The Madras HC allowing the appeal in favor of the revenue board, held that the striking of the Company Name from the Register of Companies could not affect Assessment if no records presented to strike off the name from Income Tax Department.

The assessee, M/s.Tarachanthini Services Pvt. Ltd. is engaged in the investment business and dealing in shares of the company. The Assessment Year under consideration for the Income-tax Return that they filed are declaring a loss of INR 78,42,605.

When the Valuation was resumed under Section 147 of the Act by announcing notice under Section 148, the assessee Company was moving on the business. The assessee fully cooperated in the reexamination proceedings. At no point in time, the assessee informed the Assessing Officer that the Company had been striked off from the Register of Companies in the year 2007.

Read our article:CBDT launched 11 days E-Campaign on Voluntary Compliance of Income Tax

Reason for filing of the Appeal

The assessee being upset by such order filed an appeal before the CIT(A). The petition was dismissed and aggrieved by such law, the assessee prefer to appeal before the Tribunal.

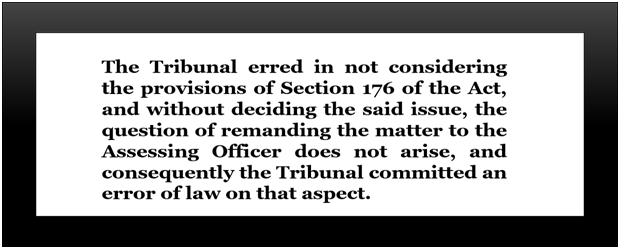

The Tribunal look into the matter to the Assessing Officer to examine as to whether the Assessee Company was in existence at the applicable time. The Tribunal has the view that if the Business was not in presence, the Assessing Officer could not stand, the precision of the order passed by the Tribunal was called in question by the Revenue department[1].

Justice T.S.Sivagnanam and V.Bhavani Subbaroyan decided that the assessee has taken no steps to notify the Revenue Department regarding the striking off the name of the Company from the Register of Company from Income Tax Department. The assessee did not submit any documents in front of the Assessing Officer stating that their PAN number has been revoked and their Income Tax account is closed by the Income-tax department.

Therefore the court held that the appropriate time would be when the Company was in existence during the assessment year 2000-01; that would be the proper time as well as the relevant year for the assessee.

The bench said that

Conclusion

The Tribunal look into the matter to the Assessing Officer to examine as to whether the Assessee Company was in existence at the applicable time. The Tribunal has the view that if the Business was not in presence, the Assessing Officer could not stand, the precision of the order passed by the Tribunal was called in question by the Revenue department of the Income Tax Department.

Read our article:CBDT extended the Filing of ITR deadline till 30th September