The word NGO stands for Non-Government Organization, a body that remains detached from the Government and profit framework of general businesses in India. These bodies operate as small units that fill the gaps at places where the government cannot reach efficiently, business cannot get done with eloquent returns governed by specific NGO laws; and work towards the broad advancement of the society bylaws.

An NGO can either be a Trust, a Society, or else a Section 8 Company. To cover all legal entities that seeks philanthropic and charitable funds and utilizes them towards the advancement of the society. This term NGO is used as an umbrella without the motive to originate profit from it or use the benefit from the business of the NGO & Legal Compliance. Those only got utilized in the implementation of its objects.

Trust Registration: NGOs as a Trust

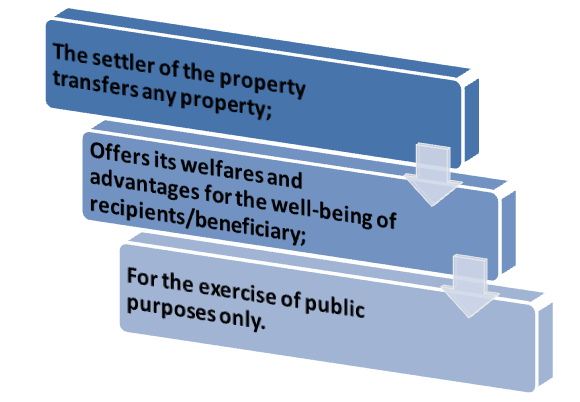

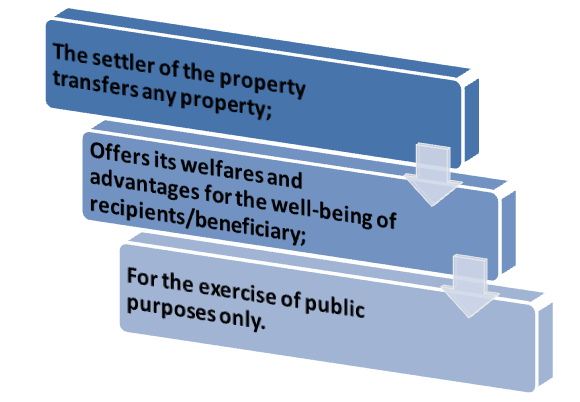

Trusts are formed when the three criterion objects are fulfilled for Legal Compliance.

The main aim of the person is to make use of the trust assets to attain the well being of the public at large and promote a charitable who registers a Public Charitable trust in India. Such trust does not own a fixed beneficiary, but the people in a massive, generally recognized with the shared attribute. A trust is irrevocably deprived of any interference of the judicial forums.

Society Registration: NGOs as a Society

The society holds the Rules and Regulation or by laws, Legal Compliances for NGOs, and Memorandum of Association (MOA). The Society registration fees and processes permanently to be registered with the Commissioner of Trusts, which are appointed by the respective State Government or Registrar of Society. Moreover, any Society has a chance to alter its Memorandum of Association working from time to time and intensify or reduce its objectives.

If we talk about the termination, Society can get terminated as per the termination clause in the Rules and Regulation or bylaws, Legal Compliances for NGOs and Memorandum of Association (MOA) only. Subsequently, the Society can also get merged with a Society of similar objectives and purposes. A society must inform the Registrar annually changes in the quorum of the Society along with all the Legal compliances thereon.

