The Income Tax Appellate Tribunal laid down that in case of any conflict between the provisions of The Income Tax Act and the Accounting Standards laid down by the Institute of Chartered Accountants of India, the provisions of the Act would prevail.

Principles of Accounting Standards

Accounting Standards are basic accounting principles which lays down the procedures and principles for financial accounting. On the other hand the provisions of The Income Tax Act are used to compute the taxes to be levied on the taxable incomes.

There are ways in which the Accounting Standards[1] can be used to levy taxes on the incomes. These Accounting Standards even prescribe the treatment of the taxes levied on income and might sometimes have overlapping conditions and in such cases, conflict arises between the two.

Read our article:Major reforms aimed at Transparent Taxation for ‘Honoring the Honest’ – PM Modi launched.

Issues Raised on Decision of the Assessing Officer

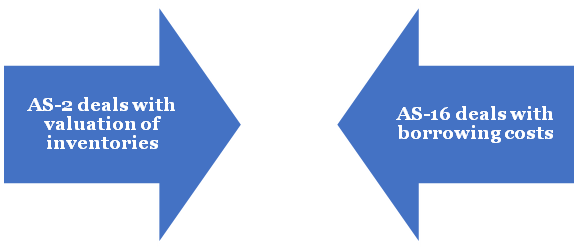

The appellant in this case challenged the decision of the Assessing Officer. The Assessing Officer has placed reliance on AS-2 and AS-16.

The Assessing Officer held that the interest cost is not allowable and should be added to the cost of the inventory. The main issue here was whether the provisions of The Act could prevail over the Accounting Standards.

Interpretation of the Case

The bench held that the provisions mentioned under The Income Tax Act and the Accounting Standards laid down by the ICAI are of two different sets. They regulate different areas of incomes. The bench stated that as for deciding this issue the reliance will be laid on the well settled judicial precedent that is if there is a conflict between the two the provisions of the income tax act would prevail. In the current case the Assessing Officer had referred to the AS but since the AS were contradictory to the provisions of the Income Tax Act, they would no longer apply.

Views of Bench

The respondent was unable to establish any precedence showcasing a decision opposite to this one whereas the assessee placed reliance on the case of DLF Limited vs ACIT(Supra) where a similar view was taken by the bench. The Bangalore bench therefore, declined to interfere in the order of the CIT(A).

Conclusion

The best time to start preparing your tax-saving investment is at the beginning of the financial year. Most taxpayers postpone until the last quarter of the year, resulting in pressurized decisions. As an alternative, if you plan at the start of the year, your investments can compound and help you achieve long-term goals. Tax-saving should be an additional perk and not a goal in itself. Our Corpbiz Professionals will help you with Income Tax Return Filing along with various compliances.

Read our article:CBDT Rolled Out New Conditions for Pension Funds for Income Tax Exemption