Form 10BA is a statement as recorded by the taxpayer who needs to maintain tax deduction under Section 80GG for rent settled on rental property. To claim deduction under Section 80GG the following two requirements must be performed:

- The taxpayer must not be getting (HRA) House Rent Allowance from an organisation,

- A taxpayer, his/her husband or wife, minor children, or if the assessee is the part of HUF (Hindu Undivided Family), then the HUF must not hold any self-occupied living accommodation.

If both the requirements complete the needs, then a taxpayer can present the statement in Form 10BA. A taxpayer must present the Form 10BA before filing Income tax return.

Section 80GG: Deduction for the Rent

Section 80GG provides the deduction for rent given for furnished or unfurnished convenience. A deduction grants to taxpayers who do not get any HRA from their organisation.

What are the Conditions to Sustain the Deduction for Rent given under Section 80GG of Income Tax Act?

- Only the self-governing person can claim a deduction under Section 80GG.

- A person can be self-employed or salaried.

- In state of a salaried person, he should not be getting House Rent Allowance (HRA) from an organisation.

- For maintaining a result, Form 10BA must present with the IT Department.

- Assessee or spouse or minor children or HUF of which he is a member must not have any living comfort at the place where he is living/working office services under-employment/offering business or service

- The assessee must not have a self-occupied home property at any position

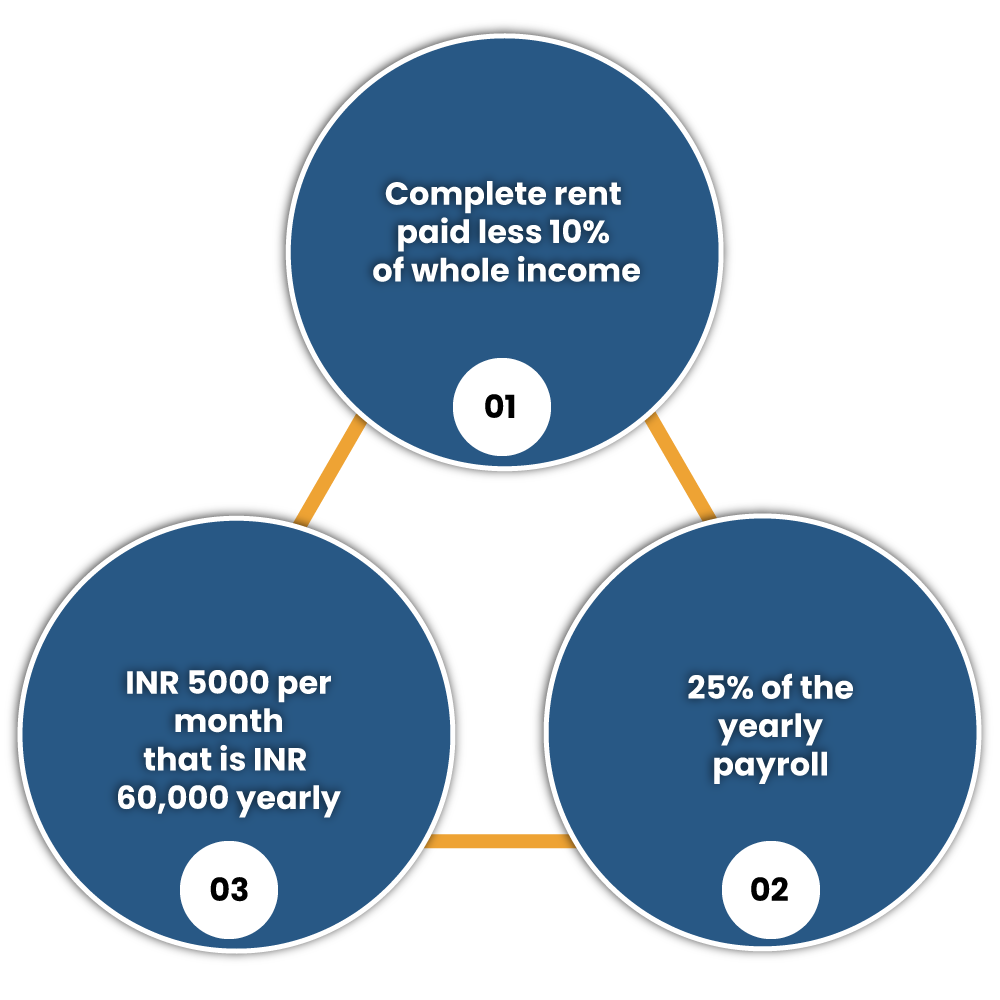

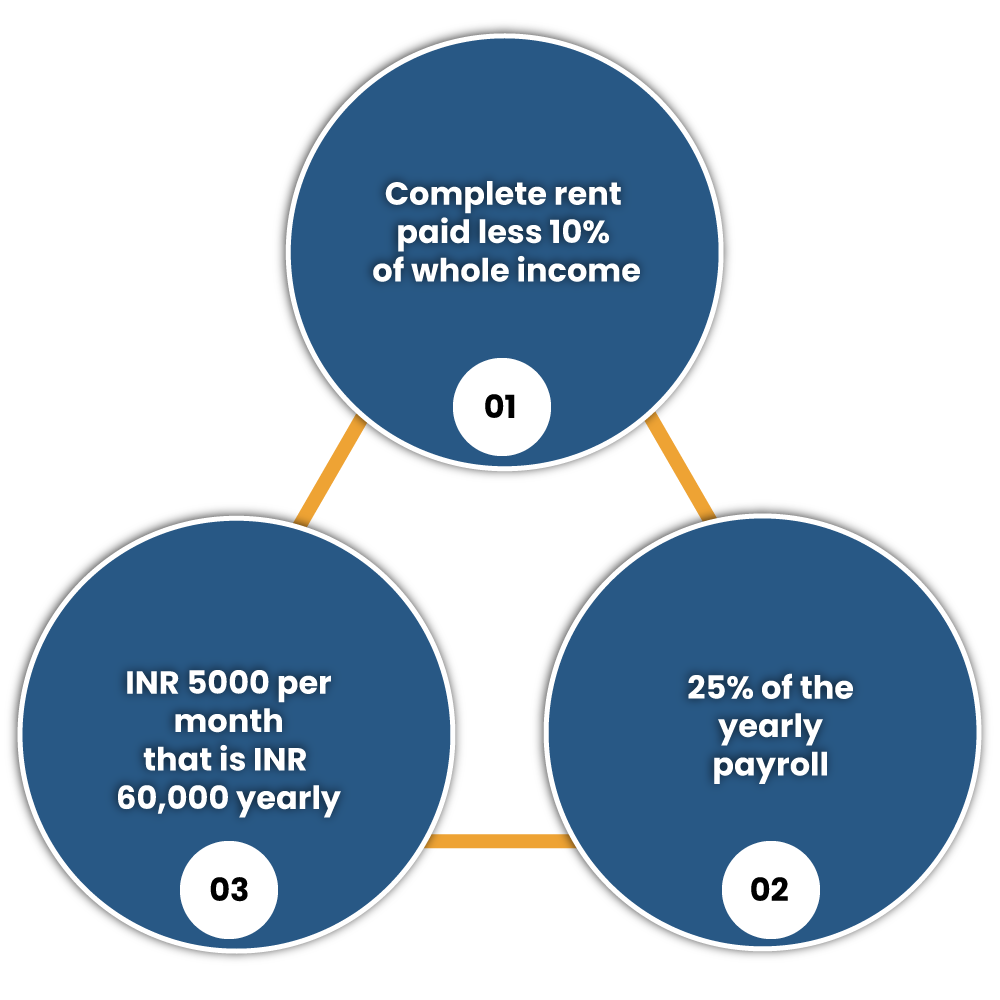

What is Deduction Purpose under Section 80GG?

For FY 2019-20 (AY 2020-21), the deduction under section 80 GG will be the least of the following:

ITR Form Applicable for the Section 80GG

The taxpayer must declare deductions under section 80GG while recording ITR by full-filling the conditions. Individuals and HUFs can claim 80GG in any of ITR Forms, which is ITR 1, ITR 2, ITR 3, and ITR 4 depending upon their revenue experts. An expected date for filing ITR is 31st July of next financial year if the tax audit is not suitable.

How to file Form 10BA?

- Go to Income Tax e-Filing Portal from the Income Tax e-filing portal which appears “Login Here”.

- Navigate to e-file and click drop-down button. Select Income Tax Forms

- Select the Form No. 10BA from the drop-down, select a relevant Assessment Year. Select the Submission Mode as Prepare and Submit Online and then click to Continue.

- Enter all details like Name of Landlord, Details of Rent Paid etc. Preview form and then submit it.