Section 8 Company Registration: NGO as a Company

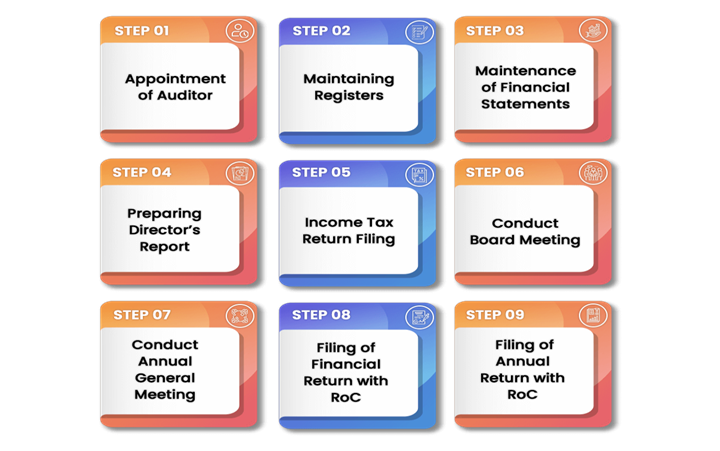

Section 8 Company requires the Memorandum of Association and Articles of Association as the Legal Compliances. Section 8 company registration needs to be filed under the Central Government through the Registrar of Companies with required approvals. It is compulsory to do the annual Legal compliances for NGOs comparable to other companies. Moreover, the process is similar to the formation of a Public Limited Company or Private Limited Company as per their Legal Compliance.

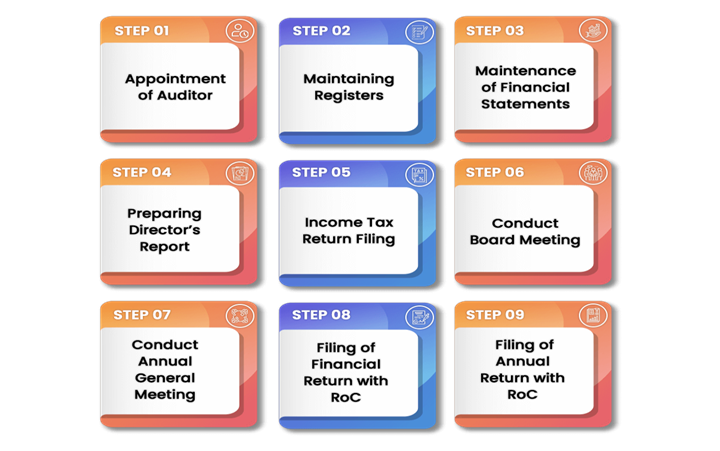

What is the NGO Legal Compliances that need to be done primarily?

A lot of people think that NGOs are immune to all forms of taxation by all the means because they believe that as they exist only for Non-profit activities as an entity. However, we understand that this is a myth only. The following requirements& talk about relevant Legal compliances for NGOs is obligatory to do to prove it’s honest and genuineness in accordance to the NGO Laws in India.

Those are as follows:-

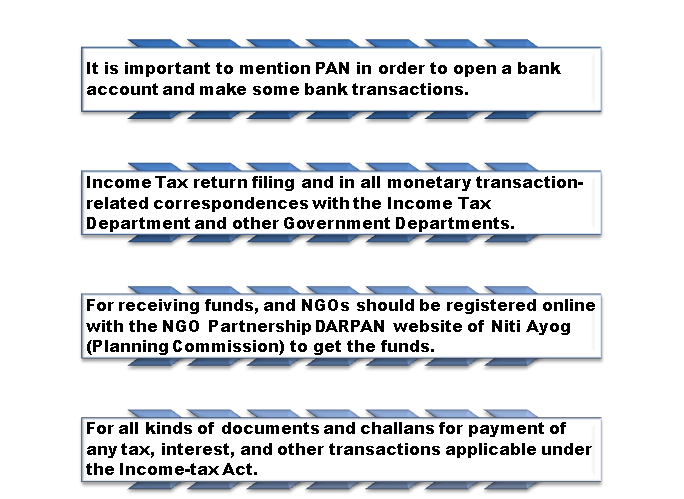

PAN Application

The very first Legal Compliances is to apply for PAN registration of the NGO after registration of NGOs with respective Authority. It is categorically essential to mention the PAN number in the accompanying archives all the banking and money transactions for income-tax assesses, including NGOs under the current Income Tax Act.

