The capital gains tax is a tax on the profit recognized of a non-inventory asset on the sale. The most usual capital gains are realized from the bonds, sale of stocks, real estate precious metals, and property possessions.

Following the Registration Act, 1908, the sale deed gets registered, where both the parties must to be present in person along with 2 witnesses. They have to get all the relevant documents in the sub-registrar’s office to sign the sale deed and close by the deal.

Overview of the Case

Case: – ACIT, Circle-02, Kota, vs. Sh. Ijyaraj Singh, Raj Bhawan Road, Kota-18/06/2020

Held by Tribunal

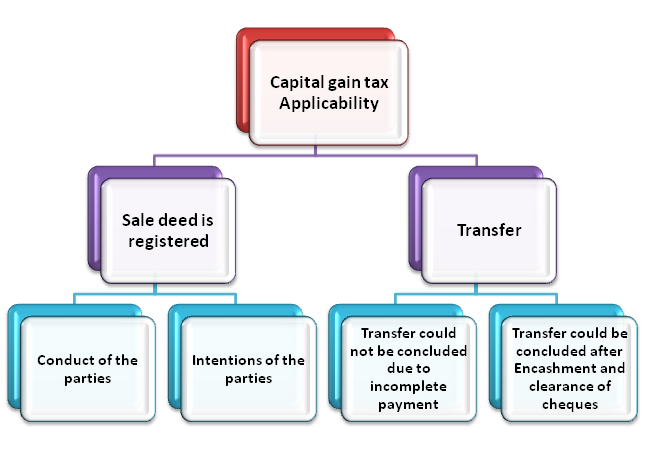

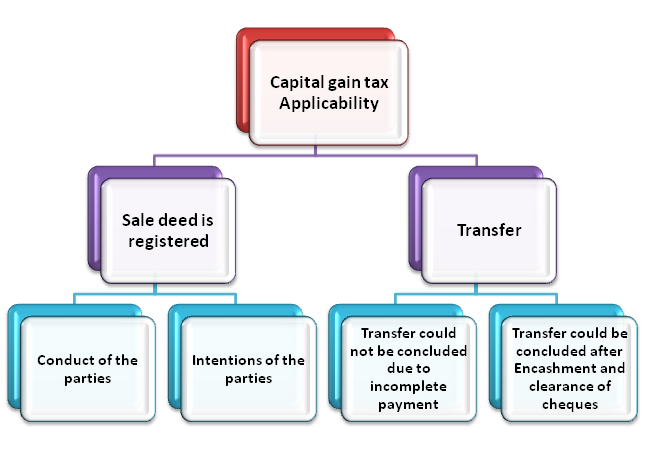

It has been observed that Capital gain tax would not attract merely based on the fact that the sale deed is registered, and the transfer could not be concluded due to incomplete payment responsibilities. It has held by the Jaipur (ITAT) bench of the Income Tax Appellate Tribunal.

Facts of the Case

As per the facts of the case, assessee transferred his land using the registered sale deed paid by cheques for a consideration of Rs 3.40 Cr. Moreover, two were tarnished and returned unpaid to the assessee out of these cheques.

While completing the assessment against the assessee, the demanded income tax from the assessee held that the Revenue transfer of land has been done through these two registered sale deeds only, in this case. Moreover, the sales deliberation was mutually settled, accepted upon, and considered established before signing and registering the sale deed previously with the Registering Authority in India.

Contentions of Parties

Parties claimed that the transaction is a substantial note to levy of capital gains tax, and deduction for not receiving any part of sales consideration in the future, is not satisfactory under the provisions of Act from the overall worth of compensation.

On the other hand, the assessee held that registration is not proof of a functioning allocation/transfer of property. Consequently, the parties had intended that despite transfer by way of sale and execution of registration of sale deed, it will become operative only on payment of the complete deliberation sum.

By considering this particular opinion, the transfer will only be affected only by receipt and payment of entire sale consideration. It will not be affected at the time of registration of sale deed and execution.

Tribunal Notes

The Tribunal noted that the purpose and intentions of the parties could be gathered from the conduct of the parties and the reading of the sale deed only on encashment and clearance of both the cheques that is the effective transfer of title in the land shall happen or not. It will not get determined at the time of registration of the sale deed and execution of it.

Therefore, it cannot be held to be a discharge and liberations of entire sale consideration at the time of implementation/execution of the sale deed, for mere handing over the cheques, which have been consequently tarnished and returned unpaid to the assessee. It has been evident that Shri Rajeev Singh has failed to discharge the full sale consideration, which is an absolute violation of the terms of sale deed by so agreed and stated in the sale deed.

Afterward, the matter has again been challenged separately before the Civil Court for cancellation of sale deed under the ‘Negotiable Instruments Act[1]‘ for the ‘dishonor of cheques’ because of breach of contract. After fair trial and discussion, Tribunal noted proving that the intention was that the transfer would be valid only on receipt of the full sale consideration at the time of entering into the sale deed”.

Read our article:ITAT: Capital Gain Deduction Claim if No Returns filed

Conclusion: Overall Observation

It has observed that the Tribunal held by putting faith in the decision of the Supreme Court in the case of ‘CIT V/s. Shoorji Vallabhdas & Co’ deciding on the Capital Gain.

Even though sale deed has been registered, Supreme court was therefore of the deliberated view that, the intention of the parties and the given terms of the sale deed at the time of entering into the said sale have not to adhere if the entire sale consideration has not been settled

It has opined that there is no income accrues and no transfer of the impugned land concerning Capital Gain. As a result, no liability towards capital gains tax rises on the part of the assessee.

This brings us to the concept of Capital Gain which cannot be any levy of tax on hypothetical income, which has either accrued/arisen or received by the assesse, and thereby can only be brought to tax.

Our CorpBiz legal experts will be at your disposal to help you with guidance concerning Capital Gain Tax applications and Registration of Sale Deed with all the related compliances for the smooth functioning, Seamless and hassle-free manner of your business in India.

Read our article:40th GST Council Meeting: Overall Updates