What are Details Required in Form 10BA?

Following details are required:

- Taxpayer’s Name and PAN

- Address of a rental property

- Rent paid

- Name and Address of Landlord

It is advisable to submit the Form 10BA before filing income tax return and claiming deduction under section 80GG.

Eligibility under Section 80GG

- The section 80GG allows taxpayers to claim a deduction for rent paid for unfurnished or furnished accommodation occupied by a taxpayer for own residence. A claim under section can only be made in cases where House Rent allowance (HRA) is not the part of taxpayer’s salary.

- To get eligible to claim deduction under the section, a taxpayer must

- Be self employed or salaried

- Have not received the HRA at any time during FY which claim is made

- Taxpayer does not own residential accommodation at the place where he/she currently reside, perform duties, or employment or carry on business or profession

- No deduction under Section 80GG will be allowed in the case of taxpayer own any residential property at any place, for which his/her income from house property is calculated under applicable sections (as a self-occupied property)

- To claim benefit under section 80GG taxpayers need to file Form 10BA with details of payment of rent.

Declaration is Filed by an Assessee Claiming Deduction under Section 80GG

I/We (Name of assessee with Permanent Account Number or Aadhaar Number) do hereby certify that during previous year I/we had occupied the premise (full address of premise) for a purpose of our own residence for a period of months and have paid Rs. __ in cash, crossed cheque, bank draft towards the payment of rent to Ms/ M/s (Name & complete address of landlord). It is further certified that not any other residential accommodation is owned by

- me or my spouse/my minor child/family (in case an assessee is HUF), at where I/we ordinarily resides/perform duties of office or employment or carry on business or profession, or

- me/us at other place, being accommodation in my occupation, the value of which is to be determined under section 23(2)(a)(i) or under section 23(2)(b).

Conclusion

Usually HRA forms part of the salary and one can claim deduction for HRA. If you do not receive HRA from your employer and make payments towards rent for any unfurnished or furnished accommodation occupied by you for your own residence, one can claim deduction under section 80GG towards rent that you pay by simply filing Form 10 BA.

Read our article: CBDT Provides ITR Filing Compliance Check for Scheduled Commercial Banks