The principal object that you would require is NGO registration if you are looking onward to start an NGO in India specifically. Additionally, you would also request information about the diverse types of NGOs which can get recognized in India. Once you have decided, find out whether it matched with your necessities or don’t. If indeed, get the NGO registration done through, and then you can continue with your plan. In this blog, you will explore diverse types of NGOs and what are their benefits as well.

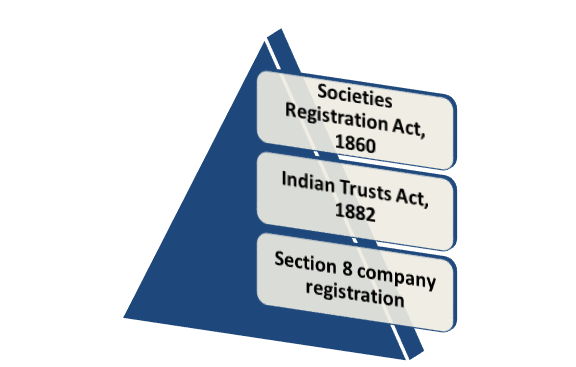

Governing Laws in India for NGO Registration

There are three possible methods by which you can get listed NGOs in India:

- Society registration

- Trust registration

- Section 8 Company registration

The Governing Laws in India for NGO Registration are as follows:-

Objectives attainable in India for NGO Registration

The ultimate goal is to opt for NGO registration if you desire to serve society and help the people of the country.

Several reasons for NGO registration in India are as follows:-

- Self-governing organization: These are the bodies that aim towards the needy people and the betterment of society by helping the deprived ones.

- Opportunity for growth: The definitive goal of NGO is to help disadvantaged people and provide them with chances for growth and prospect.

- Several Benefits: You can go ahead with NGO registration; once you have distinct list of NGOs. There are several benefits that NGOs appreciate and will be discussed onward.

Read our article:NGO Registration – Step by Step Procedure

Outlook on Non-Governmental Organization Registration in India

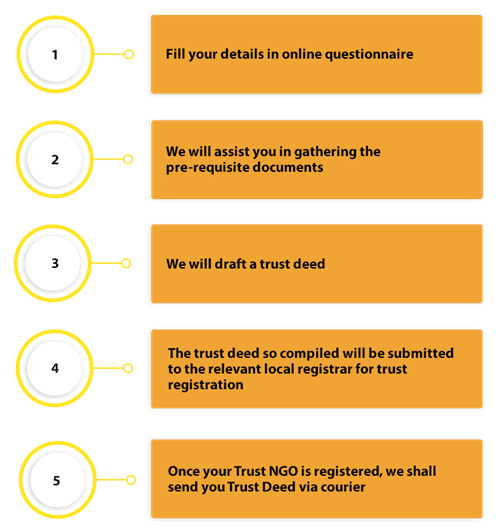

1. Trust Registration:-The registration for trust can be completed via the Indian Trust Act, 1882[1]. These are usually formed when the land or property is involved in public charitable trusts. Typically, the usage of faith is for the relief of medical aid, education, poverty, etc.

Benefits of Trust Registration

- Trusts can get land from the government Agencies

- In a maximum of the states, there’s no law that governs Public Charitable Trusts in India. However, many states such as Madhya Pradesh, Maharashtra, Gujarat, and Rajasthan do have Public Trusts Act.

- An NGO registered under the Trusts Act can practice the word “Govt. Regd.” or ‘Regd.’

- They get quite a few tax benefits such as Income Tax, etc

- 80G certificate advantage under the Income Tax Act

- Trust can get White capital for Building construction.

- Benefits in Entertainment Tax and Service Tax, etc

2. Society Registration: An additional way in which you can register NGO is in the system of society. As stated in Section 30 of the Society Registration Act of 1860, the individual comes together to promote scientific purpose, charitable purpose, and various other objectives to form a society.

Benefits under Society Registration

NGOs registering under the Society Registration Act, 1860 can avail the following benefits:-

- Exemption from income tax

Society registration is a kind of NGO registration where the firm is saved from paying income taxes, and Income Tax exemption is something everybody desperately seeks for.

- Separate legal identity

NGO is a separate legal entity in the eyes of the law, which is one of the significant advantages that come with society registration. Each member of this society is accountable for their actions only. The members of such NGOs are responsible only for the activity undertaken by them and not by other members because of the distinction given.

- Limited Liability

Society NGO is a separate legal entity from its members. Thus the liability of the members is limited to their share only. That means, in no circumstances, the members’ assets cannot be utilized to pay the firm’s liabilities. Since society NGOs are a separate legal identity, members’ responsibility is limited to their share only.

- Legal protection

You will be provided with legal protection, once you have registered your society under the Society Registration Act, 1860. It indicates that no other company or people can use your company name, your assets, etc. Anybody would be subject to punishment if found liable for any violation.

