The campaign would remain active for 11 days from the date of launch. The E-campaign aims to target those taxpayers who have failed to provide valid detail on high-value transactions or failed to file Income Tax return for the year 2019-20.

Objectives of e-campaign on voluntary compliance

The campaign objectively helps the taxpayer to authenticate their financial transaction detail against the data available at the IT department. Since the campaign promotes voluntary compliance, it would let taxpayers get rid of the scrutiny process or notice and validate their financial transactions with authority. Keep in mind that the campaign is designed to cater to the assesses for the FY 2018-19.

Key Highlight of e-campaign on voluntary compliance

The Income Tax Department[1] has taken advantage of data analytic to sort out a list of a specific taxpayer responsible for not comply with the law of income tax. The list also includes the defaulter with high-value transactions. Through this campaign, the Income Tax Department will roll out a notification (SMS/Email) to the taxpayer’s predetermined list.

As per CBDT, the notification will direct the taxpayer to validate their financial transactions against the information accumulated by the IT department from the sources such as TDS, SFT, Foreign remittances, and TCS. Furthermore, the department also took advantage of triangulation set up for the accumulation of information about export, GST, derivatives, imports, commodities, and transactions in securities.

Read our article:New Income Tax Returns Forms: CBDT Notified FY 2019-20/ AY 2020-21

Advantages to Taxpayers

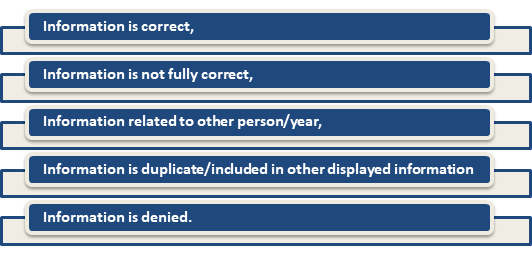

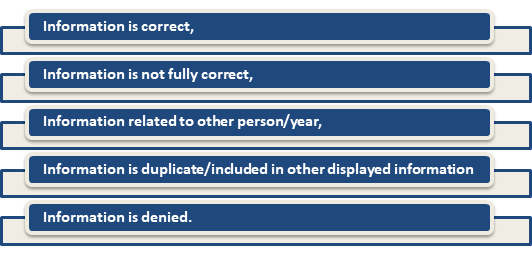

CBDT also mentioned that this e-campaign would let the taxpayer access their high-value transaction detail on the online portal. The taxpayers also need to confront some options and respond accordingly for clarification purposes. The options are as follows:-

The taxpayer need not head over to the authority premises to serve this purpose. It’s worth noting that the last date for filing the Income-tax return for FY 2019-20 is July 31, 2020.

Expert’s projection on e-campaign on voluntary compliance

Tax experts said that this campaign would be going to transform the outline of the Form 26AS completely. This is an excellent chance for taxpayers to disclose their transaction detail to the concerned authority.

It would help the taxpayers to get prepared with relevant explanations for tax authorities for the given transaction. It’s worth noting that most of the details will be goes in the new Form 26AS only. This e-campaign seems to be a conventional step before the launch of new Form 26AS.

Conclusion

The new form format was announced in Budget 2020-21. The revised Form 26AS is not just confined to details of tax collected and deducted at source; instead, it renders a more comprehensive profile of the taxpayer. Finance Minister Nirmala Sitharaman has already cited that taxpayers will get access to pre-filled ITRs that consolidate information such as bank interests, salary income, dividends, and capital gains from securities. The information about income & TDS will be accumulated from a mutual fund, stock exchanges, state registration departments, and EPFO.

Read our article: CBDT on Annual Information Statement: New Avatar Form 26AS