In most of the states the Professional tax registration process is done via online mode, and for which an online application must be submitted in a prescribed format. The documents are also required according to the type of entity registration is sought and it must be submitted by the person at the department at the time of Professional Tax registration. Professional tax enrolment certificate (PTEC) is mandatory in the case of professionals and business, which has to be applied within 30 days of commencement of practice and business.

Professional Tax Registration Process

- Visit state website

- Select the registration tab: New Dealer Registration

- Now select the “new registration” TAB (for new dealers). The detailed guidelines along with the list of required documents regarding an application process are mentioned in the instruction sheet.

- Click next to Checkbox and then select the “New dealer” Checkbox. Then click on the Next button for TAN/PAN Validation.

- Fill the PAN no enters captcha and proceed further.

- After this “Temporary Profile creation,” page will appear. Create a Temporary profile by providing a valid PAN, e-mail Id and mobile number. A temporary profile will successfully be created and valid till 90 days for applying for online registration with user-id and password.

- The applicant will then log in by using credentials as a temporary profile. After that, Dealer will select “Existing Users” option from a menu option. Then click on “Act selection” page Act. Now Dealer can select multiple Acts for registration in a single application.

- Select PTEC/PTRC Act provided in the field “Acts for Registration”.

- E-application under Professional Act will open.

- Information in the Form must be filled either by entering in the relevant fields or selecting from the drop-down lists.

- Fields marked with all they are mandatory fields.

- PAN/TAN is the mandatory requirement before applying for the registration

- Selection of constitution in the Form must be as per the PAN.

- Once a displayed form is filled completely and submitted, the data of unified fields of other forms must be needed to enter and selected by an applicant across all such forms.

- The online application form must not be accepted if it is not complete in all respects. The required documents must not be submitted along with an application.

- In case if data in any of the fields are not entered, then an applicant will receive an error message, and then he has to enter the said data.

- All communication must be made on the e-mail Id and mobile given in the temporary profile.

- The applicant must select a ‘Status of the signatory” to the application and provide relevant details, depending on the constitution of the Dealer, the application will be signed.

- The signatory, manager or authorized person are required to sign digitally or by uploading the signature at relevant places while filing an application and submit all relevant documents.

- After filing an application Form, click on the “Submit” button. After successful submission of Form, the acknowledgement bearing “Application Reference Number” must be available for download on the confirmation page. An application form will be communicated via e-mail as attached PDF[1] Format.

- The preliminary verification will be carried out, including the PAN validation with the NSDL portal, Aadhaar Number validation with UIDAI portal, IGR details with IGR portal and Electricity bill utilities with respective service providers such as Tata Power, BEST, MSEB, Reliance Energy and Toronto and also issuance of TIN by MSTD Department by the inter-portal connectivity before the submission of an application form.

Read our article:Professional Tax Registration: Rate Slabs

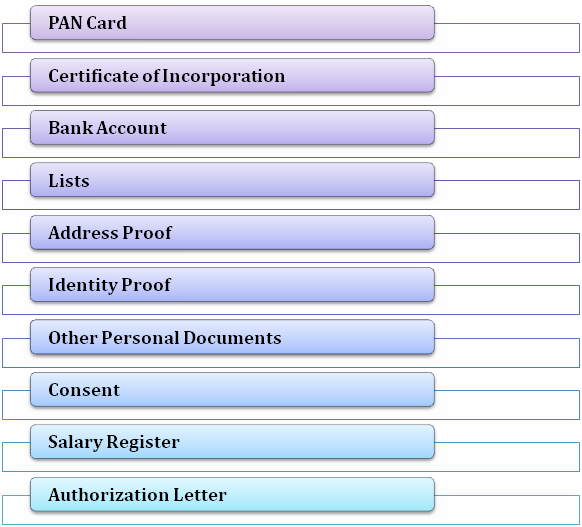

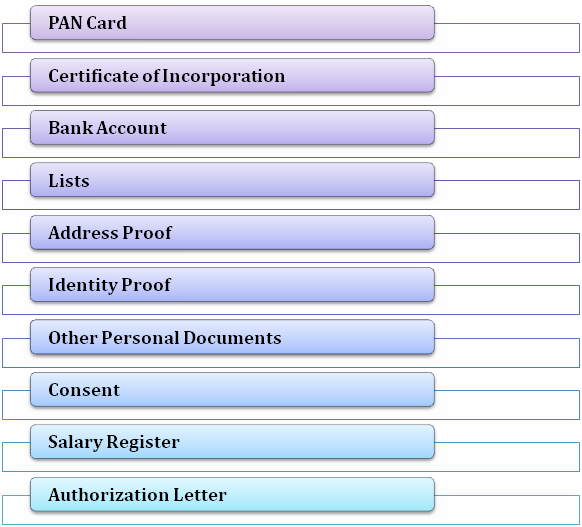

Necessary Documents for Professional Tax Registration Process

Grant of Registration Certificate

- If an application is correct and complete in all respect along with relevant documents, then Registering Authority will generate TIN after verification. In case an application is eligible for granting registration, the date of uploading the application will be considered as the date of application for the purpose of determining the effective date of RC

- Registration certificates must be sent via e-mail and post. The applicants do not require to visit MSTD offices for procurement of Registration Certificates as the same will be made available on the portal in downloadable format with a digital signature of the appropriate certifying authority.

Rejection of an Application

- If an application is found defective, then defect memo will be issued an e-mail to the applicant. The applicant required to rectify the defects within the 30 days

- In case an applicant rectifies the defects within 30 days, the Officer will verify, and if found satisfactory, then TIN would be generated. In case the date of the first application will be taken for the purpose of determining the effective date of RC.

- If an applicant does not rectify the defects shown in defect memo within 30 days, then an application will be rejected, and the temporary profile will be de-activated after 90 days.

Conclusion

The professional tax is payable to a state, hence, an online payment varies from one state to another. It depends on the state’s policy and its website. However, the professional tax registration process will be very much similar in all the states. To get an idea of how to go about paying professional tax, take a look at the process of the professional tax payment.

Read our article:How to apply for Professional Tax Registration in India?