Are you about to start a business of foreign trade by importing product from aboard? Are you not aware of the significance of IEC in international shipping? Do you wish to import commodities without IEC registration? If yes, then you have landed on the right page. This article will answer these questions by shedding some light on penalty provisions under the Foreign Trade Policy.

IEC is Mandatory- Latest Notification Made it Clear

Importation or exportation of products is subjected to legal obligations under FTP. As per the notification number: No. 24/2015-2020, announced on 08/08/2020, the Directorate General of Foreign Trade has been made clear that IEC is mandatory for all persons willing to export or import non-exempted products in India.

To be clear, given the aforesaid notification, it is impossible to import the non-exempted commodities in India without IEC registration. However, an individual can skip this requirement if the import is proposed to be made for personal uses only. One has to get well-versed in the penal provisions listed under the FTP to ensure seamless shipment of the commodities in India. One can find the exempted categories and corresponding Import Export Code in Para 2.07 of Handbook of Procedures.

What is the Import Export Code as per the Foreign Trade Policy?

An Import Export Code is a 10 digit alphanumeric code granted to the individual who is compulsory to conduct the activities related to export and import. With a view of maintaining the uniqueness of an entity, consequent upon the GST launch, IEC will be treated as an equivalent counterpart of PAN and will be issued independently by the Directorate General of Foreign Trade.

No import or export will be made by any individual without an IEC number unless specifically exempted. For the exportation of services, IEC stands mandatory in view of provision listed under the chapter of Foreign Trade Policy. Exempt categories & corresponding permanent import Export codes are mentioned in Para 2.07 of Handbook of Procedures. The application process of the Import Export Code shall be made online, and it can be generated by the applicant as per the provision listed under the Handbook of Procedure.

General Penal Provisions to Curb Illicit Importation of Commodities

- If the imported items are prohibited for import under the FTP or any other law such as Custom Act, a penalty equivalent to the aggregate value of the goods or Rs 500o shall be levied on the defaulters, which is the greater.

- In the case of dutiable goods, the defaulter shall be liable to pay the penalty not greater than the duty sought to be evaded on such commodities or Rs 5000, whichever is the greater.

- The faulty declaration regarding importing goods or baggage would attract the penalty equivalent to the difference between the declared value & the value thereof or Rs 5000, whichever is greater.

- Any unlawful importation of the Goods listed under the Customs Act of Clause (i) and (iii) would attract the same threshold of penalty as mentioned above.

Conflicts are pretty much on the card if you are not aware of what type of documents goes in the shipping process. Right documentation would perish the major amount of your stress and let you avert the conflict with the authorities. The section below encloses the list of mandatory documentation required for the importation and exportation of commodities.

Mandatory Documentation Required for Export/Import of Goods from/into India

(a) Mandatory documents required for exportation of commodities from India

- Bill of LadingLorry Receipt/ Airway Bill /Postal Receipt/ Railway Receipt/

- Commercial Invoices

- Packing List

- Shipping Bill or Bill of export.

(b) Mandatory documentation required for importation of commodities into India

- Railway Receipt/ Bill of Lading/ Postal Receipt/ Bill of Lading/ Airway Bill/in the form of CN-22 or CN 23 as the case may be.

