Professional tax Registration is a form of taxation that comes from the pocket of the all salaried professional which includes employers, employees, Chartered Accountants, doctors as well as the Lawyers.

- It is just not the tax that is levied only on the professionals but it is a kind of tax that is levied on all the professionals, trades, and employment. It is charged based on your annual gross salary and under which slab you fall into.

- The amount of tax levied on the professionals differs from state to state. The company owner deducts the tax from every employee’s salary, while in other cases you have to pay the tax by yourself.

- A lot of salaried employees might be adequately aware of the term ‘professional tax’ as it would have been stated in the ‘payslips/Form 16’ dispensed to them. But then again all of them may or may not recognize what it is and why is it look as if in their payslips/Form 16 as a deduction from their monthly salary income.

Who needs to pay the professional tax?

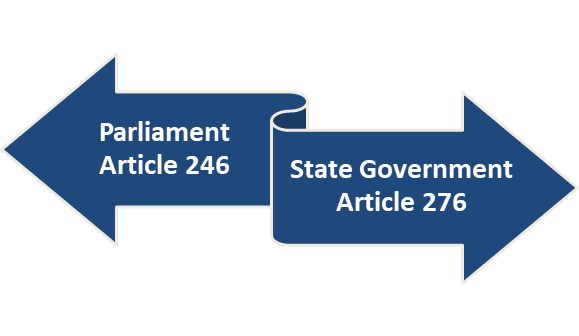

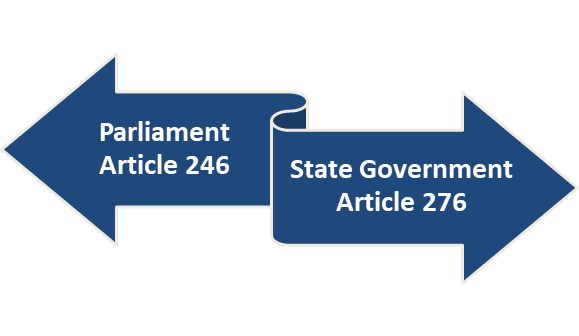

- Only Parliament has the exclusive power to create laws concerning Union List which comprises taxes on income according to Article 246 of the Constitution of India. The state consumes the power to make laws simply concerning the State and Concurrent list.

- Nevertheless, professional tax however is a kind of tax on income is charged by State Government, but not all states in the country decide on to levy professional tax.

- State Government is also authorized to make laws with terms of professional tax though being a tax on income under Article 276 of the Constitution of India[1]. It deals with tax on businesses, occupations, professions, freelancers, and trades.

How the Tax is Being Paid?

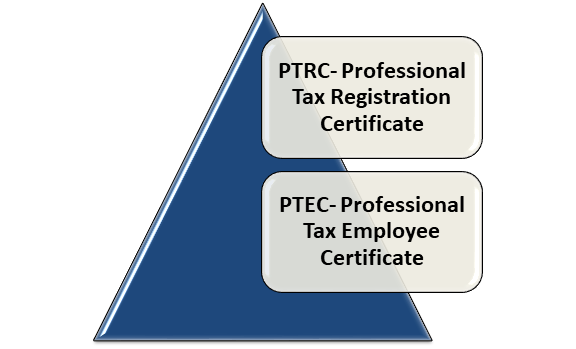

- If you are an employee of a professional company, in that case, the employer deducts the certain amount calculated according to the tax levied by the government, which may vary based on the state you are working in. And for that, the company requires two certificates:-

- PTRC– Professional Tax Registration Certificate, which works as a proof of your role as an employer.

- PTEC-Professional tax deduction of the employee, this certificate gives you an authority to deduct the tax from the employee salary.

- Within the 30 days, if above being the case, the employer shall receive the certificate of enrolment.

- Professional tax registration and tax filing can be done online. You just need to upload a few required documents and follow the guidelines.

- Professional Tax Registration Certificate is a must for the employer if it fails to do so; the employer will be penalized. If you own the firm or run some kind of professional business by yourself, then you have the responsibility of registering your company under the tax registration and pay the taxes.

- If your company has a presence at several places, then you have to get the separate tax registration certificates for every place.

- Professional from other countries working in India does not have to file the tax registration as they are exempted from this duty.

- Indians who are employed by the Foreign Diplomatic Office, or embassy or consultant do not have to take the certificate of tax registration.

What are the Documents Required for the Professional Tax Registration?

Following are the documents required for the professional tax registration –

- Company charter documents(MOA & AOA)

- Place of Business proof with ownership details

- Place of residence of all the directors with ownership proof

- Photographs of all the directors

- PAN of business and all the directors

- Canceled cheque from the company’s current account and director’s savings/current account.

- Shop and establishment certificate

- Salary details of employees

- Financial statements of the establishment

- Certificate of incorporation

What are the Penalties on Non Payment or Professional Tax Registration?

- The penalty is being charged according to the states code of tax registration for not registering your company under tax registration. Furthermore, there is a separate charge for not paying the tax within the due date.

