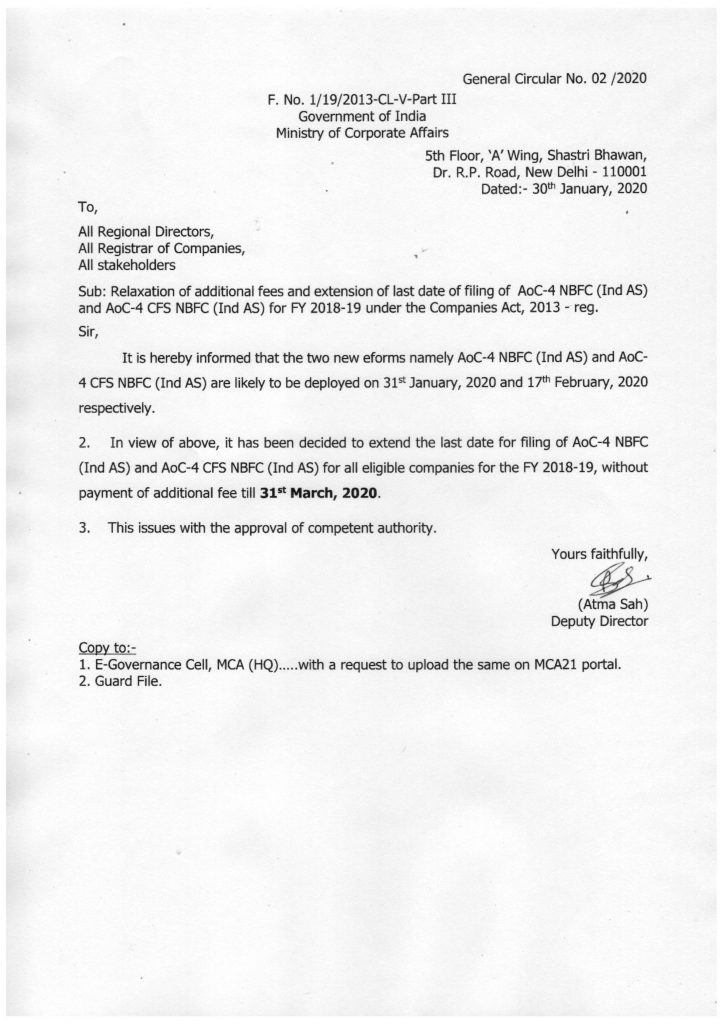

Ministry of Corporate Affairs has extended the last date of filing form AOC- 4 till 31st March 2020.

The MCA (Ministry of Corporate Affairs) has issued a notification to all Registrar of companies, Regional Directors and Stakeholders regarding the extended date of filing of AOC-4 CFS NBFC (Ind AS) and AOC-4 NBFC (Ind AS) and also the relaxation of additional fees for all eligible Companies for FY 2018-19 under the Companies Act 2013[1].

AOC-4 FORM FILING

The Company requires to file the Form in every financial year for the filing of the financial statements with the ROC (Registrar of the Companies). The Company requires to furnish the form duly within 30 days of conducting its AGM (Annual General Meeting).

Who Requires To File AOC-4 XBRL?

The companies required to file form are as follows:

- The companies in India which are listed with any stock exchange and the subsidiaries of those companies.

- All companies with the paid-up capital of Rs. 5 crores or more

- All companies which have a turnover of the Rs. 100 crores or more

- All the companies that are covered under the Companies Rules 2011

Documents required along with Form

The requirements of the documents, along with Form are as follows:

- Balance Sheet

- Board reports

- Auditor reports

- Statement of Cash Flow

- Statement of Profit and loss

- Statement for Change in Equity

- Statement of Subsidiaries of the company In Form AOC-1

- Report of Corporate Social Responsibility

- Any other relevant documents

Read our article:Are you running an NBFC? Get updated about the list of Annual Compliances Prescribed by the RBI

Filing Fees

Based on the share capital of the company following are the applicable fees:

|

Nominal Share Capital |

Fees Applicable |

|

Less than 1,00,000 |

Rs 200 per document |

|

1,00,000 to 4,99,999 |

Rs 300 per document |

|

5,00,000 to 24,99,999 |

Rs 400 per document |

|

25,00,000 to 99,99,999 |

Rs 500 per document |

|

1,00,00,000 and above |

Rs 600 per document |

Final Points

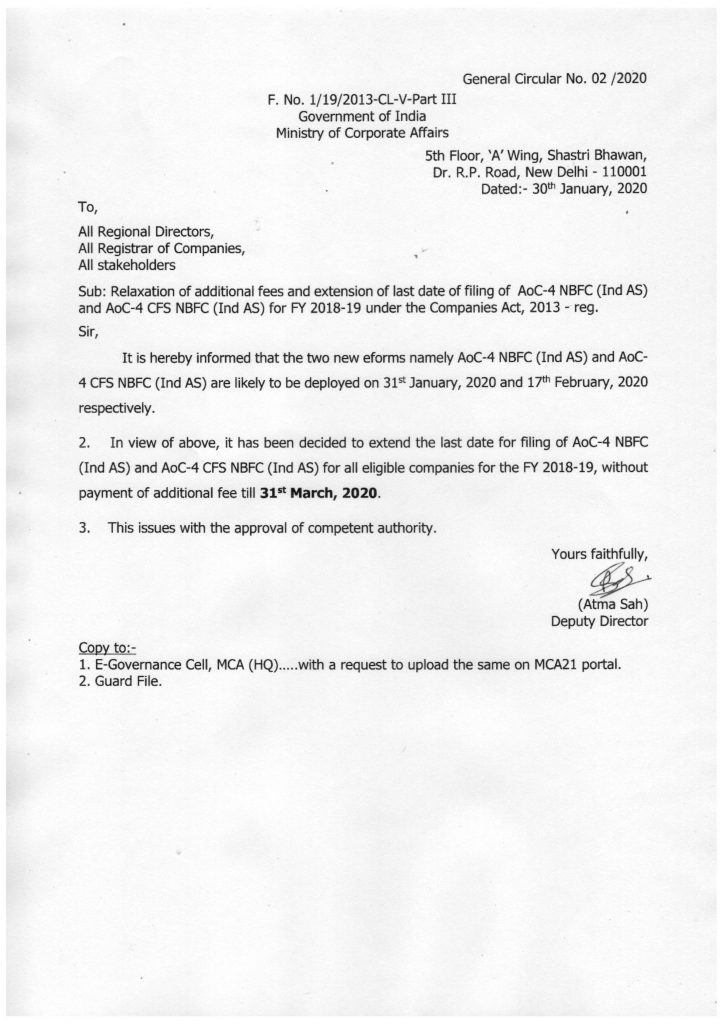

- The Ministry of Corporate Affairs has given two new e-forms that are AOC-4 CFS NBFC (Ind AS), and AOC-4 NBFC (Ind AS) can be procured on different dates 31st Jan 2020 and on 17th Feb 2020.

- Pursuant to the deployment of new e-forms, the last date for filing e-above mentioned forms has been extended to 31st March 2020 for all the companies eligible of FY 2018-19.

- Earlier the 30th Nov 2019 was the last date of filing. Now, the new date for filing AOC-4 is 31 March 2020 on which no additional fees are levied.

Read our article:NBFC Registration: Step by Step Procedure