Importance of PAN

Section 12A Registration under Income Tax Act

Intended for getting some benefits of taxation, the registration of NGOs under Section 12A is very compulsory under its Legal Compliances for NGOs. Conversely, section 12A certificate is not an obligatory registration. The primary reason for getting this registration under section 12A is to get the benefit of exemption if all the rules and regulations laid down in this section are fulfilled from the Income Tax on the Income/revenue (Legal Compliances for NGOs).

Documents needed for 12A Registration

- 12A registration applicant needs to submit the following documents/Legal Compliances for NGOs along with Form 10A

- A self-certified copy of the instrument used to establish the Institution shall be provided or create the trust.

- The Institution or trust may have been created otherwise than registering an instrument and by way of drafting. In such cases, an establishment of the Institution or self-certified copy of the document evidencing the creation of the trust should be submitted to the Income Tax Department.

- It is compulsory to submit a self-certified copy of the registration, which was made with the pertinent body. The applicable body may be the Registrar of Public Trusts, the Registrar of Firms and Societies or Registrar of Companies.

- A self-certified copy of the documents shall be submitted which provide evidence for adoption or modification of the objectives of the Institution.

- Three preceding financial years Annual financial statements and related Legal Compliances for NGO s

- A brief note on the activities accompanied by the entity

- The Income Tax department may cancel the registration granted in certain cases. The assessee is allowed to make a subsequent application after rectifying the default. It is necessary to submit a self-certified copy of the prevailing order granting registration.

- The assessee may have previously applied for registration where the application may have been rejected. In those cases, a self-certified copy of the order of rejection should be involved with the application of 12A Registration.

Section 80G Registration under Income Tax Act

The registration under this section is not compulsory under its Legal Compliances for NGOs. However, to give the benefit of ‘50% or 100%’ exemption over the donations to the donors, it is needed to get the registration under section 80G of Income Tax Act. It is indirectly a huge benefit to NGOs to raise funds.

Documents needed for Section 80G Registration

- Trust Deed in case of a Trust, and MoA& Registration certificate in case of Section 8 companies and Societies.

- NOC (No objection certificate) from the owner of the property where the institution’s registered office Institution is located

- Form 10G along with Legal Compliances

- A copy of the PAN of the Non-profit organization

- Copy of Utility Bills such as House Tax Receipt, Electricity bill, or water bill

- A comprehensive list of the donors along with their PAN and address

- The documents related to the Book of Accounts of the past three years and Income Tax Returns

- The progress report of the last three years and the list of the welfare activities that has being carried out

- A comprehensive list of the Board of Trustees

- Original RC

FCRA Registration under Income Tax Act

Once the registration procedure for an NGO is done, there will be opportunities to receive Foreign Funds for the missions of NGO. Post only essentials to the registration with FCRA department under Ministry of Home Affairs. NGO cannot get any kind of foreign donation or funds without FCRA registration. Depending upon the type of registration and Legal Compliances, following are the key requirement for applying FCRA Registration.

Those are as follows:-

Responsibilities for FCRA Registration

- The applicant must be operating for a minimum of 5 years and shall be a registered entity.

- An applicant entity must have spent for the entity which was registered excluding administrative expenses and made at least INR 10 Lakhs in the previous three years to attain its main objectives.

- The last three years financial statement shall be submitted by an applicant who should be audited by a qualified chartered accountant.

Responsibility for FCRA Registration: Prior Permission

- The newly registered entity shall apply for prior permission as per its Legal Compliances, if willing to receive a foreign contribution or foreign grants

- It shall give the details relating to a foreign owner who is contributing the fund during applying for the same

- The fund received shall be employed only for the specified/identified purpose

Read our article:Guide on NGO Registration: Types and Benefits

Documents for FCRA Registration under Income Tax Act with the online application

- Self-certified copy hold by such entity of trust deed, incorporation certificate, or any other credential

- PAN of the Non-Profit Organisation

- Copy of Memorandum Of Association and Articles Of Association

- Signature in JPG format of the chief judiciary

- A detailed report of the preceding three years on activities of the organisation

- Audited copy of the preceding three years of, Expenditure details. P&L account, Income, financial statement and cash flow statement

- CTC of the resolution authorized by NGO & passed by a governing body

- Certificate obtained under section 80G and 12A of Income Tax under the Income-tax Act which provide tax exemption to NGOs.

