Section 185 of Companies Act, 2013 is one of the essential Section of the Act. This Section puts restrictions on inter-corporate loans in the corporate world. Earlier Companies were in a habit to borrow funds and pass them to subsidiaries and other associate Companies through inter-corporate loans. The holding companies never thought to comply with the terms of loan agreement when it concerned with exploitation of borrowed funds. The bank also never monitored such exploitation. To avoid such mishap Section 185 was introduced in the Companies Act, 2013.

Section 185 of Companies Act, 2013[1] puts some restrictions on Company in giving Loan to Directors to monitor the working of Directors in the Company. In this article, we will discuss the requisites for Loan to Directors under Section 185 of Companies Act, 2013.

What is Loan to Directors?

Loan to Directors can be provided with subject to certain restrictions. Under section 185 of Companies Act, 2013, the Company cannot directly or indirectly give loan, includes any loan represented by books of debt;

- To any of its Directors

- To any another person in whom the Director is interested, or

- Provide any security in connection with loan taken by Director or such other person

For the purpose of Section 185 of Companies Act, 2013, the phrase “any other person in whom director is interested” means

- Any Company in which he/his relative is Partner

- Any Company in which he/his relative is Director

- Any Private Limited Company in which he/his relative is Director

- Any Body Corporate in which he holds or controls 25% or more of voting powers

- Any Body Corporate who’s Managing Director/Manager/Board of Directors acts on his directions.

Section 185 of the Companies Act, 2013, read with the Rule 10 of Companies Rules (Meeting of Board and its Powers), 2014 provides that Company cannot give guarantee or Loan to Directors or any other person related to the Director of Company. The above rules and provisions are clearly stating that the Director should not engage in any activity which personally benefits him/her.

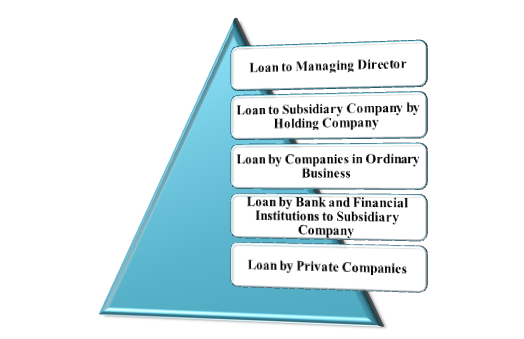

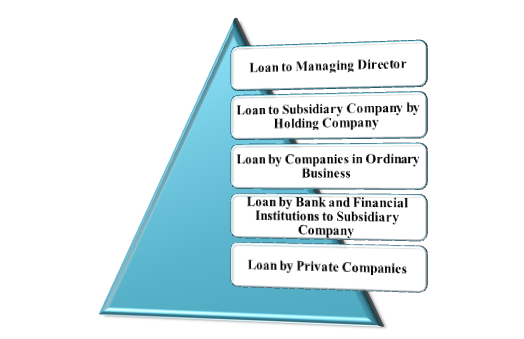

What are the Exemptions provided while Loan to Directors is given?

The exemptions to the rules followed while giving Loan to Directors under Section 185 are as follows:

Loan to Managing Director or Whole Time Director

The proviso for Section 185(1) states that the loan can be provided to Managing Directors or Whole Time Directors with respect to some restrictions. The loan can be given to Managing Directors or Whole Time Director on certain conditions:

- As a part of their Policy of Service Loan to Managing Director or Whole Time Director can be given. The policy should be available to all the employees of the Company.

- Pursuant to any Scheme in the Company Loan to Managing Director or Whole Time Director can be given. The shareholders should pass the scheme through a special resolution in Company.

Loan to Subsidiary Company by Holding Company

The Companies (Amendment) Act, 2015, the exemption is given to the Holding Company who provide loan, guarantee, or securities to the wholly-owned subsidiary company. The Subsidiary Company uses the loans which are given for its principal business activity.

Loan by Companies in Ordinary Business

In ordinary course of business, Company which provides loan, guarantees or provide security provided that the rate of interest is charged at a rate not less than rate prevailing declared by the Reserve Bank of India (RBI).

Loan by Bank and Financial Institutions to Subsidiary Company

The Companies (Amendment) Act, 2017, the exemption is given to Holding company which provides security and guarantee in respect of loan made by any bank or financial institution to its Subsidiary Company. The Subsidiary Company should use the Loans which are given for its principle business activity.

Loan by Private Companies

The Companies (Amendment) Act, 2017, a Private Company can provide for Loan including Loan represented by book debts or give guarantee or security in connection to the loan taken by any person in whom Director of Company is interested. The loan can be given only when a special resolution is passed in the general meeting. The statement of the resolution should disclose:

- All the particulars of the loan given

- Purpose for which the recipient proposes the loan, guarantee, or security.

The loans are utilized by borrowing company for the principle business activity of its Company.

What are the Penal Provisions under Section 185 of Companies Act, 2013?

Under Section 185(2) the penal provisions for not following the rules prescribed under Section 185(1) while giving Loan to Directors is as follows:

- The Company will be punishable with fine which should not be less than 5 lakhs Rupees and which can be extended to 25 lakhs of Rupees if it gives a guarantee, security or Loan to Directors or any another person or entity associated with him/her.

- If any guarantee, security or Loan to Directors or any other person or entity associated with him is given; will be punishable for imprisonment which can be extended to 6 months or with fine which shall be less than 5 lakhs Rupees and which can be extended to 25 lakhs of Rupees, or with both.

Conclusion

The introduction of Section 185 leads to a complete ban to give Loan to Directors and other persons and entities related to Director. Later on, it was felt that changes should be made in the Section for better transparency and governance in the affairs of the Company. The changes were made to keep an eye on the fiduciary character of the Directors of the Company. To provide ease in doing business, the Section was changed. Section 185 of Companies Act, 2013, now allows Loan to Directors with adequate safeguards and additional responsibility on the part of Company and its officers.

Read our article:Companies Act 2013 Provides a Procedure for Appointment and Resignation of the Directors