- Commercial Invoice

- Packing List*

- Bill of Entry

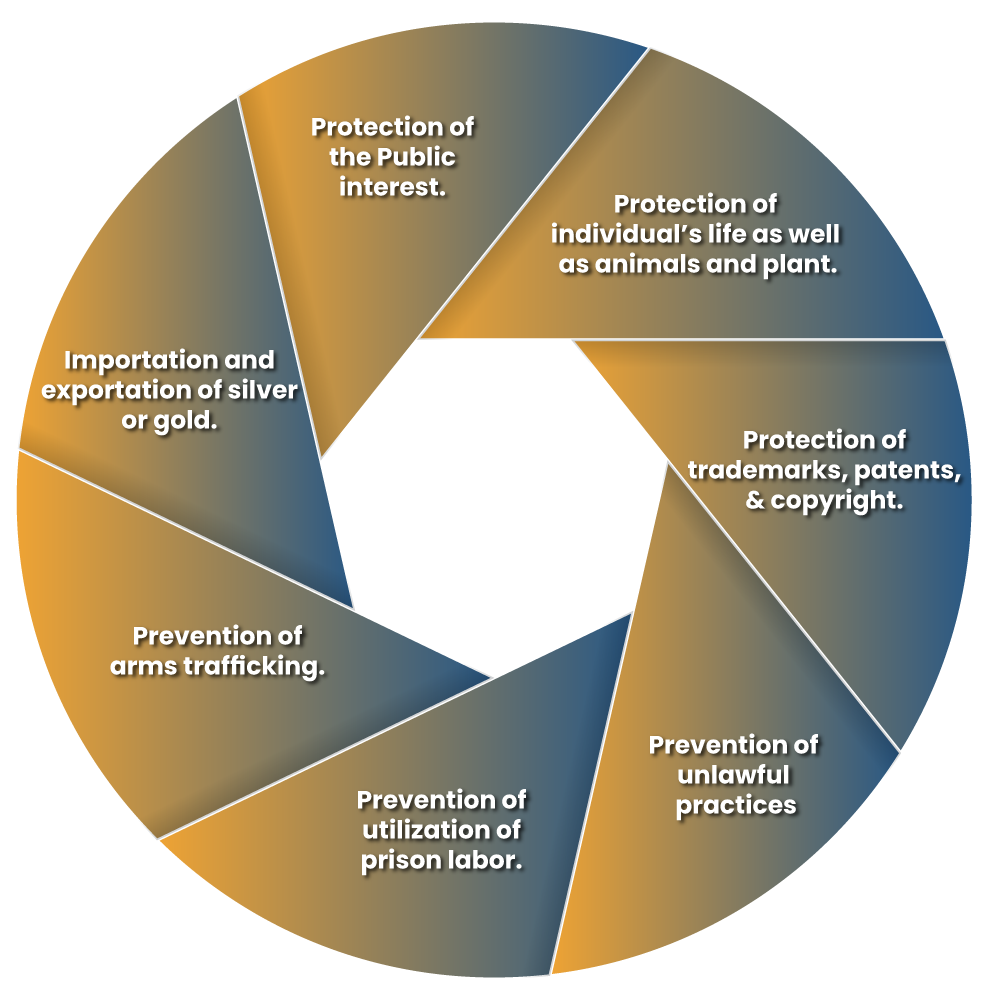

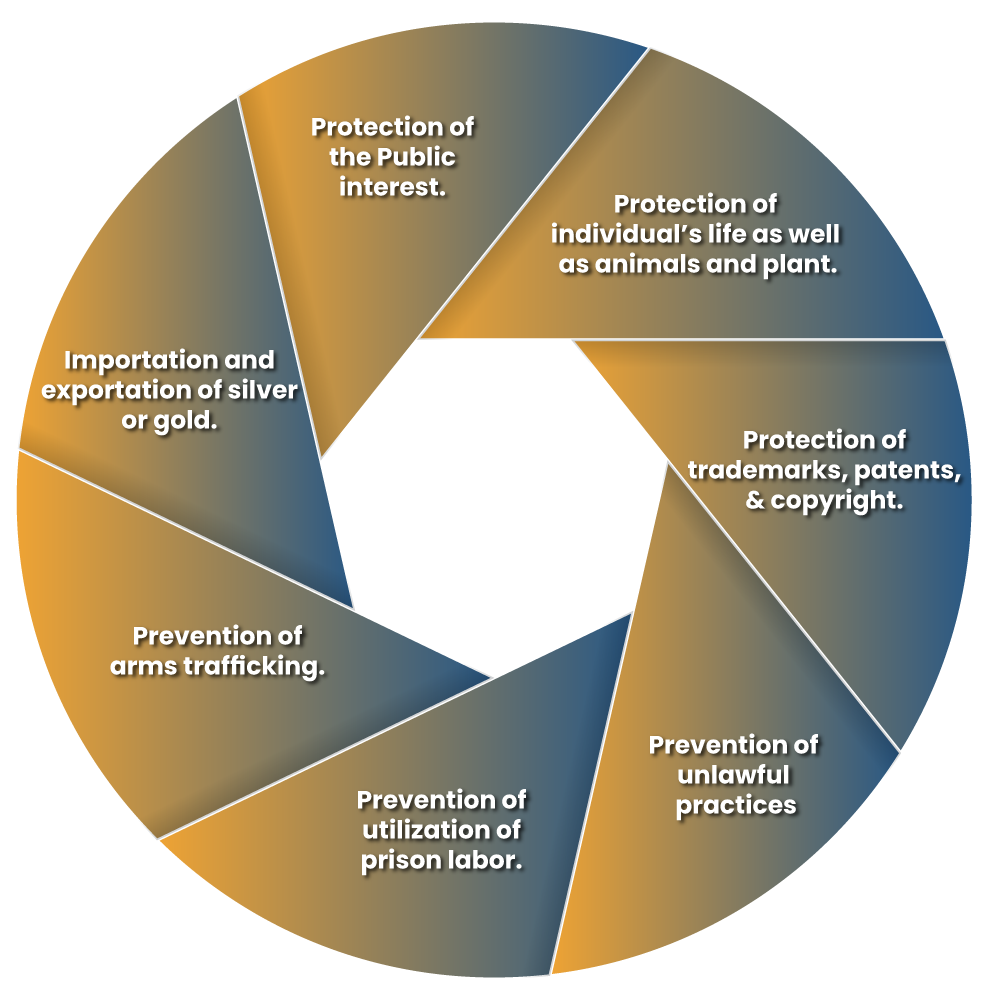

Principles of Restrictions

Directorate General of Foreign Trade (aka DGFT[1]), through a notification, impose limitations on the import and export necessary for the following agendas. Those are as follows:-

Conclusion

Import Export Code is an essential requirement for importing commodities from overseas countries for commercial purposes. In a nutshell, IEC registration serves multiple purposes apart from legalizing the shipping process. It packs tons of benefits for the importers in terms of government subsidies and growth-oriented schemes. On the other hand, it is equally stringent when it comes to penalizing illicit trading activities. Therefore, it’s better if you remain well-versed of all the FTP provisions related to unlawful trading. Conducting trade without IEC could lead you into trouble.

Connecting with a professional can help you avert intricacies with the shipping process. If you are unwilling to step forward or encounter nuisances regarding the shipping regulations, let Corpbiz expert help you out. We have a vast experienced in dealing with all sort of government-based licenses and registration. We know the optimal ways to getting license with minimum of hassles.

Read our article: Step by Step Guide to Raise IEC Certification for a Partnership Firm