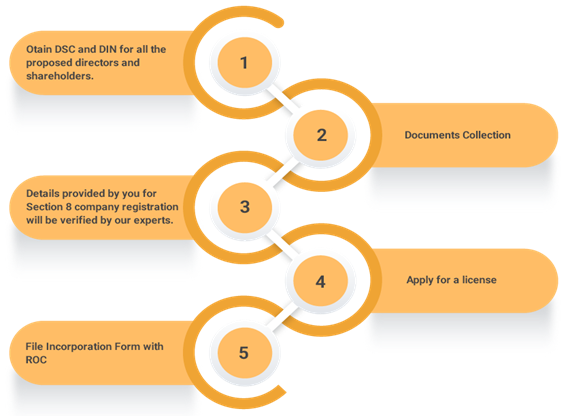

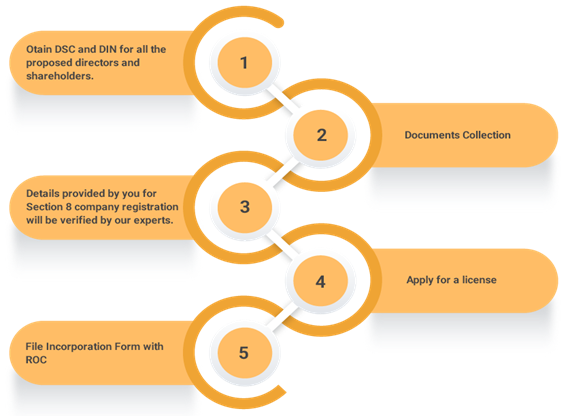

3. Section 8 Company Registration: The third method to register an NGO is by Section 8 of the Indian Companies Act, 2013. These companies are recognized to protect trade, religion, charity, etc. Nevertheless, the earnings of this company are used by the company for promotion work, not used by the shareholders. You can register the company as a private limited company (needs two directors) and a public limited company (requires three directors).

Benefits of Section 8 company registration

NGOs registering themselves under Section 8 company registration can gain various advantages from it.

Those are as follows:-

- No minimum capital requirement

There is no minimum capital requirement for creating NGO as per section 8 company. Unlike other existences such as public limited company, section 8 companies have no prescribed limit for any minimum capital necessities. However, the capital structure of the firm can be modified at any stage, which may be needed for the growth of the business.

- Separate legal entity

Comparable to the trust, a Section 8 company also gets the special recognition of a ‘separate legal entity.’ Like Private Limited and other limited companies, a Section 8 company, too, continues its own identity and possesses its separate legal entity from its members. Furthermore, Section 8 Company has continued survival.

- Tax exemption

One of the advantages that every NGO receives is the benefit of tax. Aside from the stakeholders, the NGOs’ contributors can also receive tax exemption for the donation given to the NGO. It’s one of the most significant advantages that NGOs registering under Section 8 Companies are presented with, especially those subscribing to section 8 companies. Even the contributors can claim the tax exemption upon the donation made to this pattern of NGO.

- No stamp duty payable

NGOs are exempted from stamp duty formalities, which is unless applicable for the registration process. Such NGOs are also exempted from the payment of stamp duty appropriate for registration as fitting for record comparable to the one applicable in public limited companies or private limited.

- No title needed

There is no title demand. Moreover, section 8 companies do not need to use a suffix to its name, which the public limited or private limited company has to apply. Unlike in the case of the private limited and public limited company, where names and titles are obligations, a section 8 company doesn’t require to use a suffix next to its title.

- Better reliability as compared to others

There is better reliability. If it is compared with any other NGO structure, a Section 8 company is more reliable. The central government does not administer section 8 company, and hence the MOA (Memorandum of Association) and AOA (Article of Association) remain blessed. It is thus making its legal structure more dependable as correlated to trust or society NGOs.

- Security of ownership or title transfer

Secure transfer of ownership is something that Section 8 Company appreciates. As per Section 8 of the Income Tax Act of 1961, people can transfer the ownership of both moveable and immobile assets externally with no restrictions. Apart from the above-described advantages, there are many other advantages of section 8 company registrations, such as exemptions from income tax act, attending general meetings under a short notice period, which is within 14 days rather than 21 days, and many more.

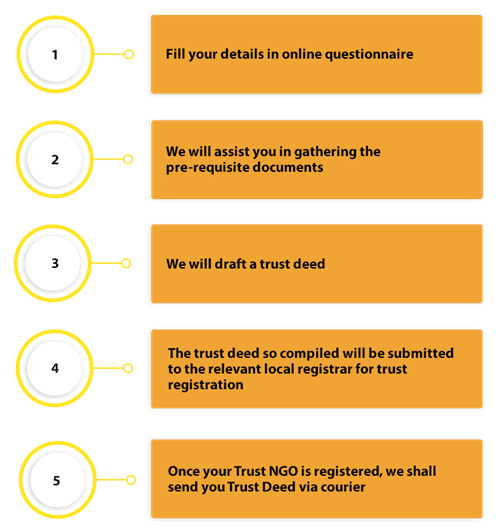

How should we go about it quickly?

Registering an NGO in India is quick, easy, and can be done online within three effortless measures:

- Determination of Right Entity – CorpBiz will address all your queries about entity determination and guide you to choose the most relevant item.

- Documentation with Online Guidance – CorpBiz will help you get the entire process of filing and registration accomplished.

- Listing out of Entity – CorpBiz will register the NGO and control all the formalities (Trust Act, Society Registrations Act, or the Companies Act, Conditional on the entity determined).

Conclusion

Forming an NGO in India is an uncomplicated process if you have complete documents and other papers available as per the rules. The data mentioned above gives the details of different types of NGO registration in India and the various advantages of cultivating for the same. Therefore, the paperwork specification may vary based on different types of NGOs that you want to express your registration.

Read our article:Setting off Excess Expenditure against Income of next year by Trust and NGO