking the screenshot. You will need to provide the BSR code and the challan number to enter in your return.

If you forget to download the tax receipt, you can head over to your net banking account and download it from there. SBI bank account holder needs to visit e-tax>reprint challan to view to challan. Meanwhile, the account holder of the ICICI bank ought to follow the given sequence – Payments and Transfers > Tax Center > e-Tax challans.

HDFC bank[1] holders need to click on the “Request” located on the sidebar. After that, scroll on the same page and select “Regenerate Direct Tax Challans.”

Read our article:Reduce your Income Tax Liability to save money for your future

2. Declaration Regarding the Tax Paid (Requirement to be met after paying taxes)

After you have submitted the appropriate tax amount, you need to provide the same detail in the IT return. Select the “Self tax payment” option and enter the challan number from challan 280 and the BSR code. BSR code and challan entail 7 and 5 digits, respectively.

3.Implications Regarding the Advance Tax

If you were required to pay annual tax dues whose amount exceeds Rs 10,000, you must pay income tax in advance. Generally, the individual from the salaried class addresses these income tax payments through TDS deductions.

Advance tax is paid in the following scenarios

- You are salaried but have high income from rental, capital gains, or interest.

- If you are working as a freelancer.

- If you have a business.

Method to Calculate the Advance Tax

Identify your income from all sources and sum it up. If you are working as a freelancer, estimate annual income from all your clients and deduct the expenses from it. Rent of your workplace, expenses related to mobile carrier, data connection, travel, depreciation on computer.

How to Verify & Permit Deductions?

Reduce deduction you wish to claim from your aggregate income & arrive at your taxable income. The deduction comes under the regime of Section 80C, 80D, 80E, or any other you wish to claim.

Method for Calculation of Tax due on Aggregate Income

Look out for the latest income tax slab rates on your income, which is subjected to taxes for calculating the Income-tax due. Deduct the TDS that might have been subtracted from your aggregate tax due. Ensure you have paid as per these installments. You can leverage an online platform to make these payments.

4. Self Assessment Tax

You were not liable to pay IT return to the concerned authority unless you have paid tax dues with no leftover. Often, you might see tax payments in the event of filing your return. This tax is referred to as Self Assessment Tax, which you can submit electronically to ensure successful e-filing. If you wish to pay tax after 31 March, then you must pay interest under section 234B and 234C in addition to the tax due.

5. Outstanding Demand Payment

Often, you might have to pay tax to stay in line with an income tax demand notice. If you agree with the accessing officer’s decision and decide to pay the demand, you may so electronically. It is refers to a tax on regular assessment.

Offline Method to Pay Income tax using Challan 280

- Visit to your bank and ask for challan 280 or download it from the website of IT department.

- Fill all the relevant details accurately and submit the challan.

- In response to this, bank will provide a “Counterfoil” with act as a proof of payment. Make sure the counterfoil encloses the following details

- 7-digit BSR code of the bank branch

- Date of deposit of challan

- Challan serial number

Conclusion

The law mandates that only two categories of the taxpayer are liable to make online tax payment. These include a) Companies b) Taxpayers are other than companies that are liable to conduct audit under Section 44BB. The remaining taxpayers can pay out their taxes in a conventional way by furnishing the challan at designated banks. However, you can also avail of the electronic payment option as it is simple and save a considerable amount of time.

Read our article:An Overview on Filing of Form 10BA of Income Tax