TAN under Income Tax Act

It has to first apply for TAN for its Legal Compliances, if NGOs become liable to remove the tax from a source during the functioning of NGOs at any point of time.

No specific document or proof of identity is needed for TAN registration. Form 49 B needs to be filled and submitted for obtaining TAN.

GST Registration

NGO has to firstly apply for the GST registration as a Legal Compliance if the gross revenue from works crosses the basic exemption limit of GST and if the NGO is providing services like research activity or consultancy work etc.

Documents needed for GST Registration for NGO

- Proof of Constitution of Business (Any One)

- Registration Certificate

- Any proof substantiating Constitution

- Photo of Stakeholder (Promoter / Partner)

- Photo of the Promoter/ Partner

- Photo of the Authorised person

- Proof of Appointment of Authorised Person (Any One)

2. Letter of Authorisation

3. Copy of Resolution followed by BoD/ Managing Committee and Acceptance letter

- Proof of Principal Place of organisation (Any One)

- Electricity Bill

- Legal ownership document

- Municipal Khata Copy

- Property Tax Receipt

- Rent / Lease agreement

- Rent receipt with NOC (In case of no/expired agreement)

Professional Tax Registration

Professional Tax is an accountability of NGO to deposit to the Government and deduct from the pay of employee. Different states of India have different Legal Compliances&rules and regulations for Professional Tax, in consequence Professional Tax is said to be State Government.

- Company agreement official papers (MOA & AOA)

- Place of business evidence with ownership particulars.

- Place of residence of all the directors along with proof of rights.

- Two photos of all the directors of the Organisation

- PAN of all the directors and business

- Director’s saving and current account and cancelled cheque from company’s current account

- Shop and establishment credential

Retirement Advantage

If NGO develops and the size of employees are more than the prescribed limit in this acts, in that case the Retirement benefits like Provident Fund[1], Gratuity, ESIC,etc. gets pertinent under its Legal Compliances.

Shops and Establishment License

NGO must fetch a License under the Shops and Establishments Act, if an NGO employs any person in their office to carry out any work pertaining to the NGO According to the NGO laws in India.

- Scanned PAN Card of Partners/Directors/Proprietor

- Rental agreement/Sale deed of commercial space

- Number of employees

- Name of establishment

- Registers maintained to date

- Aadhar Card / Voter Id / Driving License / PAN

- Photo of Shop along with Owner ( you can Click with Mobile Phone as well )Rent

- Electricity Bill

What are the Penalties to be charged in case of Non-Compliance?

In case of encounters of any non-compliance with the procedures, the Ministry of Corporate Affairs has the ability to impose certain penalties.

Penalties to be imposed are as follows:

- If it has been found that the organization is working falsely or in a way violative to the object of the organization, then the Central Government may reject the permit allowed to the organization.

- The administration of the Institution will be culpable with fine, which will not be under ten lakh rupees and can be overextended out to Rs. one crore.

- Each official along with the chiefs of the organization who is in default will be culpable with detainment for a term which may bounce out to twenty-five lakh rupees or it can be both.

- Every official in default must be at risk for activity under area 447 if in the event that it is discovered that the issues of the organization were directed falsely.

Conclusion

The data mentioned above stretches the details of different types of Legal Compliances for NGO registration in India and the various advantages of enlightening for the same. Therefore, the paperwork requirement may vary based on different types of NGOs that you want to direct your registration. If you are preliminarily starting an NGO in India, you need to stick to your objective of working for the well-being of entire impoverished communities and societies along with upliftment of survive of people living in condensed circumstances. At Corpbiz, our experts would aid you in the entire registration process along with Legal Compliances.

Read our article: Casting Lights on the Steps to Start an NGO in India