Professional tax is a state-level tax which is imposed on income earned by way of profession, trade, calling or employment. Hence, Professional tax is applicable to all working professionals like chartered accountants, lawyers, and doctors. The tax is based on slabs depending upon the income of an individual who may be self-employed or working as an employee of the entity. The professional tax registration documents are important for successful professional tax registration in India.

Is professional tax registration is mandatory?

Every professional, the Directors of Company, the Designated Partners of LLP or any other employer (maybe Company or LLP) is under an obligation to seek the professional tax registration. It is also done to ensure that professional tax is deducted from salary of employees. The deduction from professional tax from employees must be deposited in the appropriate office designated by the state government.

The return of professional tax must be filed specifying the payment of the professional tax. Every employer is under an obligation to deduct and pay tax on behalf of employees. For this purpose the employer must obtain the registration certificate from a departmental of professional tax[1] within 30 days from the date of liability generated.

Professional Tax Registration Documents for Companies/LLP/Partnership

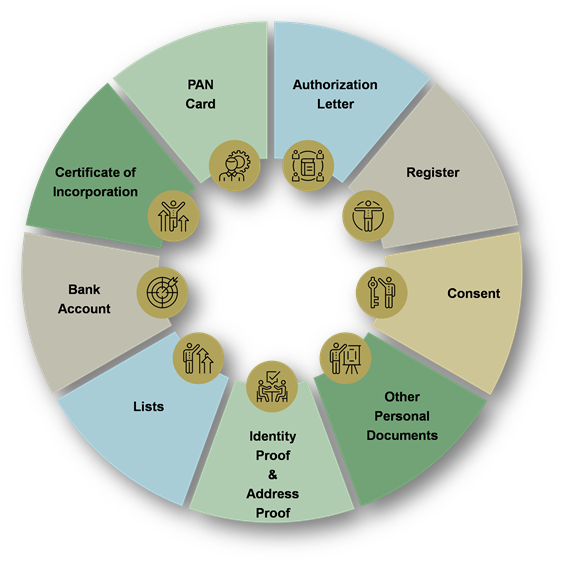

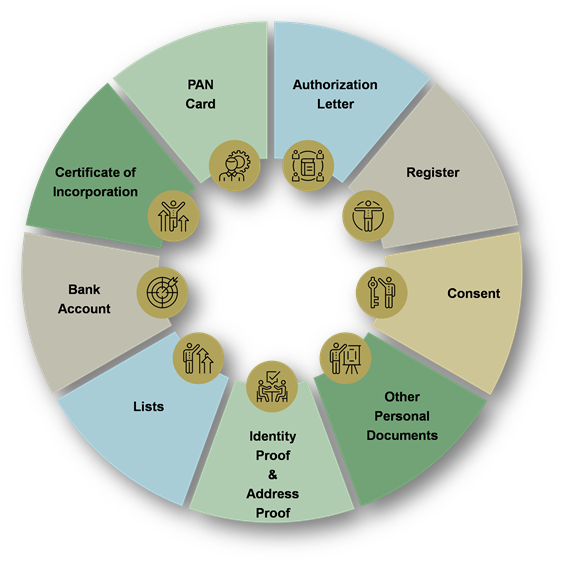

The documents required for Professional Tax Registration in India are as follows:-

PAN Card

PAN Card of Company must be attested by the Director of the Company. PAN card of LLP/Partnership Firm must be attested by the Designated Partner of LLP or any partner of the Partnership firm.

Certificate of Incorporation

Incorporation Certificate of the Company, including MOA (Memorandum of Association) and AOA (Articles of Association) or LLP Agreement/Certificate or certificate of Partnership firm Registration or Partnership Deed

Bank Account

Proof of Bank Account of Company, Cancelled Cheque and Bank Statement or Bank Account of LLP/Firm, Cancelled Cheque and Bank Statement.

Lists

List of all Directors or List of all Partners and also the list of other employees of a company/LLP/Partnership firm

Address Proof

Address Proof of office location of the company with ownership papers in case the premise is owned by an applicant, in other cases rent agreement and (NOC) no objection certificate from the owner of the premises. Address Proof of LLP/Firm – Ownership papers in case the premises are owned by an applicant, in other cases, rent agreement and (NOC) no objection certificate from the owner of the premises.

Identity Proof

Passport Size Photographs of all Directors or all Partners. Identity proof from all the directors or partners such as Aadhaar Card etc

Other Personal Documents

Documents of the Directors or Partners like I.D. proof such as PAN card, Passport, Driving License, Voter Card, Aadhaar Card is acceptable and for Address proof as Electricity Bill, Telephone Bills and other utility bills.

Consent

Board Resolution passed by a Director of the Company authorizing Professional Tax Registration. Consent by partners for the application to register under Professional Tax.

Register

The employees Attendance Register and Salary Register are also required.

Authorization Letter

Authorization Letter with the signature by Director or Partners for obtaining a user I.D. and Password of Professional Tax Department.

Professional Tax Registration Documents for Individual

- Self-Attested PAN card of Proprietor

- Bank Account of Proprietorship, Cancelled Cheque and bank statement

- Passport size Photographs of the Proprietor

- Address proof of Proprietorship – Ownership papers in case the premises are owned by the applicant, in other cases, rent agreement and no objection certificate from the owner of the premises.

- Documents of the Proprietor – I.D. proof such as PAN card, Passport, Driving License, Voter Card, Aadhaar Card is acceptable and for Address proof as Electricity Bill, Telephone Bills and other utility bills.

- Attendance Register and Salary Register

- Authorization Letter for obtaining an user I.D. and Password of Professional Tax Department

Conclusion

Professional tax is deducted from a salary of the employer, which is later eligible for deduction from the computation of taxable income. The registration must be obtained by the employers and business owners with respect Municipal Corporation. Being it State-based registration, the rate of tax and method of registration is different.

Read our article: How to apply for Professional Tax Registration in India? Registration