- While the real amount of penalty or penal interest may be contingent on the respective State’s legislation, a penalty may be charged. It may be charged by all such states for not registering on one occasional professional tax legislation which turns out to be applicable.

- Additionally, there are also penalties for not producing the payment within the payable date and also inadequate to file the return within the stated due date.

- For example:-

- Rs 5/day is forced as a penalty

- 1.25% per month of deferral in payment

- 10% of the sum of tax in case of delay or non-payment of ‘professional tax’

- Rs 1000/ Rs 2000 penalty for delay in filing the return

What are the States that come under the Professional Tax Registration?

- The State Government charges of Professional tax are different in different states. Each state has its particular laws and regulations to administer the professional tax of that particular state. On the other hand, all the states do keep an eye on the slab system centered on the income to levy professional tax.

- Moreover, Article 276 of the Constitution authorizes the State Government to charge professional tax. However, it has also delivered that for a maximum of Rs 2,500 beyond which professional tax cannot be indicted/charged on any person.

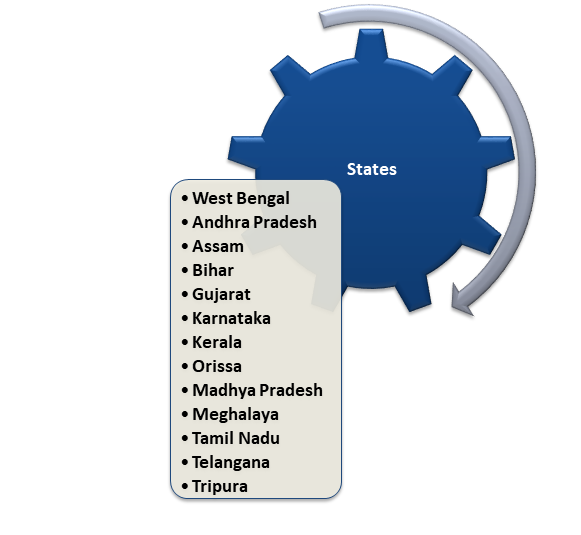

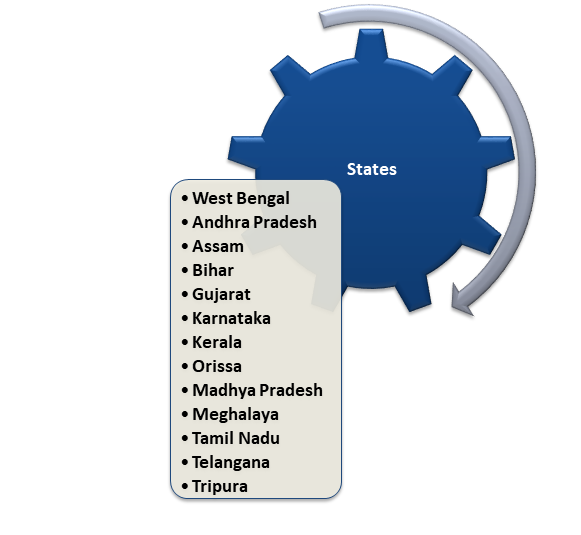

- There are several states where the tax is levied on the professionals and others. Following are the list of the state that comes under the mandatory Professional tax Registration–

Since, every state has its own tax slab for professional taxes. Given below is the example of few of the states:-

Professional Tax in Karnataka

| Monthly salary in Rs. | Tax (in Rs. Per month ) |

| Upto Rs. 14,999 | Nil |

| More than 15,000 | Rs.200 |

Professional Tax in Maharashtra

| Monthly salary in Rs. | Tax (in Rs. Per month ) |

| Upto Rs. 7500 for men | |

| Upto Rs. 10,000 for women | Nil |

| Rs.7,501 to Rs.10,000 | Rs.175 |

| Rs.10,000 and above | Rs.200 for 12 months and Rs.300 for the last month |

Professional Tax in Gujarat

| Tax (in Rs. Per month ) | Monthly salary in Rs. |

| NIL | Up to Rs.5,999 |

| Rs.80 | Rs. 6000 to Rs. 8999 |

| Rs. 150 | Rs. 9000 to Rs. 11,999 |

| Rs. 200 | Rs. 12,000 and above |

What are the Exemptions from professional tax payment?

Following are the lists of the individuals are exempted from pa professional tax:-

- Blood Relations with a mental disability or permanent disability

- Fellows of the armed forces, auxiliary forces or soldiers serving in the state.

- Persons, above 65 years of age.

- Any person who is visually challenged and physically challenged

- Women entirely tied up as agent under the:-

- ‘Mahila Pradhan Kshetriya Bachat Yojana’ or ‘

- Director of Small Savings’.

- Parentages or caretakers of persons who are mentally challenged

- ‘Badli workers’ from all textile industry.

Conclusion

Henceforward, It’s compulsory for people who are employed, whereas enrolment is indispensable for those who are involved in a profession, possess a trade, business. We at CorpBiz are ready to assist you every time you need help with the professional Tax Registration and Filing. We have a dedicated team of professionals who are always there to help you and fulfill the responsibilities.

Read our article:How to apply for Professional Tax Registration in India?